Today I bring you reflections on one of my latest reads: "The Art of Execution" by Lee Freeman-Shor. The book is short, concise, and undoubtedly prompts a lot of introspection about your portfolio management. In my case, reading the book has led me to question six positions in my portfolio. Three of them have been annihilated, two expanded, and one will surely also end up on the guillotine.

One of the most striking phrases in the book says: "stock market investing is not about being right”, but rather about “execution, execution, execution”

This book is not to be taken dogmatically; some criticisms could be made of it. Rather, it is meant to encourage more conscious decision-making, a call to action to have a plan and execute it.

Let's summarize the main teachings of the book and develop a practical application of it through an Excel template where I plan monthly portfolio rebalancing applying the principles.

Execution > being right

The author hired 45 of the world's best investors and gave each of them between 20 and 150 million british pounds to select a portfolio of a maximum of 10 stocks. After 7 years and some 1,800 investments representing 31,000 trades, the conclusion is very illuminating: only 49% of the ideas generated profit.

The differential between the best and worst investors was primarily determined by portfolio management, or as Lee says, "stock market investing is not about being right”, but rather about “execution, execution, execution”.

Here, I'll allow myself a brief criticism, which doesn't diminish the main teachings of the book: the 7-year period, short for an investment fund, tips the balance of success towards execution, whereas over longer periods, we know there are fortunes that inherited portfolios that beat the market simply by doing nothing for decades.

Returning to execution, Lee detected distinct patterns and habits in how investors behave with losing and winning positions. Let's see what we can learn regarding the losing ones.

📉Learning from losses

The three types of investor identified by the author when facing a losing position are summarized in the following infographic:

The premise is simple: you're going to make mistakes & the magnitude of those mistakes will determine your portfolio's profitability. Doing nothing with a losing position is a guarantee of failure. Just look at this table. You've surely seen it repeated a thousand times, but it should never be forgotten.

Seeing the table, it's clear there are only two options: be an assassin or a hunter. I'm sticking with the following idea:

If a losing position is close to 30% down and you don't have the necessary conviction to increase it, you must be an assassin. If you have enough conviction, be a hunter.

📈Learning from winners

The sale of winning positions is a very difficult aspect of investing that is often overlooked. I have discussed this in these two previous articles, regarding positions that came to represent more than 15% of the portfolio.

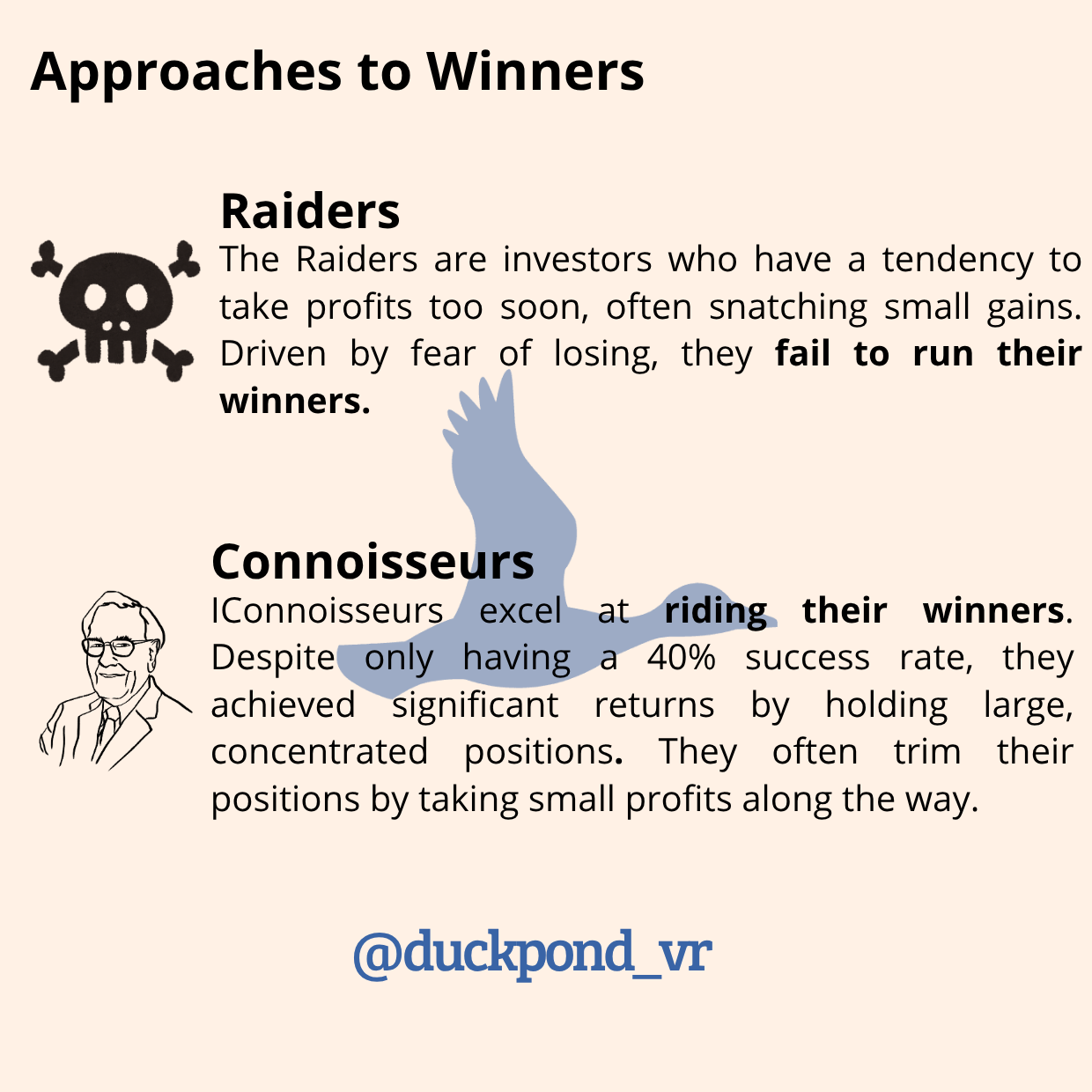

With 51% of errors managed, the analyzed investors still need to make good use of their 49% successes. The two profiles identified for managing winning positions are as follows:

This is clear: we will aim to be a Connoisseur and plan a progressive exit that allows us to be cautious and obtain the highest possible return.

Among the reasons cited by the author for holding a winning position is momentum. We are not going to deny its effect, but I will always feel more comfortable applying the appropriate margin of safety and considering the opportunity cost relative to other opportunities.

We are going to put the principles of the book into practice through a template that gives us warning signals. We don't want to fall into the trap of the rabbits, nor do we want to be a raider when we are winning.

📊Execution oriented portfolio management

To force the creation of a plan, I created a template that I've been using. This template allows for periodic rebalancing, taking into account the weight of each position, its expected profitability, the recovery needed to return to the purchase price (in the case of a losing position), or the position's contribution to the portfolio's profitability.

I'm sharing it with you for free, I only ask your suscription.

The template is quite simple to use. The gray cells indicate the necessary inputs to introduce. In my case, I have them connected to a .csv from Portfolio Performance to automate the task. Let's explain its use with a mock-up portfolio:

Imagine you have the following portfolio, you've read the book, and you want to draw up a plan for each of your positions. Let's evaluate some of them.

Position #1 in the company 'Success: Farming Last Dollars' has yielded an excellent 67% and, according to our estimates, has 30% upside remaining. That remaining 30% contributes 5.55% to the portfolio's total profitability, indicating a red flag. The red flag signals that this position yields less than the average portfolio position. This stock could be a candidate for applying a connoisseur strategy, meaning continuing to extract potential while reducing its overall weight.

Position #4 in the company 'DCAing position' has fallen 14%, and we have been averaging down. The company's fundamentals remain solid; it's merely market volatility. We could assign it a target percentage of the total portfolio and average down during declines, acting like a true Hunter.

Position #9 in the company 'Not enough conviction to double' has dropped 30%. We would need a 42% gain to return to breakeven. We've discovered new information that reduces our price target, and we're uncertain if there might be other issues. If our revised scenario plays out, the profitability would only account for 3.7% of the portfolio's total return. We are not willing to double down; it's time to be a ruthless assassin.

Position #10 is relatively new in our portfolio. It's almost certainly a multibagger, we believe, and it has also fallen, trading at attractive prices. It only accounts for 2% of our portfolio, which is too little for such a powerful idea. Furthermore, the dashboard alerts us (Alert 1) that we need more than a 30% gain to return to breakeven and that the expected contribution to the portfolio's total return is below average, at 5.55%. It's time to assign it a more significant weight; it's time to be a Hunter.

Let's see how we can approach rebalancing in the template.

Position #1 : Acting as a Connoisseur, we propose a progressive reduction to 7% of the portfolio during the month. We are more aggressive in reducing the position if the price rises. The incoming flow is €6,217.

Position #4: Currently at an 11% over total portfolio, we want to continue building the position up to 12%, planning an entry of €486. The profit contribution expected over total portfolio is 10%, more than the average.

Position #9: We project to sell position 9, realizing the losses, but generating a net flow of €3,000 to allocate to higher-conviction stocks.

Position #10: We project this multibagger will represent 10% of the portfolio with entries during the month. We will consume €4,405 from the outgoing positions.

Position #11: The outgoing balance will be invested in a new Deep Value idea we have analyzed, with a target of 8% of the portfolio

The projected change in the portfolio is shown in the following charts available in the template.

DISCLAIMER: All the information provided in this document is purely informative and does not constitute a buying recommendation (according to Spanish Law Article 63 of Law 24/1988, of July 28, on the Stock Market Regulator, and Article 5.1 of Royal Decree 217/2008, of February 15). DuckPond Value Research is not responsible for the use of this information. Before investing in a real account, it is necessary to have the appropriate training or delegate the task to a duly authorized professional.

Reach us on duckpond@duckpondvr.com