Today I share with you my reflections on one of the most psychologically difficult processes as an investor: selling. Deciding that the risks of continuing do not compensate for the potential gains when the stock has momentum and everything is positive news is not easy. That's where reason and stick to the plan have to overcome FOMO (fear of missing out).

If you follow me on X (@DuckPond_VR) you'll have seen that I have been covering Degiro closely. This German broker and bank with customers in practically all of Europe conquered the skies in 2021, under the conditions of expansive monetary and fiscal policy that flooded the financial markets with liquidity, creating bubbles for example in the cryptocurrency market.

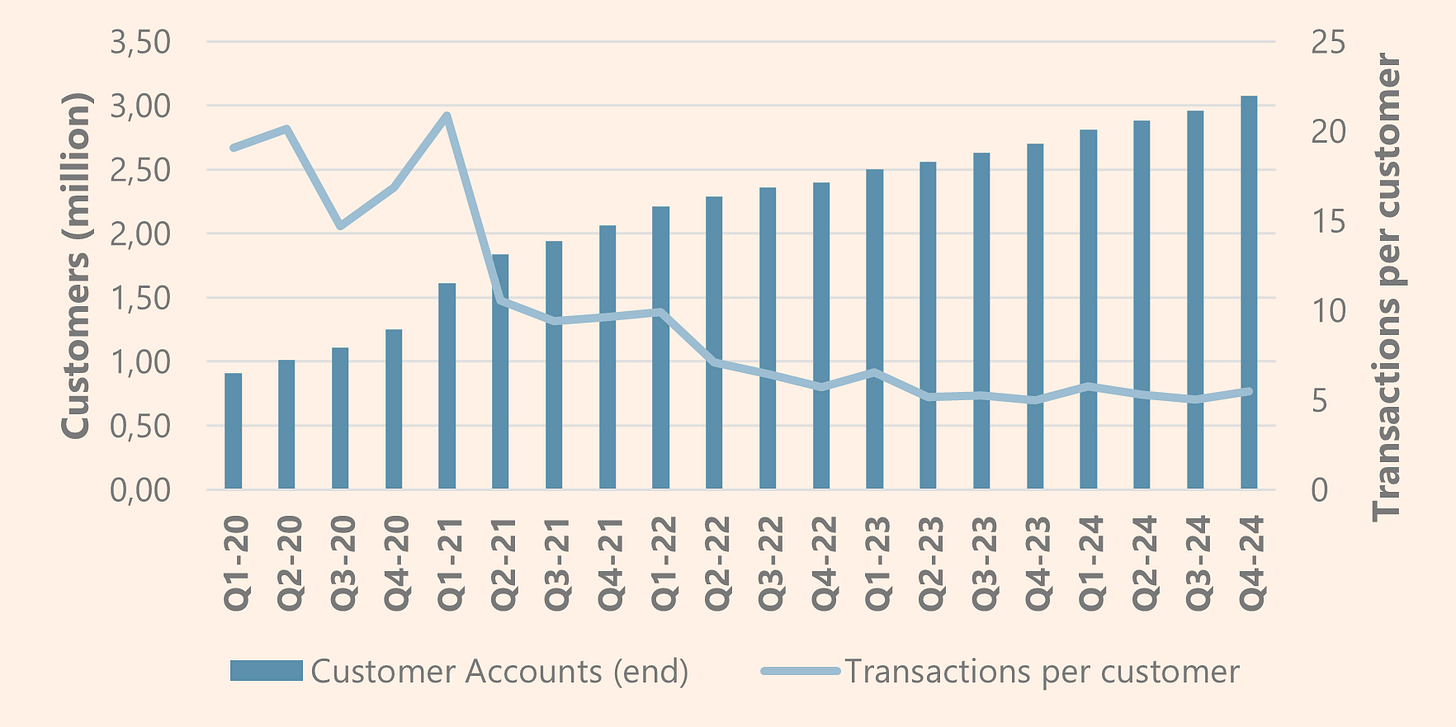

As a broker, Degiro benefited from this circumstance with a strong increase in the buy and sell transactions of shares that each client carried out. In 2020-2021, Degiro reached +50 transactions per client/year, or more than 90 million transactions in total per year.

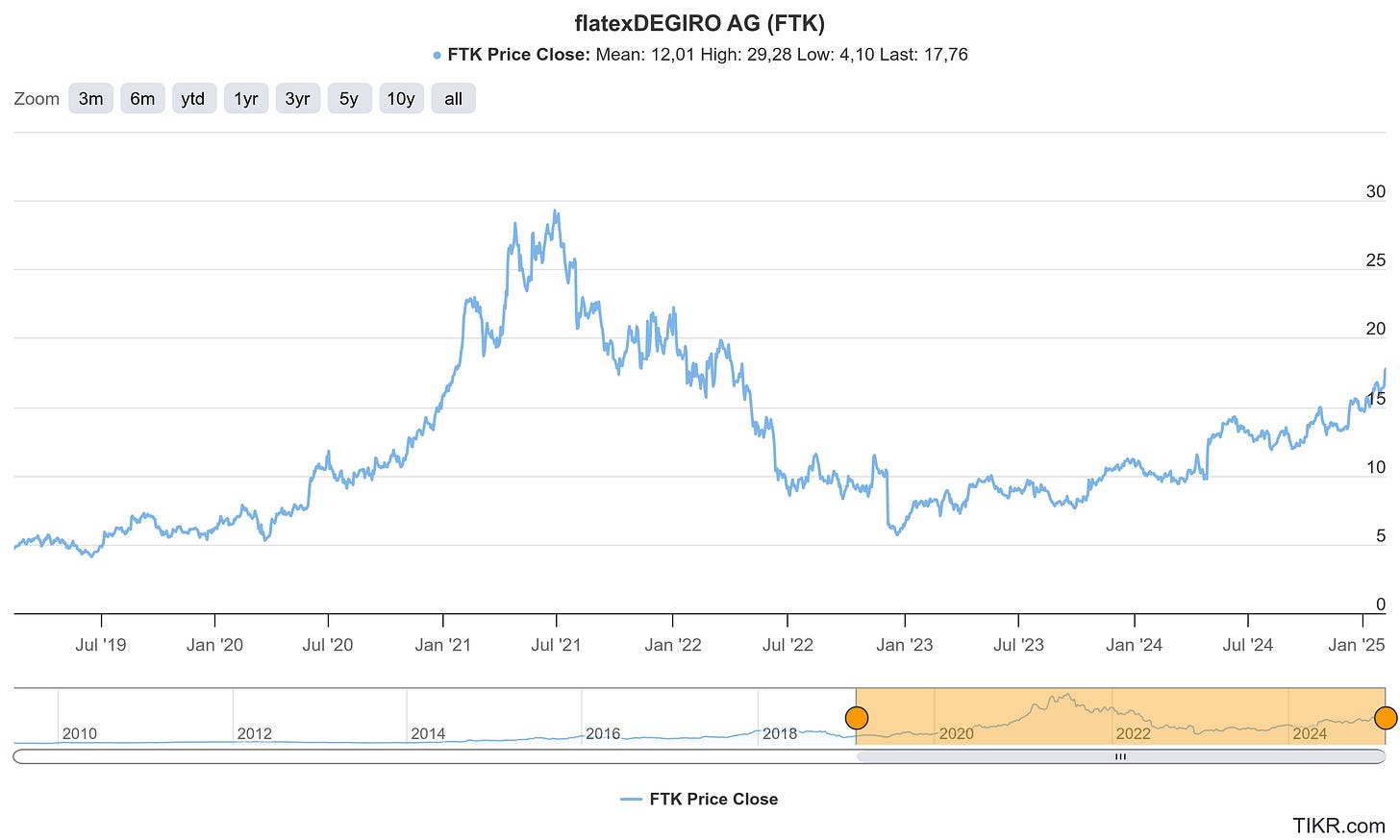

All bubbles end up bursting and, in this case, both the inflation caused by the post-covid stimuli and that caused by the Russia-Ukraine conflict achieved the inevitable. The market gave us the opportunity to buy Tesla below $200, Amazon below the current $100 (post-split) or Degiro below €8 per share. This represented a 70% drop from highs. And that's where one of my most lucrative theses of recent years began.

The thesis was clear: Despite the collapse of stock market activity, Degiro was very well positioned to grow in customers in its European markets, where it had competitive advantages and a lot of market to capture.

The recovery of transactions per client added to a larger customer base and all this driven by the effect of operating leverage (fixed costs of the platform and economies of scale in personnel) would result in a strong recovery of profit. In addition, while this recovery of transactions was taking place, the interest rate hikes by the ECB would increase interest income on the cash that clients keep uninvested in the broker.

Currently, Degiro is trading at €17.80 per share, which represents an upside of more than 100% from lows and brings us to a PE of 18 times the estimated earnings of 2024. And has the whole thesis been fulfilled?

As can be seen in the following graph, customer growth has been very solid reaching 3 million at the end of 2024, but transactions per customer have not recovered, although they have stabilized.

At current multiples, growth expectations must be very ambitious to justify the current price: It should continue to maintain customer growth and trading volumes should increase. In short, the thesis has mutated from value to growth and the risks increase significantly.

Does this mean that the price has no upside potential? Not necessarily. Customer growth remains very solid and the incorporation of crypto offering in Germany (with the potential to extend to the rest of the markets) could boost the number of transactions.

But now the thesis not only rests on the improvement of the company's fundamentals, but on the expectations that during 2025 and 2026 the stock market will continue to attract capital and transactions will increase. And we already know under what circumstances this opportunity was created in 2021.

DISCLAIMER: All the information provided in this document is purely informative and does not constitute a buying recommendation (according to Spanish Law Article 63 of Law 24/1988, of July 28, on the Stock Market Regulator, and Article 5.1 of Royal Decree 217/2008, of February 15). DuckPond Value Research is not responsible for the use of this information. Before investing in a real account, it is necessary to have the appropriate training or delegate the task to a duly authorized professional.