Introduction

Mo-Bruk SA is a Polish small-cap listed on the WIG index of the Warsaw Stock Exchange. It ranks 73rd in market capitalization and has been listed in the mWIG40 subindex for being one of the 40 most liquid companies in the market. It has just over 1 billion zlotys of market cap, about €233 million.

Its attractive EBITDA margins above 45%, its net cash position and its belonging to an unattractive sector in the purest Lynch style, as well as its belonging to an emerging country in the EU environment with high growth and legal security are attractive for the investment analysis.

If you want to stay updated on the publication of MoBruk and future polish companies, subscribe to the blog. It's completely free.

The business

Mobruk is a key industrial company in the circular economy in Poland since it transforms waste that, a priori, is a problem, both due to its collection and treatment, into by products that can be used in other industries. Although it has commercial activity outside of Poland, 100% of its production is carried out through treatment plants located in the south of the country, in the area of greatest industrialization and, therefore, where the greatest volumes of waste are generated.

It operates through state licenses granted to its plants that limit the number of annual tons that can be treated. This regulatory aspect is key to the activity since it prevents the company's plants from operating maximizing their capacity, currently at around 60% in some segments, but it also places burdensome barriers to entry for competition. The difficulty of obtaining permits is evident in M&A; it is easier to acquire a company with a permit for treatment, even if its physical assets are incapable of reaching that capacity, than to try to obtain them.

Mobruk's process is relatively simple: It receives waste at its plants, both municipal and industrial, charging an amount per ton and treats it to obtain byproducts that are reused or sold. The type of waste, the acceptance price, the treatment and the plant where it is carried out are different and the by-products of the processes are directed to different industries.

This logic supports the separation of Mobruk's activities into the following three segments:

Waste incineration (35% Revenue)

Production of alternative fuel or RDF (36% Revenue)

Solidification and stabilization. (20% Revenue)

The remaining 9% corresponds to other activities of the group, specifically the operation of its own gas stations on one of the country's main highways and the construction of pavements and roads.

In the following diagram we can see the complete value chain, both the origin of the waste, the treatment carried out according to the type of waste and the by-product and the industries that consume it:

History

Józef Mokrzycki, currently the majority owner with his 20% stake through the family holding Ginger Capital, founded the company in 1985. At that time its main activity was the manufacturing of flooring and terrazzo tiles.

The current core activity, waste management, began in 1997, when the company began operating a waste recovery plant in Niecew.

The milestones considered important to understand the evolution and current situation of the company are the following:

1997: Start of waste management activity with a plant in Niecew

2002: Purchase of industrial landfill in Wallbryzch.

2004: Establishment of Hazardous and Non-Hazardous Waste Recycling Facility in Wał brzych .

2007: Construction of the Alternative Fuel Production Plant in Karsy,

2008: Acquisition of the company Raf-Ekologia, owner of the Jedlicze waste incineration plant.

2010: First time listed on the NewConnect stock market with non-voting shares.

2010: Opening of research and development center.

2014: Completion and commissioning of the hazardous waste incineration plant in Karsy.

2020: Sale of ferrous and non-ferrous metal recycling plant in Zabre. low-performance segment where the recycler must pay for the waste.

June 2022: Józef Mokrzycki, founder of the company, leaves the position of Chairman of the Board of Directors after 37 years at the helm of the company.

November 2023: Acquisition of the El Kajo company. Diversification of presence in Poland with first delegation in the center of the country. They are licensed to more than double current capacity in the solidification segment.

Currently, two sons of the founder are in management positions. Wiktor and Tobiasz, members of the board of directors and with executive roles, have been academically trained with a view to managing the company and have experience within it. In the case of Wiktor, more focused on the commercial area , he graduated in entrepreneurship with a specialty in environmental engineering and Tobiasz is more specialized in construction engineering.

Despite having heirs, the founder has delegated the responsibility of the Chairman of the Board and the position of CEO to Henryk Siodmok, a doctor in economics from the University of Krakow, with experience in company management after 12 years at the head of Atlas Group SP, a company dedicated to the manufacturing of construction chemicals and 4 years in Dobrowolski SP, manufacturer and supplier of specialized vehicles such as tanker trucks, garbage collection trucks or airport vehicles.

The decision to put as replace an economist with experience in running companies seems correct in order to maintain the creation of value for the shareholder as a maxim. As a curiosity, Henryk is an expert at the Adam Smith Center so we can assume his liberal vision of economics.

An innovative company

Józef's entrepreneurial nature has been key in the development of the company, which has based part of its success on innovation in the waste treatment process. In 2010, Mo-Bruk opened a laboratory at its Niecew plant with which they have obtained several patents:

Patent No. 220706 from August 2021: The technology is used at the company's facilities in Niecwi and Skarbimierz and involves the processing of inorganic waste to produce artificial concrete.

Patent No. 235357 of April 2012: Invention for the comprehensive processing of hazardous waste to generate byproducts. Specifically, the use of the energy potential of hazardous waste for the production of steam, later used in the drying of alternative fuels.

Patent No. 235346 October 2016: Technology for the processing of secondary waste from incinerators. Mo-Bruk owns 50% of the patent rights, and the remaining 50% belongs to the Krakow University of Technology.

Patent No. 235365 November 2017: Invention related to a mixture to produce cellular concrete. Mo-Bruk owns 50% of the patent rights, and the remaining 50% belongs to the AGH University of Science and Technology.

In addition to the patents mentioned, it has been applied, together with the aforementioned Universities, to four others. The pace of innovation does not stop: they are replacing the use of energy with energy generated through waste incineration to reduce their dependence by 100% and, perhaps, become a net generator of energy.

Segments

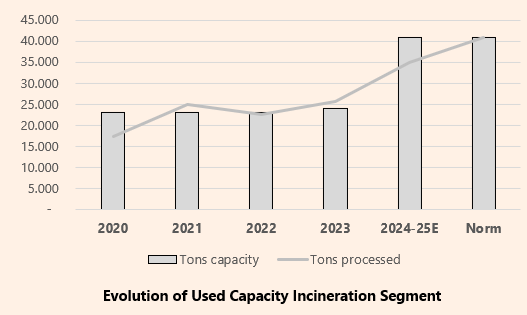

The main activity of this segment is the incineration of hazardous waste. The advantage of incineration is the reduction of waste to a minimum, while the vapor released into the atmosphere is cleaned of hazardous waste through filters. The remaining ashes from incineration are stored in silos. The segment is operated through its plants in Jedlicze with a capacity for 11,000 tons of medical and hazardous waste and Karssy with 15,000 tons for industrial waste. The byproducts of the process are two: the processed steam that is resold to refineries and the calorific value that is used in the drying process of the RDF production segment. The company is installing a turbine at the Jedlicze plant to generate electricity that would reduce the group's electricity needs by 100%. The income from the sale of processed steam is residual and is sold through long-term supply contracts to necessarily nearby industries.

In the last 5 years it has doubled income with the same capacity, by increasing prices per accepted ton of waste. This price dynamic is due to Poland's convergence with Europe in terms of waste collection, including the treatment of so-called "ecological bombs" or illegal dumping, and the lack of installed capacity with the capacity to treat this waste.

In addition to the two Mo-Bruk facilities, there are only six other industrial waste incinerators in Poland. In terms of capacity, only the Sarpi/Veolia facility is capable of handling quantities of waste comparable to Mo-Bruk, the rest are small plants not designed to handle large loads. Of the 100,000 tons per year of incineration capacity Mo-Bruk has approximately 30%. Comparatively, Germany has a capacity of 12.5 tons per thousand inhabitants compared to 2.63 per thousand in Poland.

The entry barriers detected in this segment are:

Objections from the local population to the opening of new plants.

Long process of obtaining permits and construction of the plant.

Experience requirements to obtain contracts.

Relations with waste generators and process know-how.

Given the difficulty in opening more plants and the limited M&A possibilities, Mo-Bruk is expanding the capacity of its plants as much as possible through improvements and expansions. At current prices these investments are amortized in 3 years:

2024: 7,000-ton expansion at the Jedlicze plant for about PLN 30 million.

2024: 10,000-ton expansion at the Karssy plant for PLN 135 million

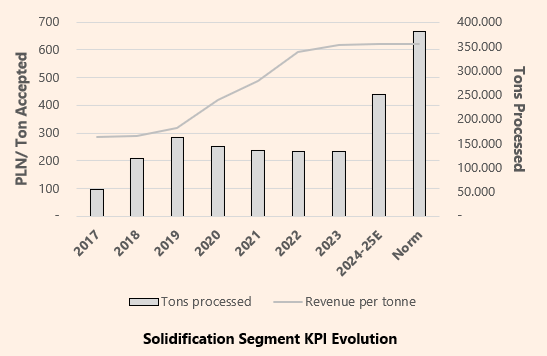

This segment of Mo-Bruk's activity is dedicated to the solidification and stabilization of hazardous waste, including waste from the incineration of urban waste such as remains of galvanized materials, remains contaminated with heavy materials or petroleum derivatives and corrosive materials such as soil and sludge. . Through the compaction process and various chemical processes based on its unique technology, granulated cement is obtained, a by-product that can be used for road foundations or sealing landfills or mines. One of the services offered by Mo-Bruk in this area comes from the cleaning of industrial land and soil contaminated by heavy materials or contaminated debris, an area where the company sees growth.

The company's operations are carried out through two plants: The Skarbimierz plant has the capacity to operate up to 140,000 tons of waste per year, although it has permission to treat only 70,000. For its part, Niecwi has a processing capacity of 100,000 tons per year.

As in the incineration segment, the application of EU regulations and the toughening of penalties for illegal dumping is boosting the price per ton entered by Mo-Bruk in accepting the waste.

The only competition in this segment within Poland is a similar plant in the city of Konin in central Poland, which Polish bank MBank says is experiencing similar revenue growth.

Outside of Poland, Germany has installed capacity, but Mo-Bruk has a deep moat built around two conditions:

Prices in Germany are around €150/ton (about PLN 640), without taking into account transport over 400 km, which is not feasible for a product of such low value.

The export of toxic waste requires government permits and licenses, both in the sending and receiving countries.

In meeting environmental goals with the EU, Poland has to reduce the amount of urban waste in landfills to 10% of the total by 2035. The European Environment Agency's June 2022 report urges Poland to take measures since it is very far from the objective (40% in 2020). To achieve this objective, the incineration of urban waste to reduce its size and the Mo-Bruk solidification plants to treat the embers generated in the process are key.

In this sense, Poland is opening urban waste incineration plants throughout the country, as we can see in the map below, and Mo-Bruk is well positioned to absorb much of this demand.

Mo-Bruk's expansion and M&A activity in this segment is focusing both on expanding installed capacity and obtaining permits to operate them at 100%. The projected operations are the following:

2024: The company has acquired the company El Kajo SP, with an operating capacity of 220,000 tons in central Poland (geographical diversification) for around PLN 34 million. At the group's margins, the transaction price is around 3 times EBITDA.

Projected: Achievement of permission to operate the remaining 70,000 tons of the total capacity of the Skarbimierz plant.

Projected: Expansion of the capacity of the Niecwi plant by 40,000 tons.

The expansion strategy given the lack of capacity and the situation of need to comply with EU directives seems appropriate and the company does not rule out more M&A movements.

RDF production is the weakest of Waste Management's three segments. The interruption of the sale of RDF affects the amount of garbage that can be accepted since it is not profitable to treat this type of waste if there is no margin for the sale of fuel. In fact, the segment operated at 37% of its capacity in 2023. The RDF fuel used mainly in cement plants competes with other fuels, mainly coal, which has a calorific value equal to or greater than RDF, which is why it is used as a substitute in the event of price increases. On some occasions the RDF has to be delivered at a loss or even with payment for the storage cost. In this sense, Mo-Bruk relies on two conditions to reverse the situation:

RDF fuel can be promoted by European directives: it is a way to recover energy from the urban waste generated. Approximately 50% of municipal solid waste is eligible.

Mo-Bruk is opening markets for the possibility of exporting RDF outside of Poland, to countries with a coal deficit.

The price dynamics followed are similar to solidification segment:

In this market Mo-Bruk has greater competition, as we see in the following map, from national and European companies, such as the French Suez and Remondis.

In this segment there are no M&A operations or growth Capex projected given the lack of capacity with which it operates.

Demand factors

In this section we are going to address the determining factors in the demand for waste treatment. Starting from its generation to the treatment where the legislative and environmental factors of the European Union framework are decisive, not only in the dynamics of the amount of waste treated but in the price per ton.

Waste generation and treatment

In the European Union, the generation of more than 2,000 million tons of waste per year is recorded, of which around 5% is dangerous.

The Union directives are focused on the circular economy and in this sense, both the generation of waste and the treatment carried out of it are of great importance.

Regarding treatment, the action plan is aimed at reducing the number of waste stored in landfills, setting the objective of reducing at least 10% of the amount of annual waste treated in this way by 2035, where, as we have commented, Poland has a lot of work ahead of it.

In this section we are going to analyze the situation in Poland within the EU framework from the point of view of waste generation and treatment.

Waste generation

In waste generation per capita, Poland is close to the European average, with Finland and Sweden standing out for their wood industry.

Disaggregating the type of waste, we observe that Poland is far away in the generation of toxic waste. This dynamic is mainly due, as mentioned by the European Environment Agency and Mo-Bruk in some reports, to the lack of control and illegal discharges. To converge with the EEA criteria, authorities in Poland are improving controls and imposing sanctions.

For Mo-Bruk, the fact that the producer of toxic waste is obliged to certify the treatment of their waste and that the law penalizes these practices is a positive aspect. In fact, local authorities are taking action to eliminate so-called “green bombs” or illegal toxic waste dumps through tenders to which Mo-Bruk submits its offer.

In the evolution of the generation of hazardous chemical and medical waste, the main contributor to the waste incineration segment, a consistent increase is observed, with 8% annualized until 2020. In the same period, average growth in the EU27 remained flat.

Regarding secondary waste, hazardous or not, derived from the initial treatment (mainly incineration) and susceptible to being subjected to solidification and stabilization processes, they have grown substantially at an annualized rate of 8.5% (EU27: 5%). In this segment we find Mo-Bruk's latest M&A operation, the purchase of a company with a solidification license for 200,000 tons per year, doubling its capacity.

Waste treatment

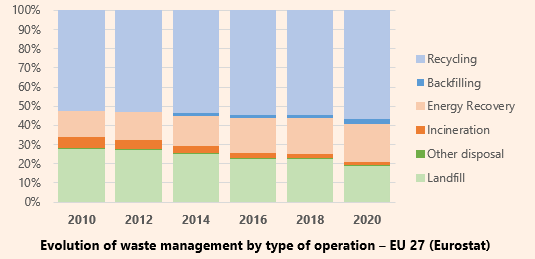

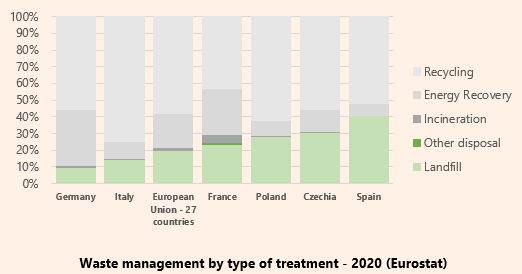

As seen in the following graph, the trend in the European Union guided by the directives is to reduce the amount of waste in landfills and opt for reuse both via recycling and incineration with recovery of energy. Of the categories established by the European framework, the main operated by Mo-Bruk are: Backfilling, Energy Recovery and Incineration .

The Energy Recovery and Incineration processes, the main ones in which we include Mo-Bruk, are very similar, the difference being in the generation of energy or some usable by-product in the process.

In the case of Poland, a different profile is observable. It maintains a higher percentage in landfills, except in 2020 affected by an extreme value of Backfilling, surely caused by the filling of an open pit mine.

In the following graph, for the last year available (2020) and excluding Backfilling which shows an extreme value in 2020, we see that Poland still has a way to converge with the EU-27, increasing energy recovery and reducing the amount in landfills.

The European Commission and the European Environmental Agency actively monitor the objectives of the directives in this matter. In this sense, in the 2022 AME report, titled “Early warning assessment related to the 2025 targets for municipal waste and packaging waste”, Poland is very far from the objectives of reducing the amount deposited in landfills.

The tools available for this reduction are mainly the “landfill tax” which, in practice, is a tax charged by municipalities to landfills per ton accepted. This tax is transferred directly by the owners to the garbage generators and this is where one of the price dynamics is introduced that affects the price/ton of the Solidification and Stabilization segment and that of RDF. As rates and taxes rise, and therefore the prices per ton of acceptance at landfills, the more Mo-Bruk can charge for the acceptance of waste.

Key points of the section

Poland is converging to the European Union average in waste generation and waste eligible for the Mo-Bruk process is growing at high single-digit rates. The waste treatments carried out by Mo-Bruk are within the framework of the environmental policy of the European Union, and its dynamics favor its activity.

Poland Macro analysis

The macro analysis on Poland has been separated from the thesis due to length constraints. If you're interested in the complete macro analysis, I'll leave the link here:

Although there are more comprehensive and expert macro analyses on Poland, I like to conduct my own due diligence in this regard as well and share my own comments.

Company analysis

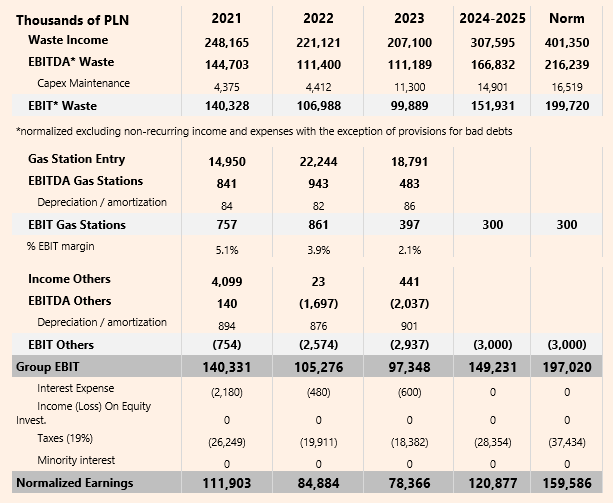

At the time of concluding this report, Mo-Bruk has not presented annual results for fiscal year 2023. All full-year data provided are estimates based on the accumulated Q3, with a sufficient level of predictability.

Profitability

The evolution of the group's income and margins since 2013 has been marked by the improvement in operating leverage. With the same number of plants in operation (with the difference of the sale in 2020 of the metals plant) it has boosted the group's income and margins:

As we have seen, this circumstance has occurred due to two events: increase in prices for acceptance of waste and increase in tons processed. Until 2022 compared to 2017, the effect of the price boom on the increase in turnover represents 58% and the quantity effect the remaining 42% with disparity by segments:

The improvement in gross margins has been transferred to EBITDA, where sustained margins above 40% have been achieved in the last 5 years:

The improvement in the group's profits has been passed on to the shareholder with sustained growth in EPS until 2021 and a normalization above PLN 20 per share. At least 50% of the net profit must be distributed to shareholders, currently assuming a yield of 4.2% at current prices:

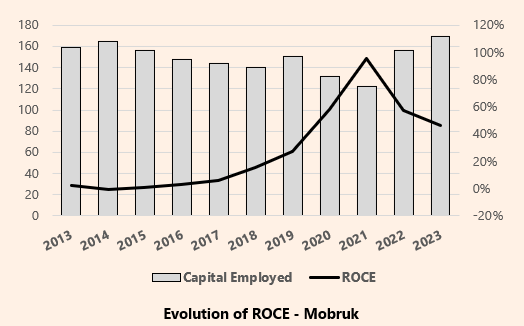

Return on Capital

The operational management data of the business are very positive and so is the return on capital with ROA above 30% in the last 4 years and with ROCE above 20% since 2019:

To calculate the ROCE, an exhaustive analysis of the working capital needs has been carried out, adding some non-current items such as guarantees created for work, as it is considered an item that must be immobilized to work and that increases with the level of activity.

The main need for working capital originates from financing clients, in this sense Mo-Bruk correctly provisions for portfolio deterioration. In the section related to clients we will see that the reported level of client concentration does not entail credit risks.

Viability

MoBruk has a recent track record of decreasing debt and steadily increasing cash:

The current financial debt, about PLN 6 million, consists of operating leases with -0.50 Net Debt/EBITDA ratio:

As for short-term solvency, it is absolutely guaranteed. With net cash alone, Mo-Bruk has a coverage ratio of 175% of short-term liabilities, 125% if we include long-term liabilities.

Customers

The concentration of clients is not excessive. In 2022, the top 5 clients were responsible for 26% of billing, with a 10% reduction in dependency compared to 2021.

The 2020 prospectus details the name of the main clients and in the top 1 with 9.5% appears the company Remondis, which in addition to being a client is a competitor. Within the top 10 of the prospectus there are also municipalities in the area.

Manage team remuneration

The remuneration of the management team represents less than 1% of the group's income. Mo-Bruk is a small cap and as such its incentive system has to be simple. Systems based on share-based compensation require a theoretical value to be reflected in the compensation, options to be assigned and market purchases to be made. The bonus can represent up to 50% of the fixed remuneration, and is payable in cash based on:

40% of goals of the position.

60% financial goals

¾ dependent on EBITDA per share.

¼ per bonus based on increased income.

No information has been found regarding insiders with shares, beyond the owners, nor has this information been provided by the company's investor relations department.

Shareholders

The main shareholder of the group is Ginger Capital, a holding company of the Mokrzycki family, and therefore the founder has recently been removed from management and the two sons have an executive position. The rest of the minor shareholders are pension funds and fund managers, mostly Polish. Through preferred shares, Ginger Capital controls 33.33% of the company.

Among the minority funds, fund managers such as DWS or True Value stand out. With a market cap of approximately 280 million dollars, it is too small for funds like AZValor Internacional or Bestinver Internacional, a 5% stake for their fund would mean acquiring approximately 30% of the company.

In this part, I apologize for my bias towards references to Spanish value funds. Even if you are reading this from outside of Spain, I urge you to learn about Alvaro de Guzman and the team at AZValor, whom I believe should be a reference beyond our borders. A startpoint here: AZValor investor letters

Audit and confidence in financial statements

Mo-Bruk is audited by Mazars, the French company. All the reports consulted show a positive audit opinion. On a negative note, the full-year audit reports for 2022 and 2021 have been impossible to locate on their website or in any online portal and have been provided by Investor Relations after express and insistent request. In 2021 the audit was carried out by Grant Thorton.

The company has a very simple consolidation perimeter, Mo-Bruk SA owns 100% of RAF-EKOLOGIA and, as of 2024, owns 95% of El-Kajo + acquisition option for the remaining 5%, consolidates the group through global integration. It is normal procedure for Raf-Ekologia to distribute 100% of the profit as a dividend to its parent company.

As an additional check, two analysis have been conducted: Net Debt Check and Beneish M-Score with positive results in confidence in the accounts.

Regarding the Net Debt, an almost perfect balance is made with divergences of less than 5% of the assets. The results are transferred to the reduction of debt in a coherent way:

The Beneish M-Score scores below the -2.22 limit in all the years of the analysis except for 2013, showing a favorable opinion regarding the profit reported by the group.

In the company's own analysis process, no points of inconsistency have been found, although there has been a lack of additional detail in some items, although they are of little relevance:

Deposited guarantees 1-2% assets: Based on the investigations carried out, it seems that the opening of some contracts, surely related to public administration, implies a mobilization of resources, but not enough detail is provided.

Deferred income from subsidies 3-5% passive: The subsidies received are attributed to results according to the useful life of the object of the subsidy. The impairment of this liability is carried out without a great level of detail

Valuation

Moat analysis

Mo-Bruk operates through plants that “no one wants in their backyard” (NIMBY) and therefore the supply is limited by social and legal barriers. Except in cases of legal uncertainty, the licenses granted to Mo-Bruk to operate are for life.

Furthermore, the price/weight ratio protects it from competition in its operating areas; treatment must occur where the waste is generated since the transportation of garbage is not profitable except over a short distance, which creates geographical niches that are difficult to erode.

It also has patents, although in this case it is not possible to assert that these patents grant it a defensive moat.

Before evaluating the narrowness of the moat, the relevant aspects of the thesis have been summarized in this SWOT matrix:

Regarding the negative aspects, weaknesses and threats, the following comments:

o Weakness over competition: The majority of foreign competitors, mainly Suez, Remondis or Veolia, have entered the market in Poland through M&A of already established companies. This could represent a takeover opportunity for the Mo-Bruk shareholder.

o Lack of capacity: Mo-Bruk is in a financial position and relationship with institutions to be the main precursor of a new facility in the incineration segment and is acquiring and expanding capacity in the solidification segment.

o Risk environmental requirements: The application of any technical update in the factories would be reflected in the price. To date, this circumstance has occurred on other occasions without harm or deterioration in margins.

o Risk of legal uncertainty: Via revocation of licenses. This regulatory risk is assessed as low, Mo-Bruk is positioned in the circular economy, key to development, and Poland is a country with sufficient legal guarantees.

o Dependence on RDF cement companies: Although management is looking for alternatives for the sale of RDF and a regulatory push for the sale of RDF is possible, this risk is assessed as high.

o New management without rack record: Replacing the entrepreneurial founder with generational change when it involves several heirs can be a difficult moment in an SME. Many companies do not survive the 3rd generation and some do not survive the 2nd. In this sense, the appointment of an external CEO and the focus of the children's studies and experience in two different operational areas may be a controlling force of this trend. The family remains the largest shareholder and Mo-Bruk is its main asset.

Moat assesment:

In the Incineration and solidification segments, Mo-Bruk is given a wide defensive moat as it is positioned as a leader in a market with high barriers to entry. This moat does not affect the RDF segment where there is greater competition and where the negotiating power of the fuel customer is very high

Sales Projections

Through the projected processing capacity in annual tons of growth capex and M&A, the normalized income has been modeled once the aforementioned processes are completed and integrated. 9-10% of the group's income depends on other activities (mainly gas stations) which have been excluded from the KPI projection due to lack of data and due to their minimal importance in the group's EBITDA.

The conditions and explanations that lead to this normalization in each segment are the following:

Waste incineration

The segment has tailwinds. Within the framework of economic development in Poland and its convergence with the EU in environmental matters, hazardous waste continues to increase at 8% annualized with very limited processing capacity. Medical waste is a market that will grow globally at 6% until 2030 according to the website marketsandmarkets.com. Mo-Bruk, with approximately 30% of the market share, has the capacity to absorb part of that growth and cover the additional installed capacity:

In 2023, acceptance prices have moderated, after 3 years where the processing of the well-known ecological bombs has inflated demand and prices:

Given the limited supply and increased demand, a drop in income below PLN 3,000 ton is not expected, which could even grow. This scenario provides a sufficient margin of safety.

Solidification and Stabilization

In this segment, waste generation and EU directives also generate tailwinds. The objectives of urban waste in landfills, as we have previously commented, are very far from those set by the Union. The increase in urban waste incineration will cause an increase in demand for solidification and stabilization and Mo-Bruk is positioning itself by increasing its capacity and via M&A with the purchase of El Kajo.

After a few years of adaptation to the new capacity and acquisition, occupancy rates similar to those of previous years are projected, close to 76%, although there is no limitation on not reaching the 2021 highs of 85%.

Prices in 2023 have stabilized from the growth of previous years and it is projected to maintain them due to a margin of safety in the valuation and lack of guidance in that regard.

RDF Production

Although coal production decreases every year in Poland, it is still a large producer and cement companies use it as the main source of energy due to its performance and price. This segment has no projected capacity increases, and operates at occupancy ratios between 30-40%.

Income, closely linked to the sale of RDF and landfill taxes, has remained stable since 2021 and the projection is made with a slight decrease.

Normalized Earnings

Depending on the nature of the expense, the normalized income statement has been modeled, using sales, tons processed or the number of employees and their cost as key KPIs. The main changes in the projected cost structure are the following:

The substitution of external energy (electricity) for self-consumption has been taken into account.

The increase in the cost of employees due to tensions in the labor market in Poland and an increase in the number of employees required per ton have been taken into account.

From the normalization of the core business, the other two segments that Mo-Bruk reports separately have been incorporated: gas stations and Others, which corresponds mainly to the activities of the R&D center. Given the lack of detailed information on the two activities, it has been projected with a high safety margin.

Regarding the financial result, it has been taken into account that Mo-Bruk currently has a net cash position with which it obtains interest benefits and a very contained financial debt. In fact, in the last two years it has obtained interest income higher than its cost.

PE Valuation

At the time of completion of this thesis, Mo-Bruk shares are trading at PLN 313 at a multiple of 12.84 times (LTM) and 12.11 times (NTM).

Despite its quality (low net debt, moats, high return on capital), given its status as a small cap in a country like Poland, it has been decided to keep a PE of 12 times, maintaining a prudent valuation.

At 12 times earnings, the upside given by the valuation is 74%.

EV/FCF Valuation

Adopting an approach based on the expected Cash Flows from Waste Management's NOPAT, the following FCFs have been modeled:

Mo-Bruk's business model is a high generator of EBITDA and converts much of it into cash. Excluding the gas station segment and imputing the cost of the R&D center (EBITDA Others), to achieve an adjusted FCF and applying a multiple of 12 times EV/FCF, the valuation gives a potential of 65%, close and consistent with the valuation by PE.

Final statement

“Not in my backyard” is the perfect definition of Mo-Bruk's defensive moat, a quality company, with zero debt, the founding family at the helm maintaining 20% of the company and a coherent investment plan. “Circular economy” is not just a green slogan for Józef, its founder, who has been innovating in the treatment of waste and creating by-products from it since 1996.

Poland is an attractive market with a favorable macro scenario, although dependent (who is not) on the global context and promises higher growth rates than the rest of the EU. As in any investment, although the intrinsic value provides a margin of safety with the market price, an influx of capital is necessary to bring out that value, that is, a catalyst is necessary. The European small caps have the flammable liquid frozen and if we add belonging to a secondary (or tertiary) stock market, Mo-Bruk can spend a long time in the refrigerator... but that should not be a problem for a retail value investor.

With a view to 6 years and active monitoring of the achievement of the M&A, the tons processed and the market prices, all that remains is to sit and wait and, in the meantime, the management team promises to distribute at least 50% of the net profit via dividend. And who knows, maybe some multinational company discovers this gem before the market and we see the intrinsic value emerge faster.

I usually demand a wide margin of safety from valuation models, typically over 80% potential for appreciation. In this case, despite being more constrained around 70%, and given the cautious assumptions made, it represents a good opportunity.

DISCLAIMER: All the information provided in this document is purely informative and does not constitute a buying recommendation (according to Spanish Law Article 63 of Law 24/1988, of July 28, on the Stock Market Regulator, and Article 5.1 of Royal Decree 217/2008, of February 15). DuckPond Value Research is not responsible for the use of this information. Before investing in a real account, it is necessary to have the appropriate training or delegate the task to a duly authorized professional.

Reach us on duckpond@duckpondvr.com