In the previous publication we analyzed in detail Dowlais, the Autoparts sector including its most direct competitors, the capital cycle and the medium-term outlook.

In it we have mentioned that Dowlais is in the process of merging with American Axle, which has made an offer to acquire all the shares. The merger is pending approval at the Annual General Meetings of American Axle on May 1st and Dowlais on May 21st, as well as from the regulatory competition bodies. It is expected to be effective by the end of 2025.

At the time of writing, there is no reason to believe that the merger will not go ahead. Dowlais board recommends accepting the merger and there have been no statements against it from its ownership structure, which is mainly represented by investment funds. The same is true for American Axle.

In this part II we are going to analyze the merger, the American Axle offer for Dowlais shareholders, valuation of American Axle shares in the event of the merger and Dowlais standalone in case it doesn't happen in the end.

American Axle + Dowlais

Dowlais and American Axle are competitors and are also very similar in size. Both companies, in addition to their Driveline divisions, have a segment dedicated to the manufacture of parts using powder metals: Dowlais' Powder Metallurgy division has one of its main competitors in the Metal Forming division.

Despite being competitors, they also complement each other. Let's see what they bring to each other and what the merger brings to the whole:

American Axle

The Detroit company would bring to the combination a greater presence in SUVs, off-road vehicles, pickups and light trucks. American Axle is a leader in electric beam axles, which gives it a position in this type of vehicle that Dowlais does not have. In addition, its production position in the USA and national brand would allow it to address the complexities that tariffs can produce in this industry.

Dowlais

The British, for their part, bring a greater diversification of customers to the mix: American Axle has a greater concentration in three large groups: GM, Stellantis and Ford. With Dowlais, it goes from 68% of revenue concentrated in 3 customers to 60% in 6.

Furthermore, Dowlais brings positioning in China and in these new OEMs that can transform the industry: As we saw in part I, Dowlais has extensive experience through a Joint Venture with HASCO. This JV is a leader with a 40% market share in Driveline and works with most Chinese OEMs. The expected growth of this market is higher than that of traditional markets.

Combination

In company merger processes, even in the most disastrous, one of the sales pitches most used to sell the idea to the markets is the synergies produced by optimizing resources. That is why it is necessary to have a critical vision, to question them and to work with a safety margin.

In this case the merger proposes 300 million a year in savings from the third year onwards with an initial investment of approximately 300 million, distributed as follows:

The achievement of these synergies would mean an increase of margins close to 2.5%, which would take us from a combined EBITDA of approximately 12% in 2024 to 14.5%.

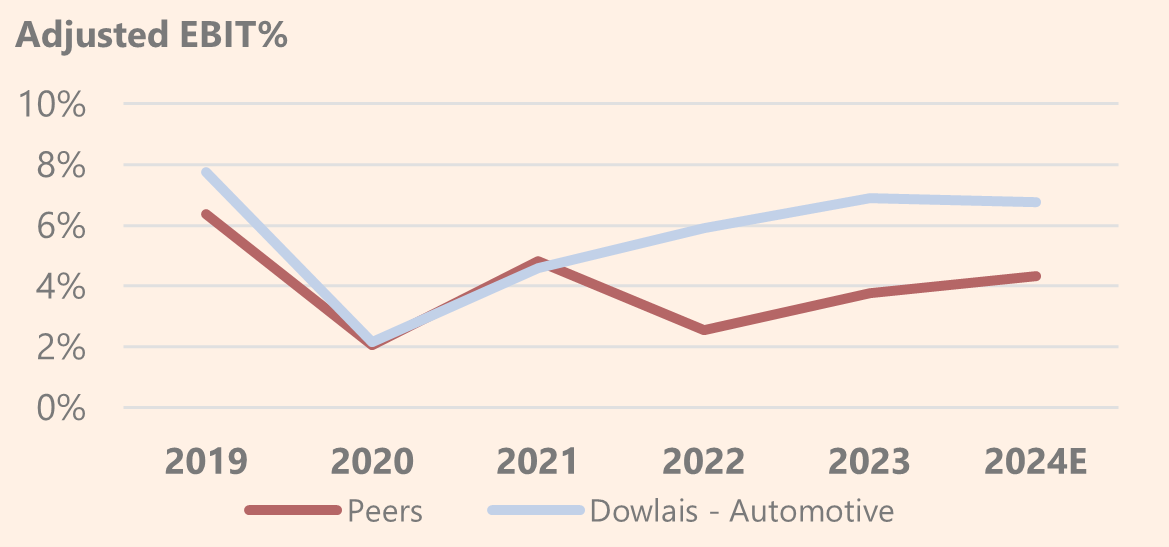

At this point in the journey, I would like to recall the restructuring process that Dowlais went through, which we explained in Part I, and bring up two graphs that summarize a little of what we saw:

Restructuring processes in industrial companies produce short-term effects, so synergies that the combination offers are realistic, given the process carried out by Dowlais and the similarities between American Axle and the British company.

I'll leave you with this article from bain.com, entitled How Auto Suppliers Can Navigate the Industry's Perfect Storm, which develops the process of operational optimization in the sector more extensively.

From the linked article I bring you this table which approximates the impact on margins of restructuring initiatives by area. I think this reinforces the realism of the expected synergies.

From the combination we can expect a solid group, as the company itself illustrates in this diagram with data from 2023. Although impressive, two things must be taken into account: EBITDA includes synergies and there are other players that could be in that circle in 2025 and beyond, such as Autoliv.

In summary, the merger makes sense and makes it easier for the new company to face the challenges of the industry, such as electrification or new competition between OEMs.

One negative point as a Dowlais shareholder is the leverage of the combination. American Axle has a Net Debt/EBITDA ratio of 3x (excluding pensions) and Dowlais has a ratio of 2x. In addition, American Axle has committed bridge financing to carry out the merger with the expectation of restructuring all the debt once the merger is completed. It has not been considered a substantial risk but it should be taken into account.

Let's deep dive at the offer.

The offer

The agreement, which will be voted on during the shareholders' meetings and will presumably be approved, includes the following offer for Dowlais shareholders:

Cash payment of GBP 0.42 per share

Special dividend of GBP 0.03 per share (from Dowlais)

New American Axle shares: 0.0863 American Axle shares for each Dowlais share.

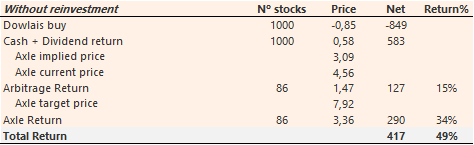

The implicit valuation of American Axle, which nets the current price of Dowlais to 0, is $3 when it is trading at $4.56. That is to say:

Dowlais share price = Cash Payment + Special Dividend + Implicit AXL value x 0.0863 shares.

Dollarizing the current price of Dowlais, around GBP 0.65 per share, we have:

That is to say, on the initial investment of 0.85 USD per Dowlais share, we obtain 0.55 USD in cash, 0.04 USD in special dividend and shares in the new AXL for 0.39. This gives us an arbitrage yield of 15%. This can be altered by the milestones of the agreement & by the performance of each company in Q1 and Q2, and by the USD/GBP pair.

This agreement means that Dowlais is valued at approximately 3.2 billion USD.

Starting from a 15% arbitrage yield, let's see what we can expect from the shares that American Axle is giving us.

New American Axle valuation

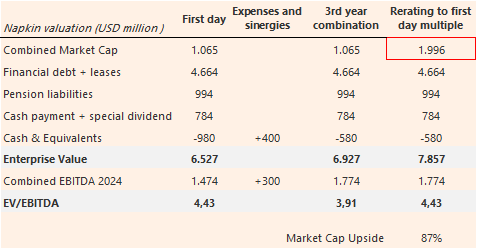

Simply combining the current EBITDA and Enterprise Value, including all outgoing cash flows derived from the payment to Dowlais shareholders, we obtain an EV/EBITDA of 4.43.

If we add the restructuring costs to the numerator and the expected synergies to the denominator, we get a multiple of 3.91x. Rerating to 4.43x gives us an upside of 87% of Market Cap. That's it, see you next time!

Okay, too simplistic. Let's work on it a bit by projecting sales, costs and synergies.

In the projections, we incorporate the guidance of both companies for 2025 with a 3% drop in sales and an increase in expenses to carry out the restructuring process. From 2026, sales begin to grow at 1.22%, the growth rate expected by the S&P Mobility Forecast.

In terms of margins, both the costs of the merger and the synergies that are progressively incorporated have been modeled until 2028-2029, when the EBITDA margin target is reached.

This combination allows us to reach an EBITDA of 1.6-1.7 billion between 2028 and 2029 with margins of around 14-15%. In 2021, the combined adjusted EBITDA of both companies reached 1.567 billion and a margin of 14.7%.

We will use this EBITDA for the valuation. You will see that it is somewhat lower than our napkin EBITDA, and it makes sense, reflecting the outlook for 2025 and the slow recovery.

Now, we have to talk about the multiple we put on this scenario. As we have seen, the sector is at the bottom of the cycle and is expected to bottom out in 2025, but there are legitimate uncertainties that could be delayed till 2026.

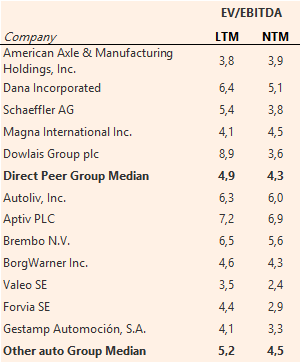

We keep talking about the cycle, so let's talk about it one more time, but in this case about the expansion/contraction of multiples during the cycle, illustrated together with GDP and vehicle sales:

In the cycle between 2010 and 2019 (perhaps we could talk about two cycles) we had an average EV/EBITDA multiple of 5.5 times for the companies analyzed that were listed at that time. As we can see in both graphs, between 2010 and 2012 there was solid sectoral growth with depressed multiples.

Despite the improvement in fundamentals, the disaffection with the Auto sector after the financial crisis prevented the sector from being re-rated. This only happened from 2013 onwards, given the strength of the economy and the sustained growth of the sector.

In 2015, with the slowdown of the sector, the multiple fell to 5, reaching a maximum of 7 in 2017 with sectoral margins at their highest. In 2019, the cycle went back down with lower growth expectations and with the end of 2019 anticipating a potential recession.

In the current scenario, the sector's growth prospects are below GDP growth and are affected by the instability of tariff policy as well as great uncertainty, both technological and in terms of OEM transformation and the inclusion of new players.

For this reason, the imposition of an average multiple below the previous cycle is justified and the upside of the thesis is based primarily on the materialization of synergies and the potential reduction of indebtedness, leaving aside a potential re-rating of multiples in the sector.

These projections with the chosen multiple give us a potential of 74%-128% between 2028 and 2029. Let’s stick to 74% conservatively.

Remember that this upside is only for the 0.0863 shares granted for each Dowlais share, which means that on our invested capital it would be 34%, incremental to the arbitrage. Example with 1.000 Dowlais stocks:

A whole range of possibilities opens up here. Let's calculate the expected return if we reinvest all the cash we get from Dowlais:

This sounds better, right?. One thing to keep in mind is that the reinvestment price is not known and may vary till the cash return date.

The reinvestment in American Axle, proportional to the initial position in Dowlais, can be made once the merger has been approved instead of waiting for the cash payment. This has two advantages:

Avoid exposing to opening an additional position in American Axle in case the merger does not go ahead.

Control the price of the reinvestment.

One more point before Dowlais valuation:

The prospectus includes a potential program they call a “Mix and Match” facility to allow Dowlais shareholders to reduce their cash payment and increase their share payment. This depends on the demand for the securities and details have not been provided so an alternative maximizing the share payment could emerge.

Dowlais standalone valuation

Betting on a merger and having it not be approved is a problem. Especially if you don't like the company on its own. We learned this the hard way with Capri+Tapestry.

Capri had no plans outside of this merger, so the viability of the investment depended entirely on the merger going ahead. (Perhaps we'll talk about this in another publication, Capri could be a turnaround.) Fortunately, Dowlais is not the case.

We are going to take a similar approach to that of the merger:

Through the 2025 guidance provided by Dowlais and moderate growth projections of 1.22% from 2025 onwards, a progressive fall in restructuring costs has been modeled, bringing OPEX up to 19% of sales in 2024, compared to an industry average of 8%.

Due to a low sales growth environment, the 10% operating margin target has not been estimated, reaching 8.9% in 2029, supported by OPEX and a slight recovery in gross margins through increased volumes.

These projections reach an EBITDA of 600 million GDP by 2028-2029 with margins of 13.5%. In 2021 Dowlais reached an adjusted EBITDA of 522 million (adjustments for restructuring and spinoff costs). With the chosen multiple give us a potential of 84%-87% between 2028 and 2029.

The multiple differential (5x vs 4.5x) with the merger is justified by Dowlais' lower indebtedness than that assumed for the merger (2.7x Net Debt/EBITDA vs 3.8), reducing the risk of the investment, and by the advanced restructuring process, which implies higher margins.

Summarizing the scenarios proposed:

So I say, merger or not? It doesn't matter.

Thanks for reading!. Don’t forget to subscribe.

Behind these two articles there is a wealth of data and information that perhaps was not relevant to the narrative. The following section is not necessary reading but may provide additional information for the curious.

Additional considerations

Management insights about tariff war

Regarding tariffs, Dowlais highlights the following relevant aspects to be taken into account in its latest report:

Flows within the group between regions are not very relevant and therefore would not be impacted by tariffs.

Some raw materials and components would be impacted by tariffs on imports into the production process in the USA, but in no case is the finished product exported from Canada or China to the USA.

As part of the cost reduction programs, some production has been moved from the USA to Mexico. The impact here would be indirect, as most of the products are sold EXWorks to OEMs.

The previous history of tariff increases shows that Dowlais has the capacity to pass some of these on to its customers.

Dowlais insiders: Shareholding & incentives on combination

Liam Butterworth, CEO of Dowlais, is one of those managers who have climbed the corporate ladder from the bottom. Starting out as an apprentice operator in a British company, he moved into sales. From there he made the leap to FCI Automotive in France, where he rose to the position of CEO and led the company to its merger with Delphi Automotive. He then joined Delphi as President of the Powertrain division, also reaching the position of CEO.

In 2018 he joined GKN Automotive as divisional CEO at the hands of Melrose and from 2023 he became CEO of Dowlais.

The CFO, Roberto Fioroni, also has a long history in the sector, having worked for Goodyear and WABCO, and reached the GKN board after managing the company's offices in Mexico and the UK.

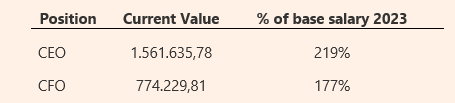

Both executives have a respectable position in the company and have recently acquired shares (March 9):

Despite the stake, both executives are required to increase their position to 300% of their annual salary, a goal that has not yet been met and that would be put on hold with the merger.

Both executives support the merger with American Axle in which they have some financial incentives:

The CEO and CFO would receive 150% and 120% respectively of their base salary conditional on their remaining in post for 6 months after the merger.

Although without a defined role, both the CEO and CFO will have a role in the new company, at least until six months after the merger is completed. This is one of the requirements for extraordinary compensation conditional on the merger.

Dowlais Capital Structure

With regard to the capital structure, there is no defined majority shareholder. Most of the capital is concentrated in investment funds. Of note is the 1% owned mainly by the CEO and CFO, among other former Melrose executives. Melrose, for its part, holds a 3% stake.

Dowlais Financial Debt & Combination considerations

Dowlais' financial debt excluding pensions & leases is low, standing at 2.0 times Net Debt/EBITDA at the end of 2024, 2.7 all included.

In addition, it has a favorable maturity schedule:

The Revolving Credit Facility (715 million) matures in 2028 but has two extensions at Dowlais' discretion, so the maturities have been spread out between 2028-2030. With EBITDA (non-adjusted) of 350 million and 336 million in cash at the end of 2024 and no large maturities in the coming years, solvency is guaranteed.

American Axle: Despite the cash payment by Dowlais, by making part of the payment in shares to a group of similar size and with lower indebtedness, the net effect is neutral. The combined day 1 indebtedness with the 2024 EBITDA would be 2.82 times Net Debt. American Axle has commitments with financial institutions for revolving lines and bridge loan agreements to refinance all the debt and intends to issue bonds once the company is established.

EV/EBITDA Current Industry Multiples

DISCLAIMER: All the information provided in this document is purely informative and does not constitute a buying recommendation (according to Spanish Law Article 63 of Law 24/1988, of July 28, on the Stock Market Regulator, and Article 5.1 of Royal Decree 217/2008, of February 15). DuckPond Value Research is not responsible for the use of this information. Before investing in a real account, it is necessary to have the appropriate training or delegate the task to a duly authorized professional.