Today this Substack has now been alive for six months, and it is a great pride to have reached 3,000 visits and 80 followers in this time, despite creating niche content somewhat erratically. Improvement is promised.

If you are reading this and are not subscribed, you can do so by clicking the button below. It's free, and you'll stay up-to-date with the publications.

A few weeks ago, I participated in a well-known finance channel, @MomentumFinancialPodcast , where I talked about Grifols, a Spanish multinational that has faced a short-selling attack by Gotham City Research, revealing a possible opportunity. During the talk, I shared my opinion on the matter, highlighting the main doubts it raises and expressing a bit of support for short-selling reports, which I consider necessary for an efficient market. The discussion is in Spanish, but I know the translated transcript is quite accurate.

The thesis explained in the video is published in the Seeking Alpha article (if any follower wants to see the SA thesis, please do not hesitate to ask privately).

Bayer AG Q1

On May 14th, Bayer AG released its Q1 2024 results with few surprises. One quarter does not determine a thesis, especially not one like Bayer's, where the best that could happen is that we get bored with no news or updates for two or more years.

In summary: Those expecting a quick turnaround should forget about it. By the way, if you want to access the complete thesis, I'll leave it below.

In this case, the best things that Q1 brought us is the reaffirmation of the 2024 Guidance, which anticipates a year with a slight decline in sales in Pharma and Consumer Health, with Crop Science remaining flat.

By divisions, here are the comments on the results:

Crop Science: Sales fell by 5.3% (-3% FX adjusted), mainly driven by a decrease in volume in the Core Business (excluding glyphosate) and an increase in volume for glyphosate, which was nearly offset by a price drop. Sales declines in the sector are widespread. Corteva reported an 8% sales drop, FMC 32%, and BASF Agricultural Solutions 11%.

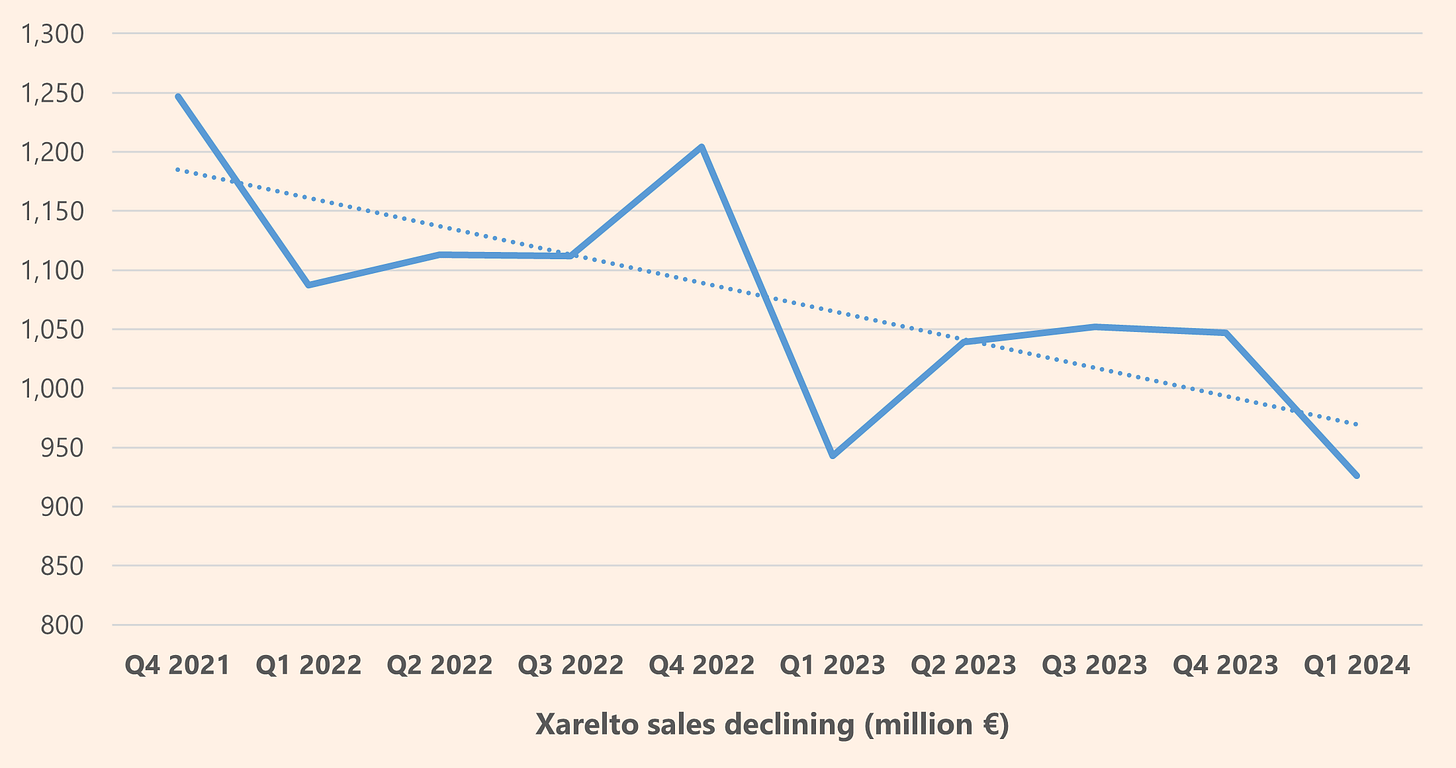

Pharma: Sales fell by 1% (+4% FX adjusted). The new drugs are performing well: Kerendia +64% and Nubeqa +66% vs. Q1 2023. Regarding Xarelto, which accounts for 21% of Pharma sales, it did not have an impact this quarter, mainly due to volume improvement compared to a poor Q1 2023, but this was offset by price drops due to the entry of generics. The impact of Xarelto will be much worse for the rest of the year.

Consumer Health: Sales decreased by 9% (-2% FX adjusted), mainly due to inventory optimization in US pharmacies and a mild winter impacting sales of cold and flu products and vitamins.

It seems that the stock price has found its floor around €26 per share, although we could see lower values if negative news accumulates in the verdicts.

The Bayer thesis is one that tests all investor biases. In this case, suffering from anchoring bias and sunk cost bias is something that crosses my mind many days.

Developing the Grifols thesis, where I have been very critical of the debt situation, has led me to review my convictions and analyze the differences that have led me to different conclusions. The main ones are as follows:

Bayer is better financed: Its fixed bond structure extends to maturities in 2083 and accounts for 90% of its debt. Additionally, most issues were made at low rates. The weighted average cost of debt is 3.7%.

Bayer has a Net Debt/EBITDA ratio of 3.44 (FY2023), much lower than Grifols, and its upcoming debt maturities do not pose a liquidity problem (as long as the litigation situation does not worsen in the short term).

The rating agencies reach to similar conclusions:

It will be a long journey, possibly with some spin-offs along the way, but in the long run, once the litigation is resolved, the value of a global leader in the Crop Science industry should be recognized.

MoBruk Q1

After the annual results presentation on April 25th and a considerable delay in publishing them in English, Mobruk presented its first-quarter results on May 16th.

Here is the complete thesis at the following link:

A transition quarter for MoBruk as the new production capacity becomes operational. Revenues fell by 6% due to both a decrease in waste volume and lower prices, particularly in the solidification segment. The EBITDA margin fell from 55% to 44%, explained by both the revenue decrease and increased costs. The main reasons are as follows:

A longer-than-usual shutdown at the Karsy incineration plant due to winter. Some of that waste was converted into RDF to avoid prolonged storage (lower prices).

Delay in the start of some contracts in the solidification segment.

Increased employee costs due to the acquisition of El Kajo (+32 employees) and rising wages in Poland. I mentioned this wage pressure in the macro analysis of Poland (link)

Expectations for Q2 are to reverse the situation of Q1 while adapting to the new capacity.

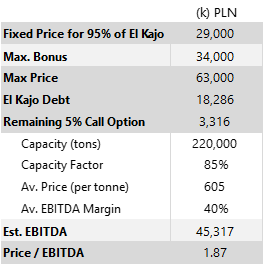

At the end of 2023, the company acquired El Kajo, adding 200,000 tons to the stabilization segment's capacity.

The acquisition of El Kajo has a variable bonus, which, in my opinion, is not sufficiently detailed in the financial statements, but initially, it does not seem like a bad investment at all.

Even with the maximum set payment, the debt, and the option to purchase the remaining 5%, we are talking about a multiple of less than 3 times EBITDA. Three years of EBITDA to pay for production capacity that could take that time to become operational from zero.

With the other ongoing projects, with a total investment of 350 million PLN, the 2023 production capacity would nearly double by 2025. One of these projects involves simply doubling the state license of the Skarbimierz plant from 70,000 tons to 140,000.

With this capacity, which will be incorporated between 2024 and 2025, the company's prospects are very positive. Additionally, public spending is expected to increase for the cleanup of “ecological bombs,” illegal toxic dumping sites, where MoBruk is well-positioned to capitalize on much of that demand.

DISCLAIMER: All the information provided in this document is purely informative and does not constitute a buying recommendation (according to Spanish Law Article 63 of Law 24/1988, of July 28, on the Stock Market Regulator, and Article 5.1 of Royal Decree 217/2008, of February 15). DuckPond Value Research & Investment Notes are not responsible for the use of this information. Before investing in a real account, it is necessary to have the appropriate training or delegate the task to a duly authorized professional.

I recently sold Mbr due to 'long time no see' of significant sales and profits from eco bombs, thus lower profitability. And, acquisitions were formerly stated to be financed by (a good portion) of debt. Now it was equity financed and a reason for lower dividend payouts, which I did not like as much. Any take on it?