Monsanto merge proved detrimental to shareholder value as overpayment and litigations drove the stock price down by over 40%, coupled with a challenging integration and a substantial debt burden.

The stock continues its plunge, reaching a 60%, due to worsened conditions from Glyphosate sales, litigations, and the Phase III failure of a projected Pharma blockbuster, compared to pre-Monsanto levels.What remains? A key player on crops & herbicides/pesticides global market, an essential industry in global food distribution.

What also remains? A Pharma + Consumer Health segment with slow growing but consistent cash flow generation.

A turnaround opportunity emerges as the stock price reflects the worst amid a series of setbacks to buy a leading Crop Science company with organic 5% annualized growth, quoting at a Normalized P/E of 15. Additionally, two cash-generating segments comprising around half of the earnings, come essentially for free.

Summary

Recent years have provided clear examples of disastrous and ruinous merges. Recently I was following the case of International Flavor & Fragrances that acquired Dupont Nutrition & Bioscience division with notable similarities with Bayer acquisition of Monsanto in 2018.

Both seemingly led to global industry leadership, yet shareholder returns were questionable. IFF shareholders lost over 50%, and Bayer AG is over 60% below its pre-Monsanto acquisition price.

Focusing on Bayer, the court decisions announcements about the opened trials for causing cancer to the users of the herbicides with Glyphosate and the failure of Asundexial trial, a failed attempt of a new Pharma blockbuster, has caused the perfect storm for Bayer stock, quoting currently at around 30-33€.

And here is where a turnaround opportunity is opened. With the worst already discounted of the price by a cascade of bad news, the panic bring us the opportunity to buy a world leader in Crop Science that organically grew at 5% annualized on the last 6 years, quoting at Normalized P/E 15, the average of direct competitors (FMC, CTVA), and getting for free two solid cash generating segments (Pharma and Consumer Health) contributors of approximately half of the earnings. From now on, our work is to explain what is Bayer oblivious to the media noise, size the problems that each segment is facing and evaluate how much of the headwinds have already passed.

Segments brief

Crop Science Division (50% sales)

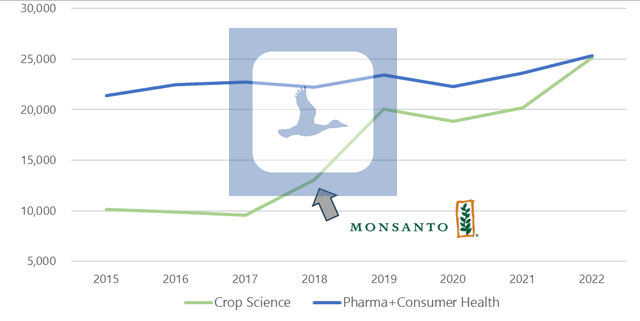

In our collective consciousness, Bayer was synonymous with the trusted German pharmaceutical company that supplied us with Aspirin and perhaps some vitamin supplements like Supradyn. However, the landscape has evolved significantly. The acquisition of Monsanto has redefined Bayer's core business, honing in on the burgeoning agricultural sector's growth prospects. Crop Science, an existing segment with sales of €10 billion in 2015, now contributes approximately €25 billion, constituting half of Bayer's total revenue in 2022.

The positioning of this industry is in the first steps of the agriculture chain, providing crop protection, seeds and traits, and digital farming solutions to farmers worldwide. The distribution is driven primarily through wholesalers, retailers, or directly to farmers.

In 2018, Monsanto was acquired amidst a low-interest-rate environment that fueled M&A activities across industries. The agreement closed at $63 billion (approximately 20x EV/EBITDA), leaving Bayer with a 5x Net Debt/EBITDA ratio and downgraded ratings (Fitch: A to BBB+).

The operation brought doubts to the market during 2018 (see price graph above), and were confirmed by the difficulties to integrate and generate synergies:

2017 combined Sales vs 2019*: $23 billion vs 20 billion

2017 combined EBITDA vs 2019*: $5.1 billion vs 4.7 billion

ROIC excluding Goodwill pre/post Monsanto*: 17% vs 14%

*Restated numbers excluding this event: Bayer was compelled by regulators to divest part of the Monsanto business in favor of BASF. By the end of 2018, Bayer was down 40% on the pre-merger price, but the snowball had just begun.

RoundUp-Glyphosate Lawsuits

In 2020, Monsanto was hit by thousands of lawsuits in USA around the component glyphosate, a herbicide widely used by Monsanto since 1970 in agriculture to control weeds and improve crop productivity content in the product RoundUp. Monsanto retained the patent for glyphosate in the USA until 2000. As secondary effects require years of product usage, competitors were not immediately affected by legal issues related to glyphosate's alleged health impacts.

Some studies have linked glyphosate to the risk of developing certain types of cancer, such as non-Hodgkin lymphoma. There is also concern that glyphosate may contaminate food and drinking water, which could have long-term implications for human health. Bayer's stance is that glyphosate is safe when used correctly and according to instructions. The company relies on regulatory assessments that have found a low potential danger to mammals.

Bayer has taken steps to address litigation related to Roundup by implementing a voluntary claims resolution program in the United States. While the company remains committed to glyphosate-based products in agriculture and their professional use, it has decided to withdraw residential products containing glyphosate from the U.S. market to mitigate legal risks. The current situation with the legal process is the following:

Settlement Agreements: +100,000 cases for 11,000 million $

Trials with verdict: 8/15 favorable verdicts. Last 4 lost with heavy amounts.

Remaining: Around 44,000 lawsuits pending.

With the available information from the law firm that is running the trials for the affected and Bayer Annual and Quarterly report could be estimated a final invoice for the Monsanto-Roundup case as following:

The residual amount may surpass the Normalized Cash Flow generated by operations by $2-3 billion annually. However, it is adequately provisioned and poses no concerns for the financial debt as detailed in the company overview in the upcoming sections of the report.

The total RoundUp invoice could achieve $22.5 billion with remaining estimated payments of $7 billion.

Crop Science Division out of the spotlight

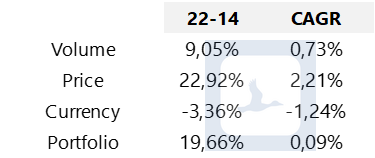

The acquisition of Monsanto has propelled Bayer into a global leadership position in Crop Protection & Seeds, covering crops, herbicides, and pesticides—a market growing at an impressive 9.64% CAGR from 2016 to 2022.

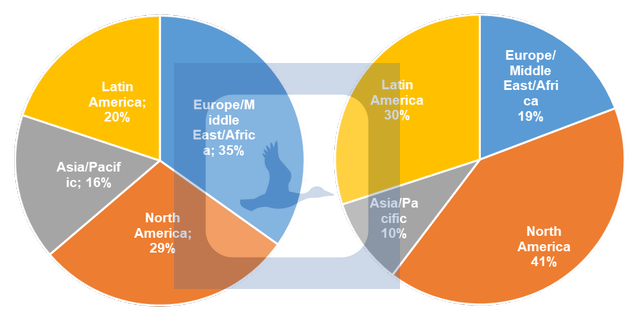

Furthermore, Bayer has experienced a remarkable fivefold increase in revenue in vital markets like North America and LATAM. These regions are crucial players in the global agriculture scene, especially the USA, the largest exporter. These developed markets stand in contrast to countries with less industrialized agriculture, which is less export-oriented and more focused on domestic consumption.

This shift in geographic distribution following the integration with Monsanto is visually depicted in the graph below, comparing regional sales distribution in 2017 to that in 2022:

Bayer's positioning in the global market is the following with a representation of 60% global market for 2022 sales:

Bayer Crop Science: $26 billion $

Syngenta + ADA: $25 billion $

Corteva Agriscience: $17 billion $

BASF Agricultural solutions: $10 billion $

FMC Corporation: $6 billion $

The size against the competitors provides an advantage on research & development that is key to be able to continuously develop resistant and more productive crops. The size of the division allows Bayer to invest on R&D doubling the amount of it's next competitor, 2.6 billion in 2022 with Sygenta and Corteva surrounding 1 billion, without deterioration margins. As shown in the graph, against main competitors:

In 2022, the division reached its peak on Revenue with a growth of 24.6% vs previous year on sales lifted by, curiously, a global increase on Glyphosate prices due to a shortage caused by a second round effect of Covid years. Glyphosate excluded, the growth was 13.2%. This effect has reverted to the mean in 2023, impacting sales and also market expectations. The glyphosate trend to average is reached with small rebound on Q3.

Despite the current situation with the Glyphosate impacting sales, rest of Crop Science division is performing mid single digit growth, closer to the long term trend:

The conclusion is:

Bayer Crop Science is a global leader in a concentrated and growing market with adequate margins, with a long term trend of growth adversely affected by short-term headwind.

Pharma Division (38% sales)

The legacy and most recognizable identity sign of Bayer is on the Pharma business with more than a century of history. Pharma focuses on prescription pharmaceuticals, particularly in the fields of cardiology and women's healthcare, along with a focus on specialty therapeutics dedicated to oncology, hematology, ophthalmology, and, in the foreseeable future, cell and gene therapy. Sales distribution per specialty on 2022 was the following:

The last eight years of Pharma do not show an intense growth division but consistent in low single digit and with EBITDA margins over 30%.

The expiration of Xarelto's patent, the latest major blockbuster contributing to approximately 22% of Pharma Segment sales, has led to a mid-single-digit decline (9M 23: -5%). Asundexial was anticipated to replace Xarelto, projecting similar peak sales. However, the Phase III trial failure for this anticoagulant has dampened portfolio prospects, extending concerns from the Crop Science segment to Pharma, exposing vulnerabilities. Pharma grapples with patent expirations, price competition, and reduced R&D productivity. Under Pharmaceuticals environment the narrative seems to confirm that we are not seeing a outstanding division, with lower EBITDA margins against the big Pharma.

There are other drugs and components in pipeline as shown in the next figure, but Asundexian seemed to be key after 2026:

The new CEO, Bill Anderson, with a background on Pharma business (Also exCEO on ROCHE) and in other executive positions dedicated to research, could revitalize the R&D inside Bayer but that is out of our valuation.

Pharma Portfolio review

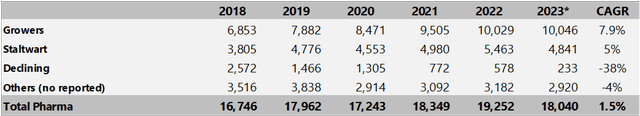

Examining the current product portfolio and its trajectory, each drug has been categorized into growth, stalwart, or declining segments based on recent performance. The "Others (no reported)" category represents sales not specified by a particular drug, and it's noteworthy that a drug in decline may fall into the Others category if it falls below the first 80% of sales representation.

The evolution of each category in recent years is detailed below:

In recent years, the majority of sales contributions have come from growers, but concerns arise due to the patent situation surrounding the blockbuster Xarelto, which constitutes 22% of total sales in 2023. Delving into the primary categories, Growers and Stalwart:

Defining the "N Year" as the first year of appearance in Bayer reporting and considering Patent Expiration weighted by the average sales of expiring patents by country, the sales evolution model suggests the growth portfolio appears mature yet consistent for the coming years. This is achieved by blending new, promising launches with proven, solid drugs that still boast lasting patents.

Specifically, Xarelto has reached its sales peak and is on a decline after the N+10 year. In contrast, Nubeqa, currently in N+2, has doubled each year since the N Year, while Kerendia, currently in N+1, doubled in its first year.

Bayer also boasts a robust portfolio of stalwart products contributing approximately one-third of total sales. These products derive their competitive strength not solely from patents but from the influential brand power and consumer confidence they command.

The pharmaceutical industry poses significant challenges for investors to comprehend. Predicting the success of a drug in trials, navigating the intricacies of the global patent system and the inevitable decline post-expiration, and managing the uncertainty and fluctuation of potential lawsuits arising from patient effects fall outside our expertise. However, the potential turnaround with Bayer allows for consideration of a no-growth division and still envision margin of security.

Bayer Pharma is not a growth segment at short-mid term but is a stable cash flow generator.

Consumer Health segment (12% sales)

Is not necessary to waste too much time here. Bayer owns very recognizable brands of non-prescription medicines and parapharmacy as the following:

Is a stable Cash Flow generating segment with slow growth and consistent EBITDA margins over 22%.

Company overview

Bayer has not improved its pre-Monsanto EBITDA, but it has enhanced its operating leverage by transitioning from a semi-fixed cost structure of 43% to 37%, primarily in SG&A (Selling, General, and Administrative expenses).

As a result of the integration, SG&A expenses initially increased to 30%, gradually decreasing as restructuring takes place. They are maintaining R&D expenditure at around 12% of sales.

Net Debt/EBITDA ratio, which was at 5 times during the Monsanto operation, has been gradually alleviated, leading to an improvement in both Cash and EBITDA, although the financial debt reduction has not occurred.

Currently, Bayer have around 47,400 million € of financial liabilities, mostly issued as bonds. More than half of the current total debt is due after 2028, with maturities on 2036 or 2082. Bayer is able to sustain high debt on markets given its track record. At Q3 2023 is slightly over 3 times Net Debt/EBITDA, with stable debt cost.

Against some of their competitors in Pharma and Crop Science environment there is no noticeable increase in the cost of financing :

As a full company, the complete integration of Monsanto with no further synergies to emerge could be concluded, accompanied by a high-debt but manageable situation.

Valuation

Bayer is a global leader on Crop Science segment and once that the effects of bad news dissipate, will be able to rebuild financial situation. Pharma and Consumer Health currently have enough portfolio to continuing being solid Cash Flow generators.

As Bayer is a complex company, having 50% on agricultural industry and 50% on Pharma, the approach for the valuation should consider this particularity. The method used for the valuation is EV/EBITDA multiples for each segment against comparable business:

Crop Science multiples:

A multiple of 12 was selected, considering Bayer Crop Science's prominent global position in the sector. Given FMC's lower debt and its immunity to glyphosate litigations, a more conservative target was set for Bayer in this segment.

Pharma & Consumer health multiples:

A multiple of 8 was chosen for the Pharma and Consumer Health division, reflecting the anticipated absence of growth and the mentioned issues concerning the pipeline and patent expiration. The following adjustment was made to the EBITDA for the Pharma segment to increase the margin of security in the valuation.

Pharma Division adjustment

With portfolio and pipeline considerations, 2023 EBITDA for Pharma segment was corrected for the valuation with the following standpoints:

Xarelto declining at 27% on sales.

Nubeqa and Kerendia performing on less than a half of the expectative of >3 billion € (1.5 billion € each)

Stalwart portfolio stable.

Excluded rest of pipeline, anticipating possible setbacks.

With no growth assumption and a Normalized 2023 EBITDA for Crop Science and Consumer Health and our Normalized 3Y scenario for Pharma segment the target price of the valuation is as following, giving enough margin of security to be a good investment:

A highly cautious scenario is being considered for the Pharma segment, with the valuation positioned in the range of 60-70 €.

Potential risks

RoundUp Lawsuits could go worse than expected. For the estimations have been used the lawyers's higher estimations for the 44.000 remaining demands.

Potential divestitures or structural changes could impact the overall valuation.

Pharma portfolio underperforms more than expected. Pharmaceutical industry is complex and is difficult to estimate future sales. In caution, no growth and bad assumption about Xarelto declining was taken in care.

Crop Science division could underperform competitors.

Thanks for reading and please let us know any doubts or comments.

DISCLAIMER: All the information provided in this document is purely informative and does not constitute a buying recommendation (according to Spanish Law Article 63 of Law 24/1988, of July 28, on the Stock Market Regulator, and Article 5.1 of Royal Decree 217/2008, of February 15). DuckPond Value Research is not responsible for the use of this information. Before investing in a real account, it is necessary to have the appropriate training or delegate the task to a duly authorized professional.

Reach us on duckpond@duckpondvr.com