Before starting, I wanted to draw attention to something that regular readers will surely have overlooked. This blog is now over a year old! And I am lucky enough to be able to write for more than 300 subscribers.

I am a reader of other Substack newsletters that I highly recommend, such as Investment Notes,

, and , among others. And reading some of your theses made me realize something:You are brave readers.

My articles are tedious, excessively numerical and very technical, so if you've ever read one from cover to cover, thank you.

So, for the thesis I bring you today, I have two new things:

The first is that I'm going to try to move away from my financial dossier style and try a more narrative and less technical style. You tell me if I succeed.

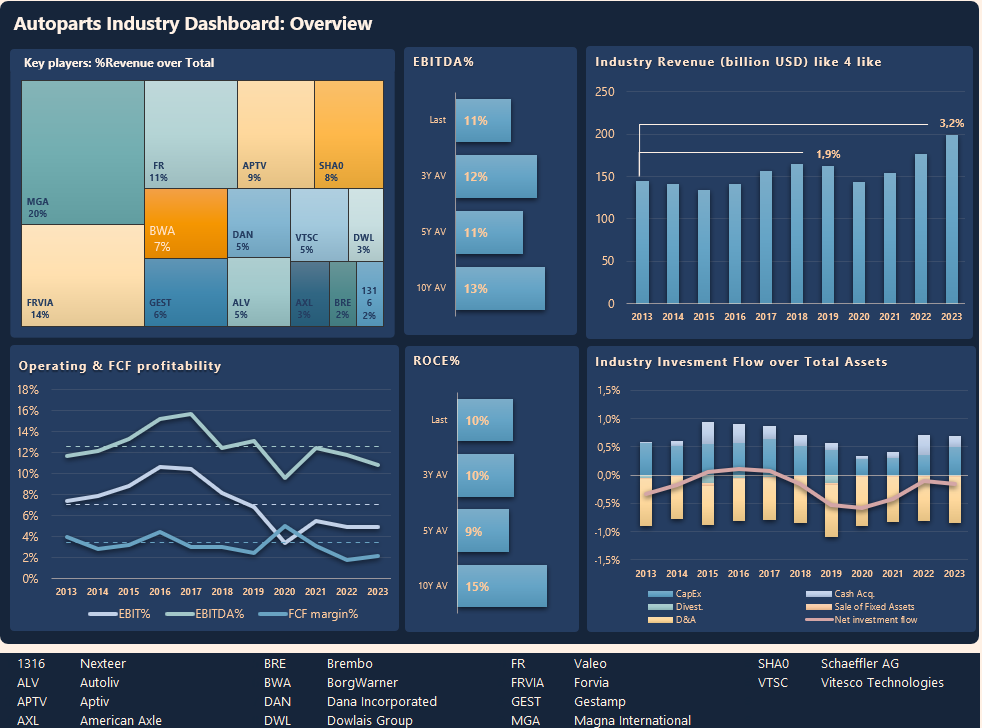

The second is that I will start illustrating my theses with industry dashboards, compiling months of work into very powerful visuals. You will be able to find them at the end of the thesis. I will also publish these dashboards from other industries on my X: @duckpond_vr profile or on my LinkedIn and in subsequent publications.

Look at this metal piece, do you know what it is? I didn't either until a few months ago. Now I know, although I still get lost in the technical aspects.

It turns out that it is a sideshaft, a fundamental component of vehicles for transmitting engine power to the wheels. Both internal combustion engines (ICE) and electric vehicles (EV) need at least two, and in some cases they can have up to four.

The company I'm bringing to you today is the world leader in the manufacture of these parts, with twice the market share of its closest competitor. It is present in at least 50% of models and works with 90% of vehicle manufacturers (OEMs) with a high degree of diversification.

Dowlais is a British company that is the result of a spin-off in 2023 from Melrose Industries, a listed British company dedicated to restructuring industrial businesses in trouble. In 2018, Melrose bought the former GKN group in a hostile takeover bid due to financial problems and set about revitalizing its accounts by restructuring the company.

In 2023, GKN Automotive and GKN Powder Metallurgy were spun off under the Dowlais brand, keeping GKN Aerospace, a division they consider to have the highest growth and margin.

Affected by the cycle of the automotive sector, Dowlais is trading at 45% below the price of the spin-off and this has caught the attention of the competition at a time in the industry's capital cycle favorable to concentration via mergers and acquisitions.

American Axle, perhaps its most direct competitor and of a very similar size, has made an offer to acquire the company. The result of this would be the sixth auto-supplier in North America, the first and by far the leader in its segments worldwide.

The thesis will be divided into two publications:

In this one, we will analyze Dowlais and its sector, as well as the industry cycle and its medium-term prospects.

In the second, we will go into detail about the offer that would lead us to become shareholders of American Axle in the event of final approval and we will address a valuation for Dowlais and one for the whole.

GKN Automotive and GKN Powder Metallurgy continue to operate as separate segments in Dowlais, let's see what each one does.

GKN Automotive

This division, responsible for 80% of sales, is a key supplier in the global light vehicle industry, for both ICE (Internal Combustion Engine) and EV (Electric Vehicle) vehicles.

As a supplier of modules or complete components, Dowlais is a Tier 1 supplier in the industry. Tier 1 suppliers differ from other suppliers because they provide complete components to OEMs (Original Equipment Manufacturers) and their relationship is direct.

These suppliers are more difficult to replace and therefore less price sensitive, as well as being part of the design, development and homologation processes for new models. Within Tier 1, Dowlais is responsible for a very sensitive part, the transmission of engine power to the wheels. Its motto:

“The architecture that rotates the wheels"

The complexity of this architecture can be seen in the following infographic with the products manufactured by this division:

To put it simply, its products are divided into four families:

Sideshafts: these are bars that transmit the force of the engine or differential to the wheels, allowing them to turn and move the car. Dowlais is the world leader in sideshafts by market share, doubling the market share of the next competitor. It also maintains the same leadership when considering only the market share of electric vehicles.

Prop shafts, or driveshafts: these are long components that carry power from the transmission (usually at the front of the car) to the rear or front differential. Dowlais is also the market leader in this area, although the gap is smaller.

AWD systems: An AWD (All-Wheel Drive) system allows all four wheels of the vehicle to receive power from the engine simultaneously or as needed. This system improves traction on slippery or uneven surfaces and is common in SUVs, sports cars and vehicles designed for difficult conditions.

eDrive systems: these are powertrains designed for electric vehicles, including an electric motor, inverter and, in some cases, a simple gearbox. Dowlais manufactures both the motors and adjacent components.

Sales are distributed as follows:

This mix is very relevant when it comes to tackling electrification, as propshafts and AWD are solutions exclusively applicable to ICE (Internal Combustion Engine) vehicles and some MHEVs (microhybrids), while sideshafts are used interchangeably. eDrive systems and components are specific to EVs, whether PHEVs (plug-in hybrids) or pure EVs.

For sideshafts, the company says, electrification is a growth advantage: ICE vehicles have 2.1 sideshafts vs. 2.4 for BEVs. The reason for this is that currently the share of BEVs with 4-wheel drive is higher on average. Here we have to put a but: The generalization of the BEV and the entry of lower ranges could amortize this difference by adding production of cheaper vehicles with only 2 axle shafts.

Returning to the graph, we see that approximately 70% of the revenues (green area) are adaptable to electrification. So, are 30% of the revenues threatened by electrification? Two things in this regard:

Propshafts and AWD systems can be applied to mild hybrid or plug-in hybrid vehicle models. These technologies are taking as much market share from ICE as BEVs in North America or Europe. (In China, the implementation of pure EV is greater)

Electrification is not so imminent. Since 2019, the forecast for BEV penetration of the total number of vehicles has been falling steadily. The latest revision puts it at 33% and government plans have been relaxed.

In short, ICE vehicles still have a long way to go, so Dowlais is limiting its investments in declining technologies, maximizing the profitability of its assets, and investing in “powertrain agnostic” product lines.

As we have said, the company is highly diversified: it is present in half of the car models and works directly with 90% of OEMs. The Others section includes more than 40 brands, including pure BEVs (battery electric vehicles).

To recap: GKN Automotive is the clear leader in the niche that represents 50% of its sales (sideshafts), this product is not impacted by electrification and enjoys a wide diversification of customers. In addition, the rest of its portfolio combines “powertrain agnostic” technologies with other pure ICEs that can generate cash for more than 5 years as production is restructured.

Let's take a brief look at what the division responsible for the remaining 20% of sales does.

GKN Powder Metallurgy

This division recycles scrap metal to create metal powders, which are either sold unprocessed to other industries (22%) or used to manufacture finished parts for the automotive industry, among others (78%). It is the world leader in the manufacture of these parts, serving as a direct supplier to OEMs or other Tier 1 automotive suppliers, as well as to other customers such as Siemens, Black and Decker and Whirlpool.

Exposed mainly to the same cycle as Automotive, this division is 7% below 2019 revenues, a smaller correction than in the case of Automotive and has been very consistent in its operating margins.

Prior to the takeover bid by American Axle, this division was a potential sale, a potential strategic move announced since the spinoff in 2023.

Coincidentally, in 2017, American Axle completed the acquisition of Metaldyne Performance Group, which is now part of its Metal Forming division. This transaction was done at 6-7 times EV/EBITDA. Together with the privatization of Hoganas in 2013, a Swedish company competing with both, done at 8-9 times EV/EBITDA, we have a proxy of how much Powder Metals could be worth:

From what we can see, covering its proportional share of the debt, the valuation of the division could cover half of Dowlais' current price, providing a solid foundation for this thesis.

The sector dynamics of both segments are closely linked, so we are going to analyze the sector and its moment in the cycle in a homogeneous way.

The (endless) cycle of capital

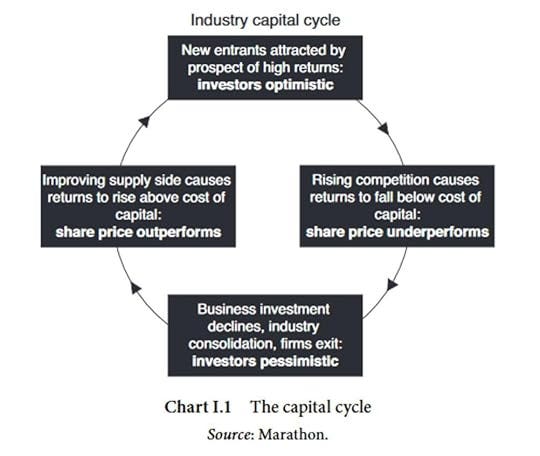

As Edward Chancellor teaches us in his Returns on Capital, industries constantly go through different phases: some where high margins attract capital to the industry and cause over-investment, as opposed to other moments where the saturation of players and productive capacity cause low returns, expelling capital and depressing share prices.

This process leads to sector concentration, either through bankruptcies or mergers and acquisitions, and lays the foundation for a new bull cycle in the industry. Basically, when demand recovers, there will be fewer competitors with fewer assets (factories) to meet growing demand. And the endless cycle will begin again. This is usually a great time to position yourself in these cyclical companies.

So, are the automotive industry suppliers in the low phase of the cycle? I think so, and I'm going to base my argument on three points based on the analysis of the 14 suppliers analyzed.

Low returns, underinvestment and consolidation

First: Margins in the sector are at a minimum: Linked to the demand for and production of light vehicles, the sector's growth rates were below inflation in the period 2013-2019 and also until 2023 based on the analyzed group of 14 companies.

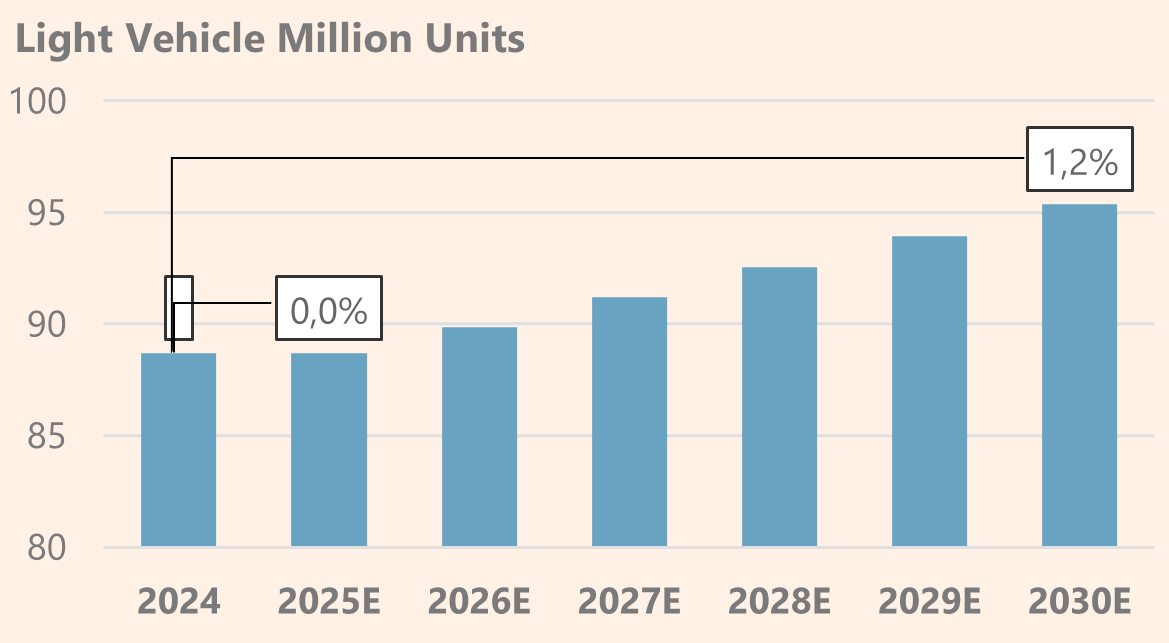

This is largely due to lower demand for vehicles due to the slowdown in growth in China, uncertainty among consumers about the legislative future of different technologies, and stagnation in the main traditional markets. The sector is not expected to recover 2019 levels until 2028-2029 according to the S&P Global Mobility Forecast.

In a sector with high operating leverage, this has led to sharp drops in margins, mitigated in the case of cash flows with lower Capex spending, as we will see in point 2.

Usually, and until the outbreak of the pandemic and the war in Ukraine which caused disruptions in the supply chain, these suppliers obtained higher gross margins than their customers. Since then, OEMs have been able to pass on the cost increases to their customers, shifting production to higher-margin models, squeezing the margins of commercial distributors or increasing prices. Meanwhile, the Autoparts have not been able to pass on their cost increases to their customers. The gap has been progressively narrowing since 2020 and there are studies that indicate that in Q3-2024 the Autosuppliers surpassed the OEMs in EBIT margin.

Within the scope of the companies that have been studied (14 Autoparts and 16 OEMs) we can see the following evolution in gross margins where the trend can be seen.

In the medium term, traditional OEMs face increased competition from Chinese brands and new pure EV companies (e.g. Tesla or BYD) in their traditional markets, a situation that would put even more pressure on margins. This may favor Autoparts by allowing them to diversify their customer base and increase their bargaining power with respect to them, although it also means more tenders and adaptations to manufacturers.

The new car manufacturers, who are threatening the leadership of the traditional OEMs, are counting on these Tier 1 suppliers in their expansion into their original markets and will go hand in hand with suppliers such as Dowlais and American Axle when it comes to tackling the internationalization of their production processes.

Dowlais operates in China through a Joint Venture with 36 years of experience, number 1 with a 40% market share in China, working with local and international OEMs.

Second: The sector has been underinvested for more than 10 years, that is to say, its assets are deteriorating at a faster rate than they are being reinvested. As can be seen, the net investment flows are negative.

Third: The sector is consolidating, with a high level of mergers and acquisitions. Some of the most relevant operations in recent years are as follows:

To put it into context, the approximately $30 billion of M&A (excluding Bosch, as it is not listed) would represent approximately 40% of the current aggregate market cap of the companies analyzed. And by 2025, our company could join this wave.

Let's see what Dowlais has been doing to navigate these waters.

Restructuring or dying

Within the cycle, part of the process of a company returning to profitability involves surviving and when Melrose acquired GKN, that survival was not assured.

From 2019 to the present, management has been implementing an aggressive restructuring plan to get Dowlais back on the road to profitability. And how aggressive is it? Like this:

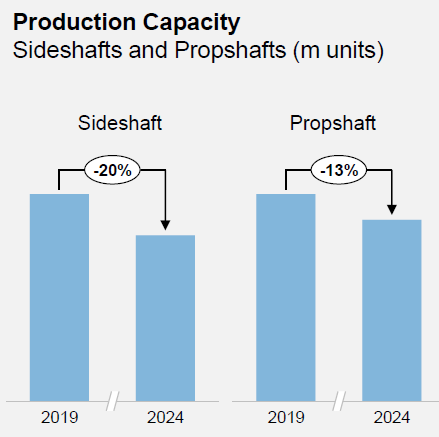

The restructuring process of recent years, present in the industry in general, has been much more intensive at Dowlais. The initiatives have focused on the following points:

Closing the least cost-efficient plants and transferring production to the most cost-efficient ones.

Opening plants in countries where they can operate with better margins. For example, in 2023 a plant in Germany was closed and investment was made in a new one in Hungary, and in 2024 the same process began in the USA and Mexico.

Decrease in production capacity in areas of lower expected growth. Example Europe:

Headcount reductions

These measures have had an impact on the operational efficiency of the business, despite the decrease in sales. Revenue per plant decreased to a lesser extent than total revenue, and revenue per employee increased.

This is how the lever of future profitability is built when sales volumes recover. The company estimates the potential of its Automotive division at >10% operating margin at 2019 volumes. But will 2019 levels return?

Let's analyze the results of Dowlais and its most direct competitors in the Automotive sector and their medium-term prospects.

Results 2024 and outlook

Within the 14 companies that make up the Autoparts analysis, the companies and divisions whose product range is most comparable have been selected. Dowlais is positioned as a major player among Driveline's competitors, facing giants such as Magna and Valeo, whose range of products serving OEMs is larger and more diversified.

Given the mix of Magna, Valeo and Dana products in its divisions, the leadership position that the planned merger between Dowlais and American Axle would entail is clear to see.

In 2024, the comparative group's revenue performance has been mixed:

This difference is mainly explained by two sectoral factors:

The regional mix of the divisions: Valeo and Dowlais have more representation from EMEA than Magna, Dana or American Axle, markets where production has decreased the most in 2024.

The weight of electric motors (eDrive systems), which in the case of Dowlais and Valeo account for 27% and 23% respectively of the division. Excluding this circumstance, Dowlais would go from -7% to -2.7% and Valeo from -6% to 0%. In this market, they are suffering mainly from two trends: the delay in the penetration of the electric vehicle and the change in strategy of the OEMs, which are vertically integrating the production of the motors in their developments and making large investments.

The evolution in sales of these players between 2019 and 2024 is not easily comparable due to segment redenominations or M&A, but the evolution of margins does provide us with some interesting conclusions:

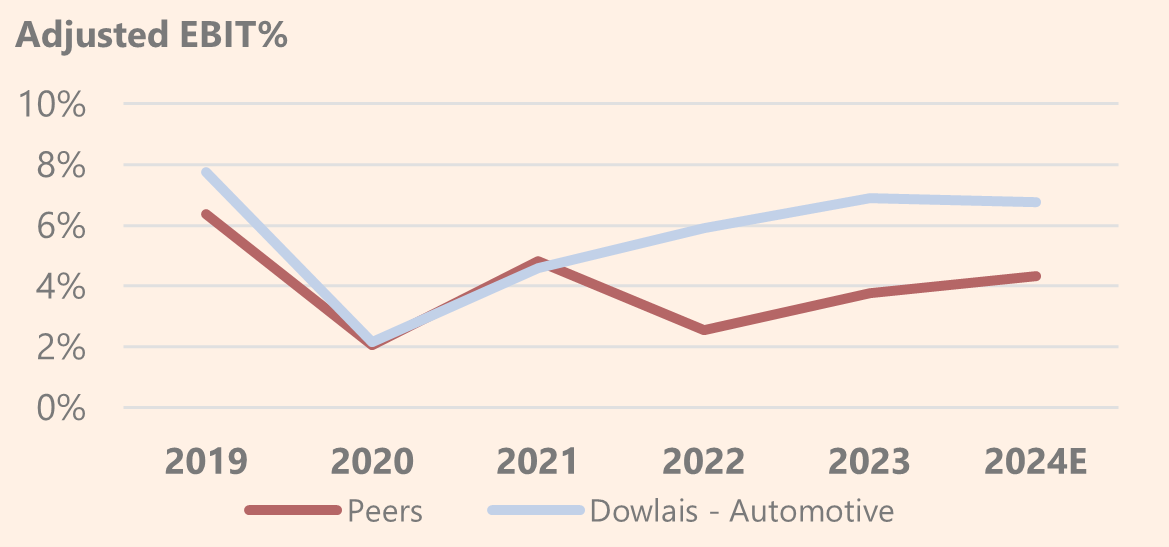

The impact of the pandemic and the aforementioned difficulty in passing on cost increases have hampered the recovery of operating margins in the sector. This has been different in the case of Dowlais, and here the role of Melrose and the restructuring process analyzed is noteworthy.

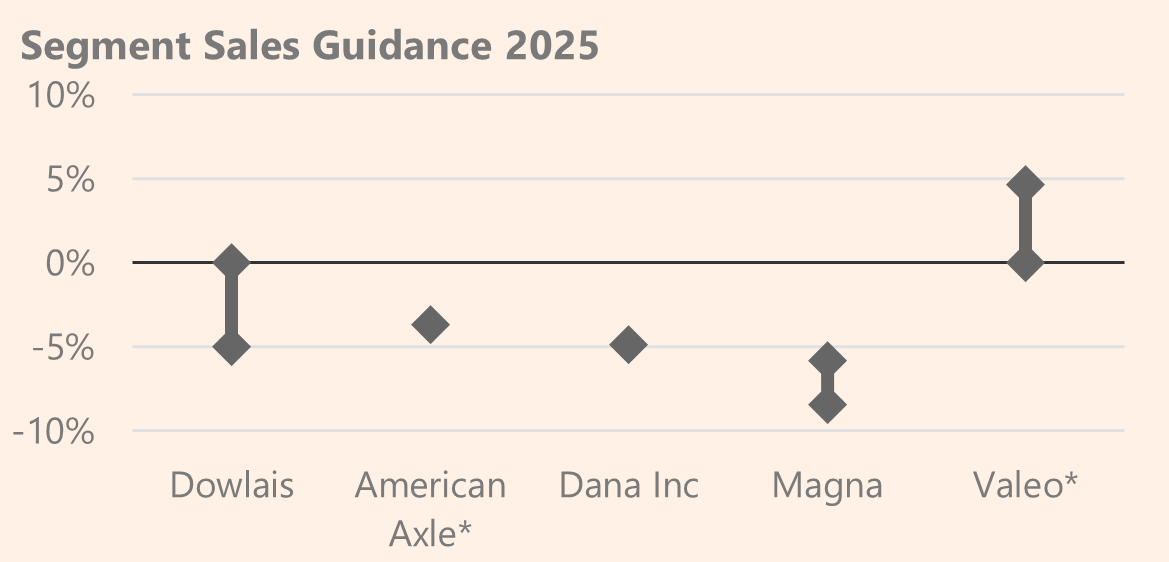

The outlook for 2025 for these companies does not reflect a positive picture with an average fall in sales of 3%. This guidance does not take into account the risk of a tariff war as they have considered it to be a scenario that is still uncertain and changing.

In general, companies are positive from 2026 onwards, based on the S&P Global Mobility Forecast, which forecasts annualized growth of 1.2% until 2030.

This would indicate that the sector expects the cycle to bottom out in 2025 and that, predictably, company share prices have discounted the entire low part of the cycle.

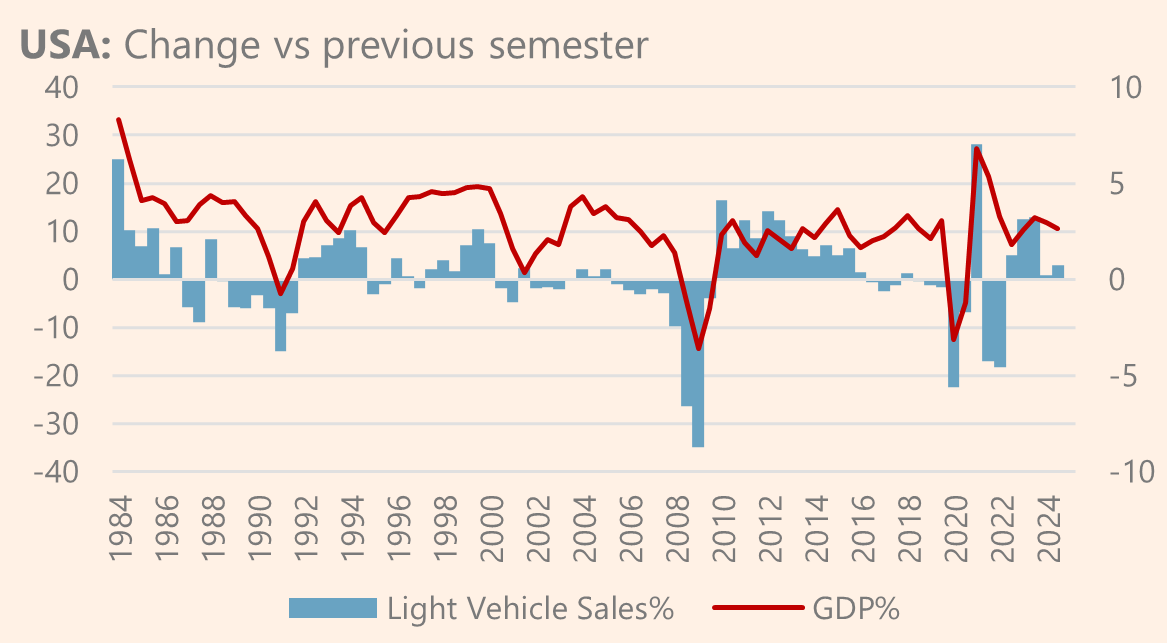

The growth expected by the sector is supported by expectations in the economy, although below it:

These forecasts must be contrasted with the instability imposed by the Trump administration with the threat of a tariff war. His changes of position and the response of other countries and the effect on the expectations of consumers and manufacturers make it difficult to pinpoint the impact on this industry and on Dowlais in particular.

Car sales are a slightly leading indicator of the cycle, anticipating falls in phases of slowdown. As we can see in the USA, sales slowed down in 2024 at the same time as GDP growth softened in the second half of the year.

In Europe (EU27), the fall in sales has accompanied a pyrrhic growth of less than 1%.

Far from trying to predict a recession, this data indicates that the prevailing instability could cause a fall with respect to 2024 and a delayed recovery to 2026 or 2027, leading to a scenario of lower growth until 2030. It is possible to fall lower and this risk will have to be taken into account in valuation.

But we will leave that for the second part.

Conclusion Part I

Autoparts Industry is undergoing a process of concentration and restructuring caused by electrification and changes in the market since Covid. At this point in the cycle, the sector can offer good opportunities and there are reasons to think that Dowlais may be one of them.

Dowlais represents a leading company in its niche, with a favorable strategic positioning in the industry. The combination of its customer diversification, its advantage in the sideshafts market and the possibility of consolidation with American Axle makes worth investment opportunity.

In part II we will talk about the merger and valuation of both companies.

Leave your opinion and keep scrolling down to see the Industry dashboard.

DISCLAIMER: All the information provided in this document is purely informative and does not constitute a buying recommendation (according to Spanish Law Article 63 of Law 24/1988, of July 28, on the Stock Market Regulator, and Article 5.1 of Royal Decree 217/2008, of February 15). DuckPond Value Research is not responsible for the use of this information. Before investing in a real account, it is necessary to have the appropriate training or delegate the task to a duly authorized professional.