It's been a little over a week since Bayer released its first-half results. There wasn't anything particularly noteworthy, so I decided to take some time and the calm of summer to review the original thesis and adjust it with the new information. Here is the original thesis and the previous update:

In this review, I wanted to delve into three aspects: the sales of the Crop Science segment and its evolution relative to competitors, an in-depth analysis of the Pharma portfolio, and a review of the RoundUp litigations. All of this is connected with the H1 results as the guiding thread.

Let's get started!

After the storm

These past months have been very quiet in terms of stock price movement. The rain of multimillion-dollar settlements has stopped, and the price fluctuations between €26 and €29 have been more a result of market dynamics than any changes in the fundamentals. In my last post about it, I mentioned, “Those expecting a quick turnaround should forget about it”, and I can only reiterate and emphasize this statement.

In the story of a turnaround, after the storm comes the calm, or rather, the oblivion. And it is in the oblivion by the markets that the foundation for a successful turnaround begins to be built.

A turnaround is often a long process, just ask Pfizer’s shareholders if you need proof:

Bayer is not the only company that has faced a 'poisoned acquisition.' Pfizer went through its own madness of lawsuits between 2002-2009 after acquiring Pharmacia, inheriting the legal problems of Celebrex and Bextra. And as we can see, it wasn’t a short journey, but patience paid off in the end.

The code of good practices

Returning to Bayer: Let's not kid ourselves, we are not yet seeing positive signs in either agriculture or pharma topline, as we will see later, and the issue of the RoundUp lawsuits still has a long way to go.

In the absence of substantial revenue improvements, the enablers of catalysts will need to be internal, namely:

Improvement of cash flows through cost reduction and better inventory management.

Restructuring of divisions to achieve a growth-oriented portfolio.

A positive sign within the new management is the restructuring of the organization. Bill Anderson, the new CEO, is carrying out a process of staff reduction linked to the decentralization of decision-making, mainly eliminating middle management (3,200 full-time equivalents less than in H1 2023).

It is still too early to judge the success of this organizational change, but it is a step in the right direction and aligns with one of the key principles from the famous book The Outsiders: Eight Unconventional CEOs. You’re probably tired of hearing recommendations for this book, but I have to do it:

I highly recommend it.

H1 2024 Results

Crop Science

Top Line: H1 shows a 3% decline in reported revenue (-1.4% currency neutral), with a 1.4% increase in volume and a negative price effect of 3%. The negative price effect primarily results from competitive pressures and product mix in herbicides.

Overall, and regarding sector dynamics, Bayer has had a relatively good first half of the year:

Seeds (40% sales): Good performance in Seeds, where we see 1% growth (currency neutral) over a historic 2023 in Corn and a 5% increase (currency neutral) in Soybeans

And competitors? Corteva, the leader in the U.S. for Corn and Soybean Seeds, grew by 4% and 6% respectively, slightly outperforming Bayer. BASF reported flat performance in Seeds.Crop Protection:

Herbicides (25% sales) : +13% in lower-margin glyphosate-based products, mainly in North America (yes, that harmful product costing millions in lawsuits). Glyphosate-free herbicides with higher added value fell by -4.5% (currency neutral), primarily due to increased competition in Europe/Middle East/Africa.

And competitors? Bayer's leadership in glyphosate-based products has partially shielded it from declines. Corteva reported a -17% drop and BASF a -21% decline compared to H1 2023.

Fungicides (15% sales): -10% with declines in all markets, primarily due to adverse weather conditions in Europe/Middle East/Africa.

And competitors? Similar declines, with Corteva at -9% and BASF at -11%.

Sector expectations

Bayer has confirmed its guidance for 2024, while Corteva and FMC have slightly revised theirs downward. Sector expectations are quite flat.

The main reason is the normalization of prices and volumes of grain commodities from the peaks caused by the pandemic and the Ukraine war, primarily for Corn.

Ukraine produced between 5-7% of the world's total. After the outbreak of the war, prices surged, and U.S. farmers responded by planting a record number of acres.

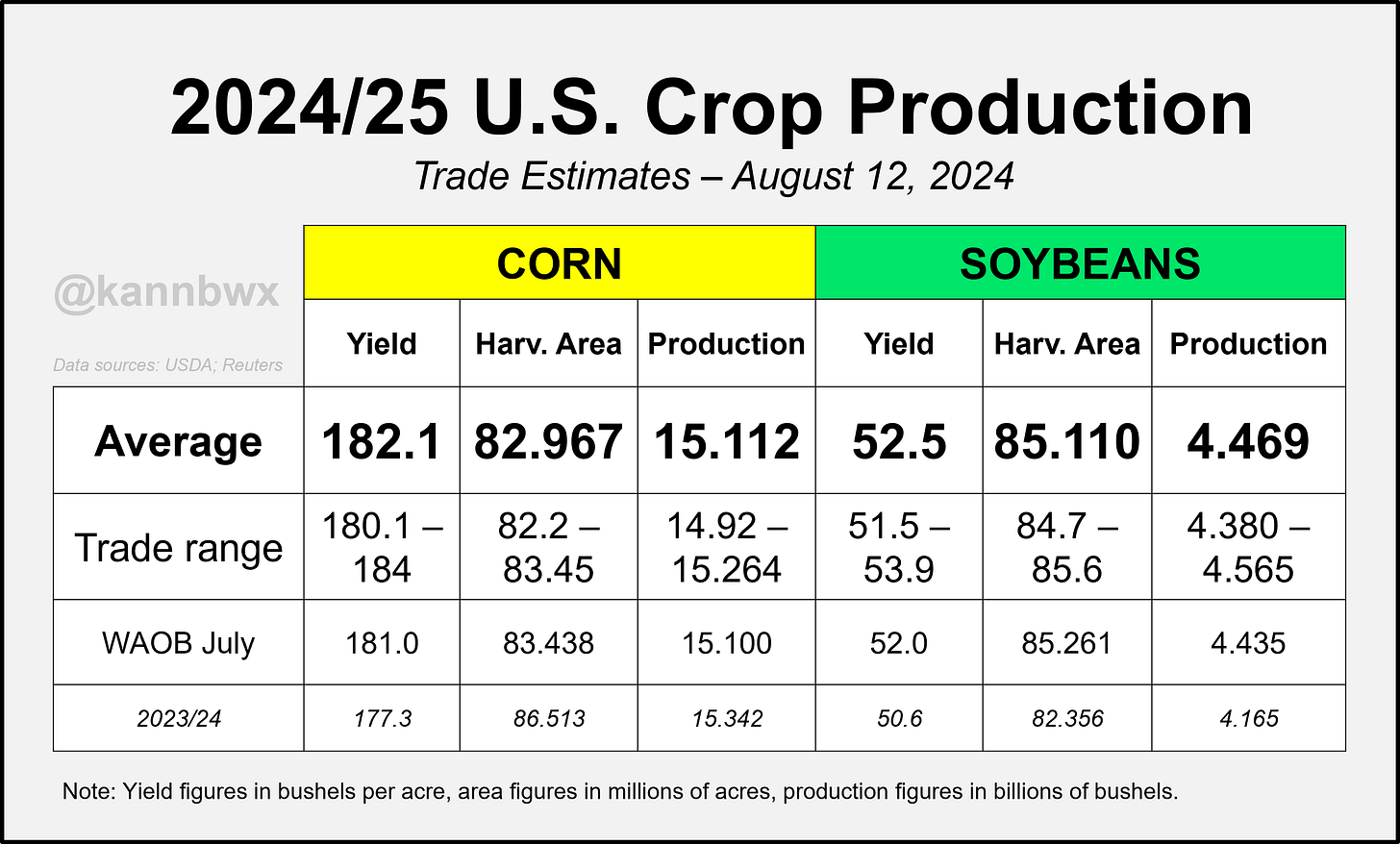

The Corn season in the U.S. for 2023/2024 (Q4 2022 - Q1 2023 for Bayer) was a record, as shown in the table below created by analyst Karen Braun (recommended to follow on X). In the 22/23 season, 78.7 million acres of Corn were planted compared to the record 86.5 million acres in 23/24. For Bayer, this represented a 12% increase in revenue compared to the previous year (similar to Corteva's 10% increase).

The planted area of Corn in the U.S. has normalized in the 2024/2025 season (Q4 2023 - Q1 2024 for Bayer), with production still high due to the land's productivity. Bayer's and Corteva's crop protection products play a significant role in this, alongside climatic conditions.

The normalization is also evident in the income of U.S. farms, which are Bayer’s clients and account for 40% of Crop Science’s regional revenue.

In this quarterly chart, we can see the stabilization in revenue from Corn Seeds for Bayer:

Conclusions: After a flat 2024, medium-term expectations for the sector are positive, with an annualized growth of around 5% in Corn and 7% in Soy, along with an increasing need for crop protection. Bayer Crop Science is one of the key global players in this market and is the main value driver of the thesis.

Pharma

A 4% increase (currency neutral) in the first half of the year, with a strong Q2 compared to an underperforming Q1.

In the bottom line, there is a slight improvement in margins, with an EBITDA of 28.1% compared to 27.7% in H1 2023. The company attributes this to containment and control of OPEX. While we don't have visibility on this, we will monitor it at the end of 2024.

Regarding the portfolio and before moving on to a longer-term analysis, here are two comments:

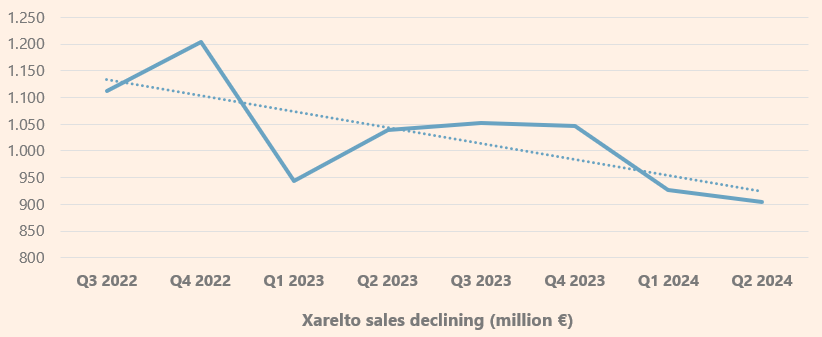

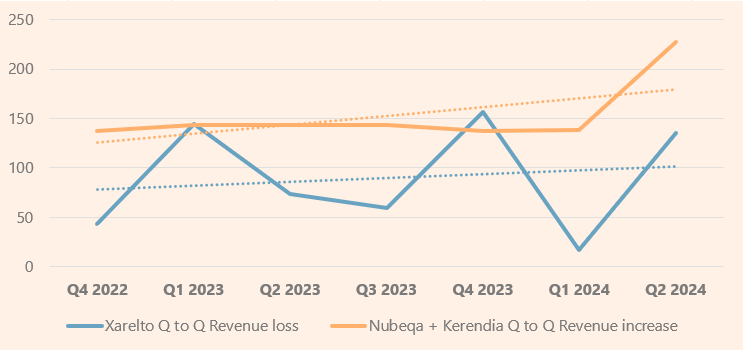

The declining of Xarelto continues as expected due to the competition of the generic solutions.

Nubeqa & Kerencia growth is more than offsetting the declining on Xarelto.

Pharma Portfolio Health

As mentioned in the original thesis, it is beyond my capabilities to analyze the potential of Bayer’s drugs in Phase II or Phase III, which are closest to becoming marketable drugs. Therefore, the assessment of this segment needs to be very conservative.

What I can analyze is the health of the current portfolio that is being commercialized. I have developed a system based on the analysis of quarterly growth rates for each drug, calculated using logarithmic slopes over 1, 2, and 5 years, with a weighting of 0.5, 0.3, and 0.2 respectively.

In other words, I calculate a quarterly growth rate for each drug over 1, 2, and 5 years, giving more weight to the 1-year rate than to the 5-year rate.

Each drug is categorized based on its rate as follows:

Growth: Quarterly growth rate of 1% or higher.

Stalwart +: Quarterly growth rate between 0% and 1%.

Stalwart -: Quarterly growth rate between -0.5% and 0%.

Declining: Quarterly growth rate lower than -0.5%.

The entire portfolio falls into the "Stalwart +" category, indicating a low-growth portfolio with 0,7% per quarter. Is not Novo Nordisk but we're not paying a PE of 40-50 for it either.

Transversally, we can use these categories and the patent expiration dates to draw the following conclusions:

The majority of the portfolio (60%) is not protected by patents or has an upcoming expiration. 44% of it is on a declining trend.

15% of the portfolio is growing, protected by long term patents.

16% of the portfolio is growing or stable despite no longer being protected by a patent. This is because some of the drugs have strong brand recognition, such as Aspirin Cardio, or involve more specialized technology that goes beyond the simple replication of an active ingredient, like Mirena/Kyleena/Jaydess.

Conclusions: Bayer's drug portfolio is not growth-oriented, but it ensures stable cash flow generation within the division, which allows for restructuring efforts aimed at returning to innovation.

RoundUp Litigations

The internal information available to us is limited, aside from the company's own website. I would like to see greater transparency in the communication regarding the litigation situation during earnings calls or interim reports, although I understand this may impact the legal process. Fortunately, the law firms representing the plaintiffs do a good job tracking each verdict and provide estimates of pending cases and potential settlements. It's worth noting that these firms have incentives to attract claimants, so I consider their estimates as a worst-case scenario.

The current status of the legal battle is as follows:

To date, Bayer wins 6 out of every 10 trials, and each lost trial has resulted in $405 million in damages after appeals (this is not extrapolable to all cases, as many of these are the most severe). Appeals are proving effective; for example, the McKivision case in Philadelphia saw a $2.25 billion award reduced to $400 million.

The provisional bill currently stands at $14.6 billion, with an additional estimated $7 billion expected.

Through the balance sheet, we can see that in H1 2024, the "Other provisions" item, which includes provisions for litigation, has not increased. Although the interim report does not provide a detailed breakdown, we can assume that it is between $6-7 billion, consistent with our own estimates.

Conclusions: There are no substantial changes in the estimation of pending litigations that would alter the valuation either upwards or downwards.

Potential risks

Update of the main risks of the original thesis:

RoundUp Lawsuits could go worse than expected. For the estimations have been used the lawyers's higher estimations for the 44.000 remaining demands.

Update: As expected.Potential divestitures or structural changes could impact the overall valuation.

Update: Ruled out in the short term although it could be key to unlocking future value.Pharma portfolio underperforms more than expected. Pharmaceutical industry is complex and is difficult to estimate future sales. In caution, no growth and bad assumption about Xarelto declining was taken in care. Update: As seen, is not a remarkable performance but it does not make the situation worse.

Crop Science division could underperform competitors.

Update: As seen, maintaining the position.

Conclusions: The main risks identified in the original thesis remain relevant, although they are currently under control.

Valuation

I reiterate the original conservative valuation, adjusted to the 2024 guidance. The adjustment of the entire net debt in the valuation is a factor that provides extra margin to the valuation.

DISCLAIMER: All the information provided in this document is purely informative and does not constitute a buying recommendation (according to Spanish Law Article 63 of Law 24/1988, of July 28, on the Stock Market Regulator, and Article 5.1 of Royal Decree 217/2008, of February 15). DuckPond Value Research is not responsible for the use of this information. Before investing in a real account, it is necessary to have the appropriate training or delegate the task to a duly authorized professional.

Reach us on duckpond@duckpondvr.com

Updating same valuation based on 2024 results and 2025 outlook from 5-mar-25, results me a target price of 51€/share, with flat growth and most Litigations still pending (6,5 B provisioned) vs. 61€ previous target price. Any opinion about them?

Any overhead /HQ costs (EBITDA) to be included and at what multiple?