Since 2023, there has been a surge in investment theses on companies in Poland in the fintweet world, and an incoming flow of capital has been observed, with investment funds opening positions in value. In this regard, Mo-Bruk, the Polish small-cap waste management company, caught my attention (of which I'll be releasing the full thesis on Wednesday, March 20th.), and as part of the analysis, it was essential to weigh macroeconomic risks. Poland's economy can bring us good opportunities, and Mo-Bruk is probably just the first of many companies I'll enjoy analyzing this year.

If you want to stay updated on the publication of MoBruk and future ones, subscribe to the blog. It's completely free.

Without prejudice to the possibility of future expansion of the analysis, these were the conclusions I drew regarding the economic situation and the stage of the economic cycle, as well as the main challenges.

Introduction

Poland is an economy still convergent with the European Union with its own currency and central bank and with a complex political situation and public opinion, divided between Euroscepticism open to remaining in the EU but without taking another step in its loss of sovereignty, and the Europeanists. Add the geopolitical risk due to Poland's proximity to the borders of Ukraine and Belarus. Given the available knowledge, the macroeconomic analysis will focus on the economic cycle, ignoring the geopolitical risk, almost assuming that the conflict will not escalate or have an imminent outcome.

Economic development

Poland's GDP reached $688 billion in 2022, with almost flat growth in 2023. Over the past 10 years, annualized GDP growth is higher than the European Union and world average.

The growth expectations estimated by the OECD are 2.6% for 2024 (0.8% Euro Area) and 2.9% (1.46% Euro Area) for 2025, higher growth than the European Union average .

Despite the GDP growth, Poland remains one of the least developed Union economies, with a GDP per capita of $17,000, with a growth of 38% in the last 10 years, far from the average of the nearby Union at $34,000.

The evolution of the GDP per capita of the developing EU countries since 1998 shows Poland in constant growth in a trend similar to the rest, surpassed mainly by the Baltic republics. It is notable that this comparative group of developing EU countries has surpassed the world average in growth in recent years, sheltered by a common market and the opening after the fall of the Soviet Union.

Currency, credit & cycle

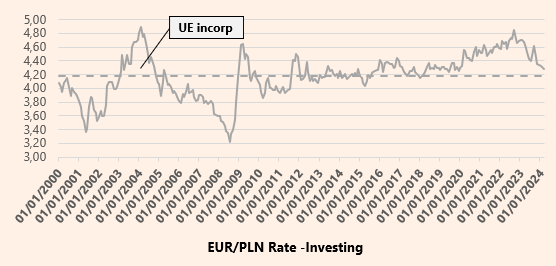

Poland has the zloty as its national currency and there are no announced plans for its incorporation into the euro; in fact, there are political voices opposed to it. With Poland's accession to the European Union in 2004, the zloty has stabilized the exchange rate at around 4.20 zlotys per euro.

Poland's economy is closely linked to the rest of the EU, 63% of Poland's GDP comes from exports of which 75% are with member countries. Narodowy Bank Polski, the ECB's Polish counterpart, has a mandate for price stability with a 2.5% inflation target but also has an interest in maintaining an export-friendly exchange rate.

The monetary policy of the NBP has followed that of the eurozone, with historically low rates of 1.75% from 2012 until the outbreak of the pandemic where they reached 0%. Inflation, for its part, was already showing signs of slight growth since the beginning of 2019, which skyrocketed from 3.5% with Covid to 5% before the invasion of Ukraine. The decision to raise rates occurs earlier than in the eurozone, even months before the outbreak of the war, where it is clearly very impacted, reaching 16% year-on-year.

In February 2024, annual inflation is at 3.9%, a drop of 4 basis points compared to the previous month, while the monetary policy decision is to maintain rates.

Going superficially into the analysis of the balance of the Central Bank (NBP), in the long-term evolution of the masses, the growth of foreign assets stands out, which has mainly been developed by delivering currency. This suggests what was previously mentioned: The central bank's “efforts” during these years of Poland's growth have come from buying currency and selling zloty to keep the exchange rate low by promoting the export industry. This has filled the central bank's assets with foreign assets, so the bank has a creditor position with respect to the world.

The Balance Sheet for 2023 is as follows, highlighting the creditor position with 85% of external assets (gold, fx...) compared to 17% of the ECB.

The sovereign debt yield curve is slightly inverted with a tendency to recover the concavity after 1 year, while the German debt is completely inverted up to 10 years. Market expectations seem to point to rates in Poland remaining above 5% in the long term, with a slight drop from current rates between 2025 and 2026.

The inversion of the Polish yield curve does not seem to be an indicator of a phase of struggle for liquidity. The low rates applied by the NBP during 2010-2019 appear to be more of a monetary policy response to maintain the exchange rate (subsidy to exporters) in the face of strong currencies than a form of credit expansion.

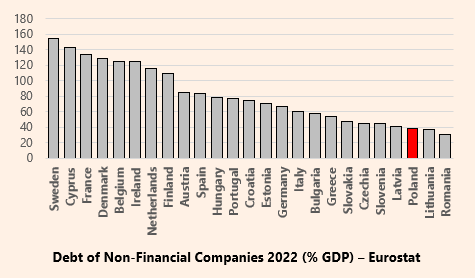

This assumption can be argued by the debt of the private sector over GDP, where we see that Poland has the lowest rates in the Union, both for non-financial companies and for families:

The evolution of debt since 1995 provides a similar vision. The phase of very low rates has not produced relevant private debt, even in decline since Covid:

Regarding debt and public spending, Poland has less than 50% public debt over GDP, well below the European average...

…although chaining 22 years of public deficit.

Comparatively, Poland is not far from the European average in public spending on GDP, at 44% in 2022.

Covid and the war in Ukraine have interrupted a deficit adjustment process that in 2018 and 2019 reached levels close to budget balance.

Without evidence of expansion of private or public credit, possible bubbles in assets are analyzed:

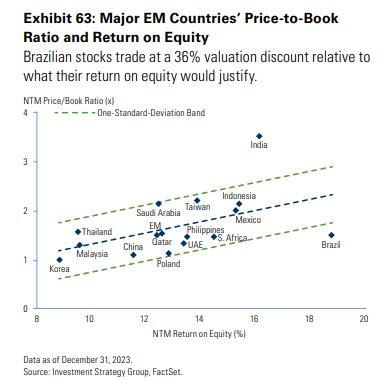

Regarding the stock market, the MSCI Poland Index with the 15 main values representing 85% of the market cap, is currently trading at a PER of 9 times earnings and a Price to Book Value of 1.27 times compared to a PER of 12 times and a P/BV of 1.66 for the MSCI emerging markets. At these multiples an asset bubble is not seen in the financial market .

Nor in real estate, as we see in the Eurostat House Price Index for the year 2022 with an index of 100 in 2015:

The weight of construction on GDP is one of the lowest in the EU, 2.1% compared to 5.7% of the average, which suggests that the revaluation has occurred due to a lack of supply and not due to a bubble driven by credit.

Key points on the section

Although it would be directly impacted by the timing of the global macro cycle, Poland's current situation does not indicate a phase of liquidity degradation or credit expansion that could jeopardize its growth in the medium term, being in a good position to continue its growth.

Unemployment and wages

The evolution of the unemployment rate in Poland reinforces the argument of economic development. Poland in 2002 had an unemployment rate of 20% of the active population and is currently at full employment with less than 3%.

At EU level it has the lowest rate only surpassed by the Czech Republic.

Poland continues to be an attractive country due to its labor costs, which in 2022 will not reach 15 euros per hour, compared to 30 in Spain or almost 40 in the EU 27 average. The growth in wages in Poland since 2008 has been 64%. Once again, in comparison with the Baltic republics, a slower speed of development can be seen.

The evolution of salaries in Poland in recent years has been sustained, mainly on the salary side:

Demography

Poland is the sixth largest country in the European Union, behind Finland, and the fifth largest by population.

Counterintuitively to its economic development, Poland has consistently lost population over the past 25 years, remaining above 37.5 million in 2023.

This fact can be explained by several combined factors:

The birth rate is below the European Union average in the last 20 years. In 2001, Poland had 1.31 births per woman compared to the average of 1.43. Respectively and for 2021, 1.33 and 1.53.

Life expectancy is slightly lower than the rest of the EU countries, at 77 years compared to 81.

The migration balance: Poland had around 5 million emigrated nationals in 2020, approximately half in Germany, while they have only received 800 thousand immigrants. The migratory balance of recent years reflects an improvement, in the heat of full employment data with the return of expatriates and a slight migration

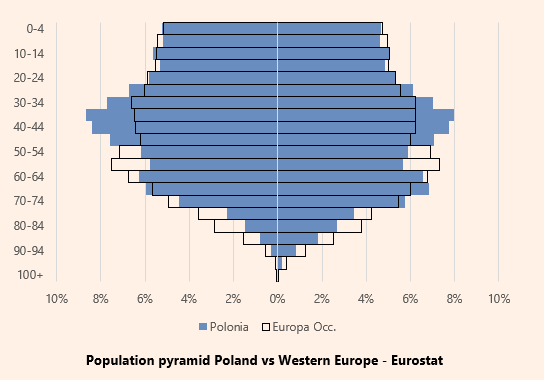

Despite this, the population pyramid compared to the rest of the Western European countries shows a healthier figure with a lower aging population and a greater number of people of working age.

Given GDP growth expectations above the European average and full employment, added to the tensions in the labor market and demographics, salary increases above the rate of previous years are expected.

DISCLAIMER: All the information provided in this document is purely informative and does not constitute a buying recommendation (according to Spanish Law Article 63 of Law 24/1988, of July 28, on the Stock Market Regulator, and Article 5.1 of Royal Decree 217/2008, of February 15). DuckPond Value Research is not responsible for the use of this information. Before investing in a real account, it is necessary to have the appropriate training or delegate the task to a duly authorized professional.

Reach us on duckpond@duckpondvr.com