It has been a while since the last Bayer blog update, and the truth is that in a company as heavily penalized as Bayer, commenting on the results of a single quarter or a specific piece of news determines absolutely nothing.

So, I have been preparing this publication for a few weeks, analyzing the AGM, the 2024 Annual Report, and waiting for Q1 to finalize it. At this point I do have things to tell you. I'll leave below the original thesis and the main update, and then we can delve into it.

Bill Anderson (CEO) says that 2025 is the 'most difficult year of our turnaround,' and he is not wrong: The cycle & competition in the agriculture sector is not favorable, the patent expiration of Xarelto is intensifying the decline in Pharma, and there is still a lot of instability in the courts. Also, shareholders approved the board's request to authorize a capital increase of 35%, if necessary. The capital would be solely used to cover legal matters.

But it could also be a pivotal year.

Bayer's strategy with glyphosate, the potential of a new trial with the failed drug Axundexian, and the organizational restructuring that the company is undertaking could lead to a recovery in 2026.

A large part of Bill's efforts since his arrival at the board are aimed at streamlining the organizational structure in a way that facilitates innovation (and reduces structural costs).

Since Bill's arrival in 2023, Bayer has reduced its workforce by 9%, going from nearly 100k employees to 91k in Q1 2025. The Texan is focusing on streamlining the company, moving away from the heavy German bureaucracy by reducing middle management, a task he previously carried out at Roche. So far, he has managed to reduce the initial 12 layers to 6 and aims to bring it down to 3. Bill's motto is 'the leanest, fastest, large life-sciences company on the planet.' Time will tell.

Although these changes are positive and necessary for the turnaround, the most critical factors remain in the courts. Therefore, let's start there and then look at how the businesses are performing.

RoundUp

The herbicide litigation remains the main obstacle to this potential turnaround that began to take shape with the acquisition of Monsanto, probably the worst M&A operation of the century so far.

Bayer continues to win around 60% of the trials and reduce compensation awards on appeal. Even so, the bill to date is outrageous:

Bill Anderson is leading a new strategy to curb litigation while Bayer continues to sell 600 million euros per quarter in glyphosate. Let's see what card they have up their sleeve.

The glyphosate battle: Bayer & farmers vs US Courts

Trump administration, with Robert Kennedy Jr. at the helm of the Secretary of Health and Human Services, intends to reform the food system under the initiative "Make America Healthy Again," where they target glyphosate as a health risk. But can the use of glyphosate be stopped immediately without harming the food system?

The fact is that glyphosate remains the most effective herbicide and the one that extracts the most productivity from crops. Furthermore, it continues to be widely supported by the regulatory agencies of major countries (see graph).

Bayer is aligning US agricultural companies to its cause, threatening to stop selling glyphosate if immunity against future lawsuits is not guaranteed.

Bayer produces about 40% of the world’s glyphosate out of phosphorus mines in Idaho and is facing competitive pressures of China in US market. The effect on agricultural prices of Bayer's withdrawal from the glyphosate market would be significant. And, furthermore, it would make the world's leading agricultural exporter dependent on China. And we know that Uncle Trump doesn't like that whole depending-on-foreigners thing.

“Imagine a foreign country having the ability to dial up or dial down the price of glyphosate in America, and the immediate effect that would have on food prices,” he said. “That seems like a bad idea.”

Bill Anderson on Semafor Interview

Part of this work has already been achieved. In Georgia and North Dakota, laws have been approved that shield pesticide manufacturers from lawsuits if the products warn of the risks of use on their labeling. In Tennessee and Missouri, there is progress in the same direction.

This will hardly end the ongoing lawsuits but, at this point, it will contain the bleeding beyond 2026 and favor out-of-court settlements.

Investment banking sees progress in this regard. Bank of America upgraded Bayer from “neutral” to “buy” highlighting that a favorable ruling in US Supreme Court could eliminate the need for a 6 billion euro provision. BofA cites a legal expert who estimates a greater than 50% probability that the Supreme Court will accept the case and, if it does, a 60-70% probability of a ruling in favor of Bayer.

There is likely a lot of volatility left to see here, but Bayer is accelerating to make 2025 the definitive year for closing this chapter.

Q1 Results & Outlook

Q1 results in Pharma were better than expected, and the management has reaffirmed the 2025 guidance. The price has reacted favorably, although it is still anecdotal.

Let's review the divisions, mainly Crop Science and Pharma, and look for indicators for that pivotal year.

Crop Science

The agriculture division is aiming for a flat year at the midpoint of its guidance, despite a worse-than-expected Q1. This was due to phasing into Q2 of part of the demand for corn seeds and glyphosate, whose revenues fell by 10%. Revenues from alternative herbicides grew by +8%.

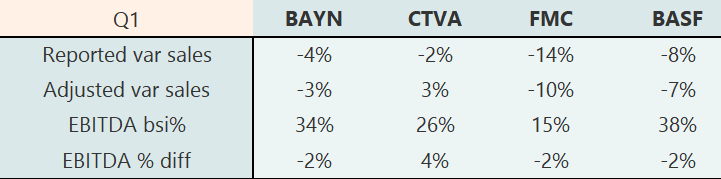

Competitors have reaffirmed their 2025 guidance following a Q1 where Corteva stood out with good results in Seeds & Traits in the USA.

It is clear that 2025, barring any surprises, will not be the year of the sector's recovery.

Let's analyze the agricultural market and the main indicators we have available to see if they provide any signals of a medium-term recovery.

Agricultural market

Bayer is the global leader in seeds & traits key to global food system. Rank 1 in Corn, Soy & Cotton, and Rank 2 in horticulture. Corn & Soy account for 41% of Crop Science's sales.

Both are key for global food supply, mainly for animal feed. These crops have grown at rates higher than the population, as increases in per capita income drive up meat consumption. Since the 1990s, the annualized growth rate in the production of corn and soy has been 3% and 4% respectively, with a population growing at 1.3%.

These two crop types remains at 2015 price levels since the drop from peak caused by the Russia-Ukraine war. The market compensated for the lost volumes in Ukraine, leading to record corn and soybean prices & production in the USA. Ultimately, this production resulted in oversupply. The usual cycle.

However, the current stocks relative to the quantity globally demanded have reached their lowest levels since 2014, and if we exclude Chinese Corn stocks, we are at the stock-to-demand ratio levels of 2011-2012. The price increase due to a lack of supply could lead to increased production, and therefore seed sales, in the coming years.

I recommend following Karen Braun on X, where she provides excellent tracking of the agricultural market, mainly in the USA and Latin America.

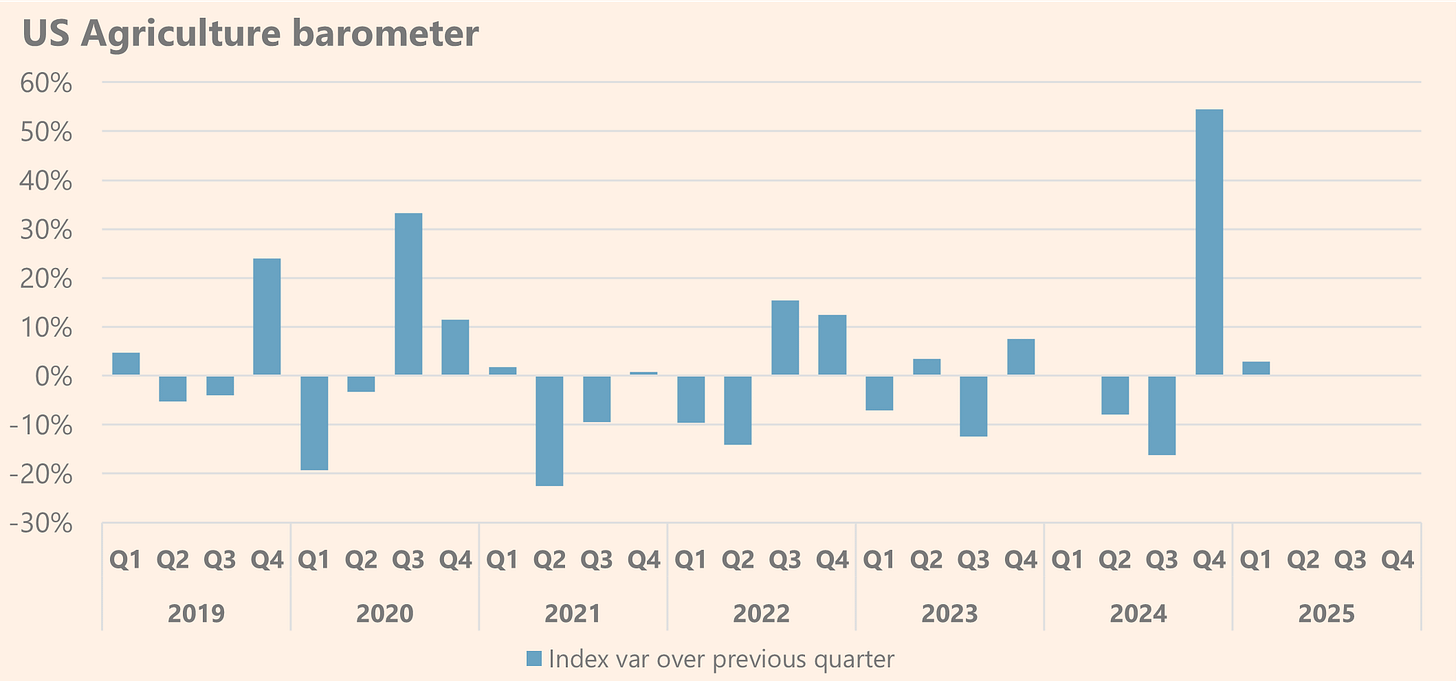

Another potentially leading indicator of demand for Bayer's products is farmers' sentiment is the Ag Economy Barometer. This indicator is a monthly index measuring the economic sentiment of U.S. agricultural producers. Based on surveys of 400 farmers. It assesses current financial conditions and future expectations.

40% of Bayer Crop Science revenues come from North America, so it is an indicator to monitor. Currently, the barometer indicates strongest sentiment change in last six years, after Trump election.

Although it is not a perfect leading indicator for Bayer's revenues, farmers plan the amount to harvest based on their future expectations (where the market prices of each product have a significant impact), making it a relevant indicator.

In this regard, we see that an above-average expectation between 2019-2021 translated to Bayer's revenues in North America in FY2021 and FY 2022, and low-average expectations between 2022-2024 did the same in FY2023 and 2024.

It is worth remembering that the agricultural market is seasonal, and a large part of the revenues in Seeds & Traits occurs in Q1, while farmers make production decisions during Q3 and Q4 of the previous year.

Pharma

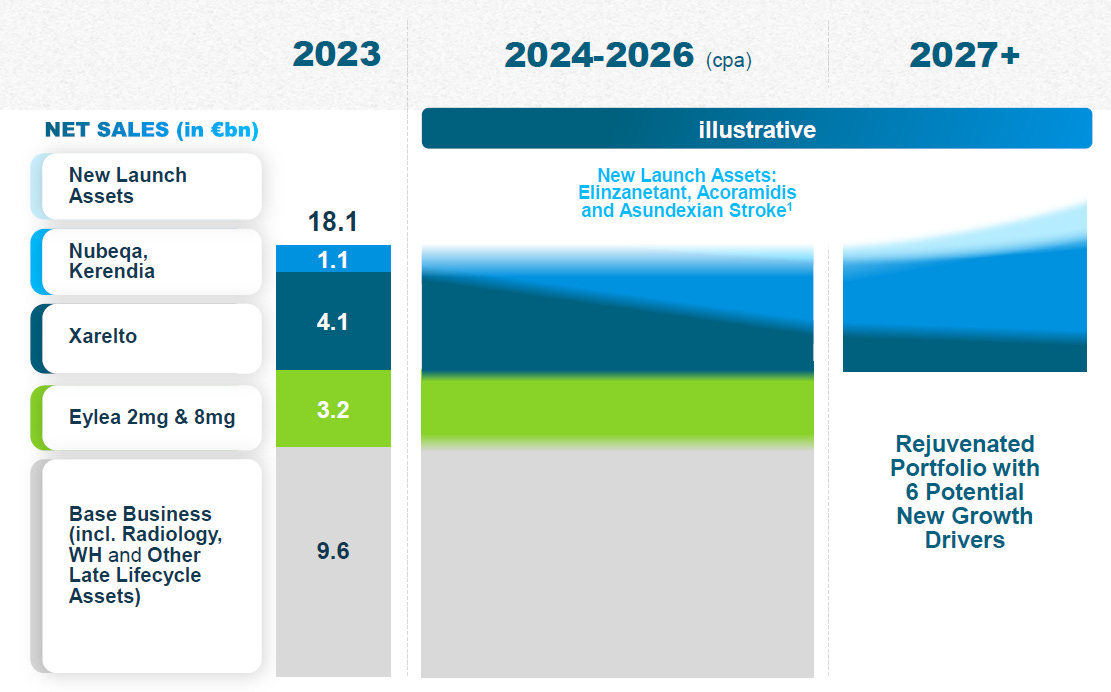

The confirmed guidance points to a year where the Xarelto patent loss worsens, also weighing on margins. The ability of the rest of the portfolio to compensate for the decline depends on Nubeqa and Kerendia, the two latest launches that began generating revenue in 2021 and 2022. For now both incremental sales are compensating Xarelto loss but company expects bigger declining in rest 2025 with margins pressure.

The expectations for 2026 is also a stable/slight decreasing portfolio, aiming to return to growth in 2027. We’ll see. We don't have to doubt Bayer's history of innovation, although we must be conservative.

The most promising drug in sight is the old known Asundexian, failed in Phase III in 2023 due to being less effective than other treatments in the prevention of strokes. Bayer is now exploring the potential of asundexian in the secondary prevention of thrombotic events and in patients with unmet medical needs, such as those who cannot take standard anticoagulants due to the risk of bleeding. Expected launch in Q4 2025, Bank of America Global Research projects a maximum of 3 billion € year sales with a 40% probability.

Portfolio check

In the last update, we evaluated the quarterly sales history by drug to check the health of the portfolio. The methodology followed is explained here.

Compared to the last check-up, the data shows a slight improvement of 0.7% to 1.5% quarterly sales growth.

We are still far from seeing an innovative pharma company, with a large part of the portfolio in decline but, at least, we can talk about a portfolio capable of maintaining stable revenue while innovation arrives.

Summary

In December 2023, we initiated coverage of the company with a valuation of €60. At that time, I boldly stated that 'the worst was already discounted in the price due to a cascade of bad news.' This was clearly a mistake. The stock price further corrected by over 40% due to the deterioration of the Pharma business, harsh legal rulings, and an agricultural sector normalizing volumes post-Covid-Ukraine. However, I also said:

What remains? A key player on crops & herbicides/pesticides global market, an essential industry in global food distribution.

What also remains? A Pharma + Consumer Health segment with slow growing but consistent cash flow generation.

And this is still true today. Therefore, I reaffirm my valuation from that time.

Thanks for reading!

DISCLAIMER: All the information provided in this document is purely informative and does not constitute a buying recommendation (according to Spanish Law Article 63 of Law 24/1988, of July 28, on the Stock Market Regulator, and Article 5.1 of Royal Decree 217/2008, of February 15). DuckPond Value Research is not responsible for the use of this information. Before investing in a real account, it is necessary to have the appropriate training or delegate the task to a duly authorized professional.

Reach us on duckpond@duckpondvr.com