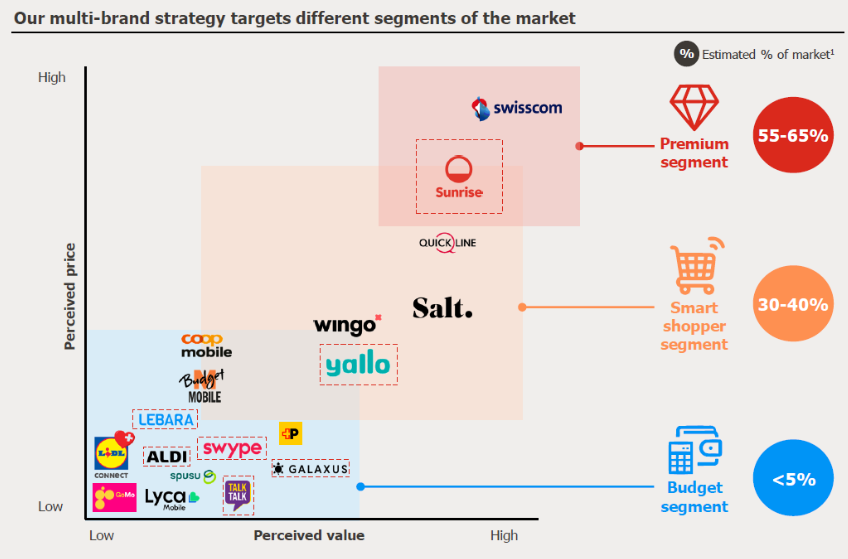

Sunrise is Switzerland's second-largest telecommunications provider in terms of revenue and offers convergent telecommunications services, offering mobile, broadband, TV and fixed-line services primarily under the core brand Sunrise and its flanker brands Yallo, Lebara and Swype. Sunrise holds a market share of 26% in mobile services, 28% in broadband and 31% in TV based on the number of subscribers.

Key points of the thesis

Sunrise is the second largest telecommunications company in the Swiss market, with a good market share, a good brand position and a good quality of mobile and fixed network that allows it to offer its customers convergent rates.

The spin-off, already approved by Liberty Global, aims to uncover the hidden value of a highly complex holding company.

Sunrise will initially be listed on the American stock exchange in the form of an ADR, although its final exchange will be the Swiss one, a market where high multiples are paid, betting on its value.

Investment thesis

Liberty Global is a telecommunications conglomerate led by the legendary John C. Malone. The company expects to complete a spin-off of its Sunrise subsidiary during Q4 2024.

The main motivation that led Liberty Global to embark on this operation is to unlock value for its shareholders, as it believes that the market does not reflect the company's true valuation. One of the possible reasons for this is that Liberty Global is a very complex company to analyse, as it is made up of a large number of companies, including listed and unlisted companies. The analysis of all Liberty is complicated and requires a lot of time and research.

Sunrise

The Sunrise company, target of this transaction, is the second largest telecommunications provider in Switzerland in terms of revenue and offers convergent telecommunications services, bundling mobile, broadband, TV and fixed-line services primarily under the core brand Sunrise and its low-cost brands Yallo, Lebara and Swype. Sunrise holds a market share of 26% in mobile services, 28% in broadband and 31% in TV based on the number of subscribers.

The Swiss telecommunications industry is mature, saturated, competitive and subject to price erosion. An analysis by Ampere Analysis shows that growth expectations for the Swiss telecommunications market are deflationary in almost all of its segments. This is because the Swiss market is already saturated, with most of its inhabitants already having a telephone service and even in many cases more than one if they have more than one residence. Thus, the only possibility of revenue growth is to capture market share from the competition, a mission that Sunrise has successfully accomplished in recent years, managing to gain up to 2% of the market share of Swisscom, its main competitor.

Even so, the company's revenue growth expectations are not very high, but it is not the main focus for creating value that the management team will use either. What can be expected is that cash flow generation, buybacks and dividends will work like a good Swiss watch. In this way, as a Spanish retail investor, it does not seem like an interesting long-term investment if we only see Sunrise as a source of dividends. What we can expect is that once the spin-off has taken place, the Swiss market, which rewards its companies with high multiples, will price the value of this division.

Liberty Global

Liberty Global will list the Sunrise shares distributed in the spin-off in the form of ADS, although their final destination will be the Swiss stock exchange. This leads us to believe that the initial sell-off, which usually occurs in this type of operation, will also occur on this occasion. But also, an important detail of this operation is to understand that the main managers of Liberty Global, who are Malone and Fries, will continue to control both companies. The fate of Sunrise and Liberty will continue to be linked to them.

As we will discuss in this thesis, even with the Sunrise spin-off completed, there will still be value left in Liberty. This fact may offer a good opportunity for revaluation, since even without Sunrise, the set of all the companies that make up Liberty have more value per share than the current share price (about $21).

What is the best move? Sell Sunrise, expand Liberty, or go for both? That is what we have tried to answer in the following analysis.

Sunrise Business Strategy

Sunrise is Switzerland's second-largest telecommunications provider in terms of revenue and offers convergent telecommunications services, offering mobile, broadband, TV and fixed-line services primarily under the core brand Sunrise and its flanker brands, yallo, Lebara and Swype.

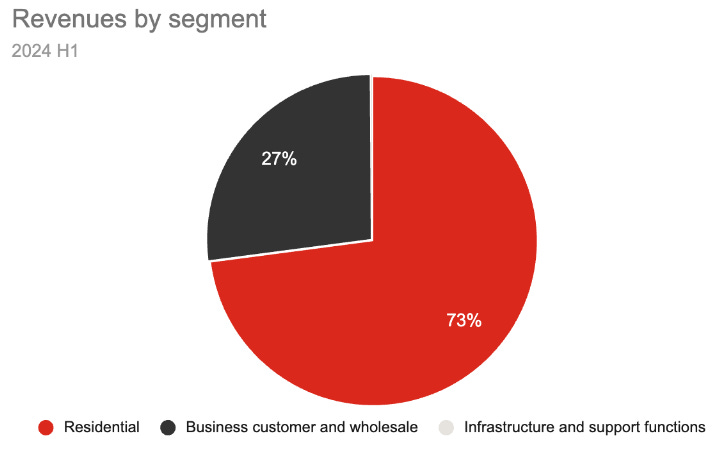

The company operates in three main segments: residential customers, commercial and wholesale customers, and infrastructure and support functions.

Residential Services (B2C)

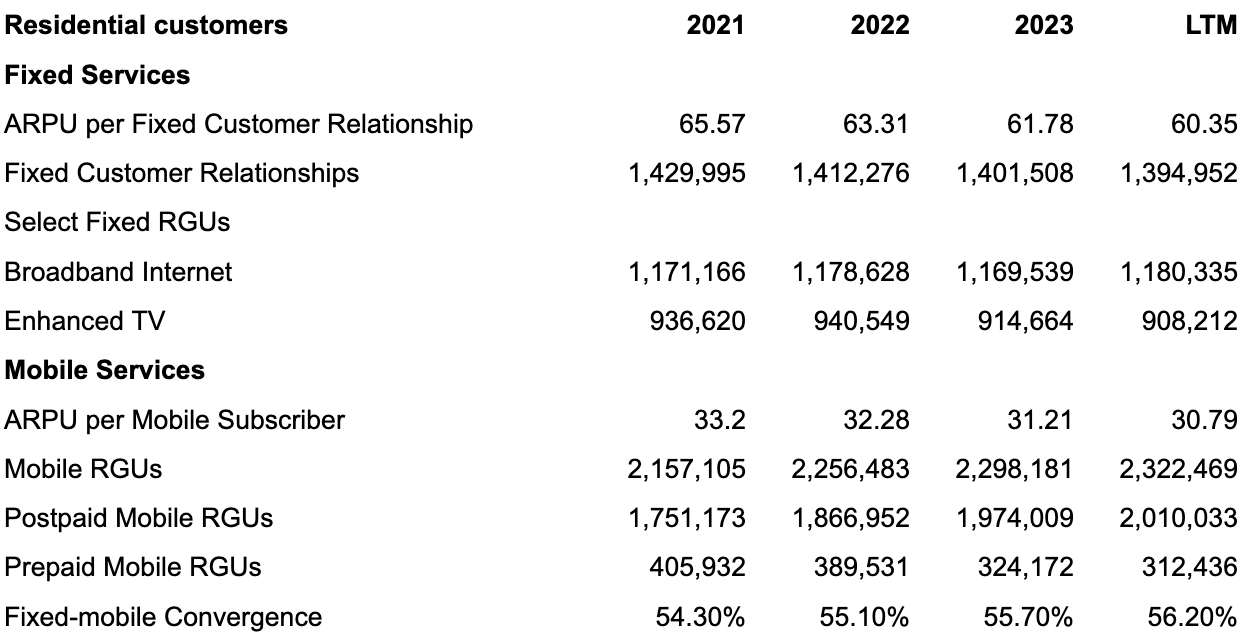

Sunrise offers residential customers landline, broadband, TV and mobile services, which can be bundled in various combinations for a fixed monthly fee. Approximately 56.20% of subscribers are subscribed to a convergent plan.

The company also operates the MySports pay-TV platform, which has exclusive rights to broadcast ice hockey matches from the Swiss National League. In addition, it offers value-added services including Devices as a Service ("DaaS") and home security services.

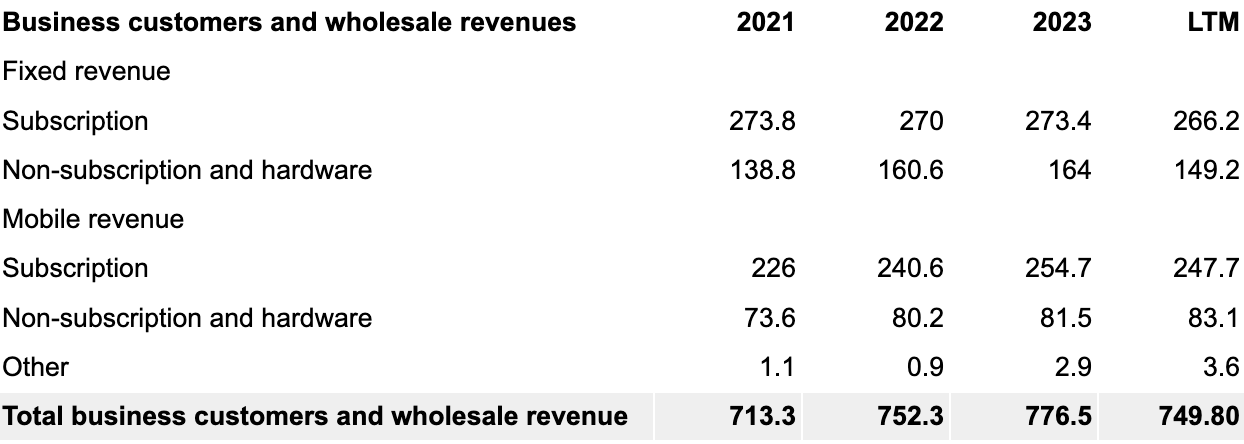

Services for commercial and wholesale customers (B2B)

Sunrise offers its telecommunications services, primarily mobile and broadband services, as well as a range of services, including cloud services, cybersecurity and automation, to Swiss companies of all sizes.

Sunrise's wholesale operations provide mobile virtual network operator (“MVNO”) services.

Infrastructure and support functions

This segment is responsible for the management of mobile towers built by Sunrise and sold to Swiss Towers and represents a very small proportion of revenues.

Network deployment strategy

It should be noted that within a telecommunications company, a very important part of its strategy is focused on its network deployment. When it is said that this sector is very “capex” intensive, it refers to the large investments that these types of companies need to make in infrastructure to bring their connections to their customers' devices.

This is precisely where companies in this sector are most criticised in Europe, as they are not able to pass on the costs of these investments and the improvements they are forced to implement to the end customer, in the form of higher prices. If Sunrise did not deploy mobile infrastructure with 5G capacity, it would possibly lose competitiveness against its rivals in a short period of time, but at the same time its customers do not expect to pay more to enjoy a much higher quality connection.

When talking about network deployment, it is necessary to distinguish between a fixed network , the medium through which connectivity reaches customers' homes, and a mobile network , the medium through which connectivity reaches customers' cell phones.

Fixed network

The fixed network is used to offer broadband, television and fixed telephony services mainly. Sunrise has opted for a mixed network based on a DSL, HFC, fibre and FWA infrastructure; this combination of technologies allows it to provide broadband services to more than 95% of Swiss households and gives it the ability to offer its services at the fastest download speed available in each geographic location.

In Switzerland, the entire fixed network has been deployed by different players, with whom Sunrise has reached agreements in order to be able to offer its services at maximum speed to its customers, which gives it an advantage over its competitors, especially considering the country's complicated topography.

Of the 60% of the network, HFC (Hybrid Fiber Coaxial) technology is used, 56% of the deployment belongs to Sunrise and 3.6% to other partners. Of the fiber network (FFTH), 40% of the deployment belongs to its competitor Swisscom and 95% of the DSL network.

The core technology of the Sunrise network is based on HFC (Hybrid Fiber Coaxial) architecture, combining optical fiber and coaxial cable, which is used in the last section of connection with the user. This network is deployed in 60% of the country with more than 25,000 km of optical fiber and 40,000 km of coaxial cable in total and is capable of reaching download speeds of up to 2.5 Gbps.

By 2023, 56% of Sunrise’s residential broadband subscribers (in both Sunrise and Yallo) are connected via HFC technology. 19% of subscribers are served via fiber, which offers a peak download speed of 10 Gbps, 24% via DSL technology, which offers a peak download speed of 300 megabits per second (“Mbps”), and 1% via FWA technology, which offers a peak download speed of 1 Gbps.

HFC technology remains the dominant technology through which Sunrise subscribers access the Internet, the reason for this is that it is much cheaper to deploy, as coaxial cable is much cheaper than optical fibre, and as we have seen, the network is made up of almost twice as much coaxial cable.

The maximum speed that the company can offer within its network based on HCF architecture is 2.5 Gbps, far from the 10 Gbps maximum download speed that architectures such as FTTH (fiber optic) can offer. This could be a disadvantage compared to competing rates; but to date, Sunrise has not planned to update its deployment to the DOCSIS 4.0 standard, which is the next generation of data transmission by cable that would allow it to offer speeds of up to 10 Gbps.

Mobile network

Sunrise's mobile network operates with 3G, 4G and 5G connectivity. It is used to provide mobile services to its customers, as well as broadband services in a small number of geographic areas, which are difficult to reach with fixed infrastructure alone due to the country's complex topography.

4G and 5G connectivity covers virtually all of Switzerland (geographically and by population). Sunrise plans to migrate all voice traffic from 3G to 4G and switch off 3G connectivity by 2025 so that the spectrum currently used by 3G is available to support better 4G and 5G coverage. Today, more than 84% of mobile voice traffic was already transported via 4G.

The company also aims to eventually migrate all 4G data traffic to 5G to enable higher data speeds, lower latency and new use cases for mobile connectivity. By 2024, more than 31% of data traffic was already transported via 5G. This technology provides coverage for virtually the entire Swiss population, allowing it to extend the geographic coverage of its broadband offering to areas that are difficult to reach with fixed infrastructure alone.

Sunrise is able to offer its mobile services thanks to its owned spectrum holdings, a total of 295 MHz. Its spectrum consists of 40 MHz in the low band (frequency range 700-900 MHz), 70 MHz in the mid band (frequency range 1400-2600 MHz) and 100 MHz in the high band (frequency range 3500 MHz). Approximately 46% of this spectrum holding extends until 2034, while the remainder expires in 2028.

The purchase of these spectrum slots is a significant event for a telecom company in terms of the investment they require. In this regard, it is important to keep in mind the date of 2028. The Swiss regulator has already indexed preparations for the allocation of any new frequencies and reallocation of existing ones in 2029 through a process that would likely begin in 2026, with an auction that could take place in 2027. The cost of renewing the Sunrise spectrum is unknown at this time, but the allocation costs could be significant regardless of the allocation method used. However, in general, the allocation of spectrum in an auction requires a higher expenditure than an allocation through a renewal procedure.

First of all, it is interesting to note that the residential segment has the greatest weight in the company's revenues. Its core business is undoubtedly focused on B2C and the rest of its initiatives are strategies to complement that revenue by other means, where the B2B business makes a lot of sense.

Sunrise is able to serve its customers in virtually the entire Swiss territory with a technological mix of network capabilities. One problem for telecommunications companies is the high degree of capital investment they need in the network. In Sunrise's case, having advanced up to 75% of the 5G network deployment is a positive point. Although it must be kept in mind that in 2028, 54% of the spectrum rights it has in its mobile network will expire. This will undoubtedly entail a significant capital outlay.

On the downside, ARPU, the value of each customer, has been declining since at least 2021, as we can see from the data. This means that the company is not able to update the prices of its products, not even at the level of inflation growth, even though the inflation rate in Switzerland is very low.

This highlights the fact that the market in which the company competes is very competitive and prices are constantly under downward pressure. Telephone rates are commoditized products.

The Swiss telecommunications market

The Swiss telecommunications sector is mature and saturated, highly competitive and subject to price erosion. Telecommunications in European markets is a commoditised product, and in Switzerland, virtually all citizens have one or more telecommunications services.

The main operators with which Sunrise competes in the Swiss market are Swisscom, the country's largest telecommunications company, and Salt. Within the broadband, television and fixed telephony markets, Sunrise also competes with certain public entities, which can compete more effectively on price.

In addition to these three major players within the Swiss market, there are also MVNOs (mobile virtual network operators). MVNOs do not have their own mobile network infrastructure, but have agreements with mobile network operators (Swisscom, Sunrise and Salt) to access the mobile networks of these providers at wholesale rates.

Market share of each operator in 2023:

Between 2020 and 2023, Sunrise has managed to increase its market share against Swisscom by 2% in mobile services and 1% in TV services. Although this may seem like a small increase in a highly competitive market, it is a significant increase.

In general, the Swiss market does not differ significantly from the Spanish market. Consumers of this service are looking for convergent products that combine all services, data, internet and TV in a single package. This has led all operators to offer this type of product, which has led them to offer increasingly lower prices to maintain their competitive prices and reduce CHURN, the churn rate.

Due to the high market competitiveness, all companies offer their services under different brands targeting different customer segments. In the case of Switzerland, Swisscom and Sunrise are perceived as premium brands. Whereas Yallo and Swype (owned by Sunrise), Wingo (brand owned by Swisscom) and Salt are perceived as smart shopper brands. Low-cost brands are Lebara (licensed by Sunrise) Das Abo and GoMo (owned by Salt).

As for television, that is also an important differentiator for this type of product. Sunrise’s MySports pay-TV platform has exclusive rights to broadcast ice hockey matches from the Swiss National League and other leagues, such as the National Hockey League and European tournaments. Swisscom’s Blue TV, on the other hand, has the exclusive rights to broadcast the Swiss Super League and other football matches. However, by law, both companies must allow their subscribers to access each other’s channels, although each company can offer its channel exclusively or with promotions to its own customers. An offer that all companies complement with OTT services, through which they add third-party services such as Zattoo (in Switzerland) or Netflix, Disney+ and Amazon Prime.

As regards network quality, all operators have a good score in different tests carried out by independent entities, which is not a differentiating factor between any of the three brands.

Financial Strengths

One of Sunrise's main objectives is to use its free cash flows to support attractive distributions to shareholders. The company intends to start paying dividends in 2025, for which it wants to distribute a substantial part of its free cash flow as dividends and targets progressive dividend payments per share.

Sunrise's cash flow generation is very solid, and it is also able to maintain a constant EBITDA margin over time. This makes us think that this company has an interesting profile as a good long-term dividend investment.

Capital structure after the spin-off

Sunrise will have two classes of shares, Sunrise Class A (voting) and Class B (high voting). Under Swiss law, a Sunrise Class B share will have one-tenth of the economic rights of a Sunrise Class A share, but both will have one vote per share. Therefore, 10 Sunrise Class B shares will represent the same economic rights as one Sunrise Class A share, but 10 times the number of votes.

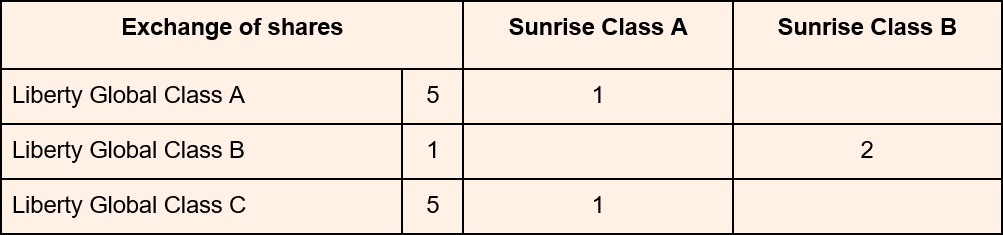

As a result of the spin-off, Liberty Global shareholders will receive: one Sunrise Class A share for every five Liberty Global Class A or C shares and two Sunrise Class B shares for every Liberty Global Class B share they own. This will maintain Liberty Global's historic high-voting Class B shares and ensure continuity with Liberty Global's core shareholders.

Using an example:

100 Liberty Global Class A shares will be exchanged for 20 Sunrise Class A shares, each of which will have 20 voting and 20 economic rights.

100 Liberty Global Class C shares will be exchanged for 20 Sunrise Class A shares, each of which will have 20 voting and 20 economic rights.

100 Liberty Global Class B shares will be exchanged for 200 Sunrise Class B shares. Thus, they will have 200 votes and 20 economic rights equivalent to the Sunrise Class A shares.

This disparity in ratios is due to the fact that Swiss law provides that all ordinary shares, regardless of their class, must have one vote per share. As a result, for Swiss companies, differential voting between share classes is implemented by issuing shares with different nominal values, with a maximum difference of 10:1.

In this way, the distribution of votes after the operation would be as follows:

With this distribution of votes, Malone and Fries will have significant voting power, since between them they account for 40% of the voting rights.

Spin-off process

Liberty Global has decided to deliver all of the Sunrise shares distributed in the spin-off in the form of ADSs ( American Depositary Shares ).

Holders of Sunrise shares, which are listed as ADSs, will have the right to transfer their shares for trading on the Swiss stock exchange at any time after the completion of the spin-off process, which is the final destination where the company will be listed.

Sunrise Class A ordinary shares will be listed on the Swiss Stock Exchange under the symbol "SUNN" and Sunrise Class A ADSs will be listed on Nasdaq under the symbol "SNRE".

The listing of the shares as ADSs on Nasdaq will be for a transition period only. This transition period will extend from the date of commencement of trading until nine months thereafter. After the transition period expires and the delisting takes place, the Sunrise ADSs will be traded in the US over-the-counter, i.e. they will be delisted from the main stock exchange.

Holders of Class B shares in Sunrise ADSs will be able to exchange such shares for shares of Class A ordinary shares traded on the Swiss index.

As a result of the operation, the following set of actions will be created:

69,832,656 Sunrise Class A ordinary shares, with a par value of CHF 0.10 per share in the form of an equal number of Sunrise Class A ADSs,

25,977,316 Sunrise Class B shares, with a nominal value of CHF 0.01 per share in the form of an equal number of Sunrise Class B ADSs

Key dates are as follows:

November 4: Record date of Liberty Global common shares registered for distribution entitling Sunrise shares of the relevant class in the form of American Depositary Shares (ADS).

November 12: Sunrise shares issued in the form of ADSs.

November 13: First day of regular trading of Sunrise Class A ADSs on the NASDAQ.

November 14: Commencement of the option to exchange Sunrise ADSs for underlying Sunrise shares.

November 15: Listing and first day of trading of Sunrise Class A shares on the SIX Swiss Stock Exchange.

November 22: Sunrise Class A shares are scheduled to be included in the Swiss Performance Index (SPI).

Valuation

Switzerland, as a country, has historically had a strong and stable currency, the Swiss franc, is often considered a safe haven currency and its tax rates are among the lowest of the 15 major EU countries.

Switzerland has had relatively low inflation compared to EU-15 countries. According to the IMF, between 2017 and 2023, Switzerland had an average compound annual inflation rate of 1.0%, compared to 3.2% for EU-15 countries over the same period. This is relevant in a commoditized product such as telephone rates, since the only ability of operators to raise prices is to match them with inflation. Making higher increases could lead to these types of companies losing competitiveness compared to their rivals.

Swiss consumers' per capita telecom spending is one of the highest in Europe. Per capita telecom spending in Switzerland in the residential and business segments was CHF 85 per month in 2023, which is 119% higher than the EU-15 average of CHF 39.

Based on analysis by Ampere Analysis, each segment within the telecommunications market is estimated to grow between 2023 and 2028 at the following rates:

The fact that Swiss telecoms enjoy a higher ARPU than their European peers is due to the fact that Swiss citizens also have a higher per capita income than their neighbouring countries. Although the profit per customer is higher in this market, this does not mean that the growth in this market is much more promising than in other European markets, because the competitive conditions and infrastructure challenges are the same. In recent years, the ARPU per customer has been deflationary in Switzerland, even though it has better conditions than its European peers. European telcos are unable to pass on the costly infrastructure improvements they need to make to remain competitive to their customers.

Sunrise's only remaining growth option is to capture market share from its competitors, as it has been doing in recent years, and it must also be taken into account that the company will face significant capex investment in 2028, as it will have to resort to frequency auctions to renew its mobile network.

The circumstances of a sector with flat growth rates lead us to make a conservative valuation based on the estimated EBITDA for 2024, as we already have data for the first 9 months, based on the multiples of a group of European comparable peers:

The multiple chosen for the valuation is slightly higher than the average of the comparable group, reflecting the particularities of the sector in Switzerland, which are reflected in a slightly higher multiple for Swisscom.

Sunrise's standalone valuation justifies at least half of Liberty Global's current share price of around $21 per share, with a target price as a standalone company of CHF 50.38. November 13 is the first day of trading and if the spin-off pattern holds true, it could create an interesting investment opportunity.

But can it make sense to go through the process of separating as a Liberty Global shareholder before November 4? Subscribe to our Substack, we will publish the second part where we try to answer this question and outline a possible strategy.

DISCLAIMER: All the information provided in this document is purely informative and does not constitute a buying recommendation (according to Spanish Law Article 63 of Law 24/1988, of July 28, on the Stock Market Regulator, and Article 5.1 of Royal Decree 217/2008, of February 15). DuckPond Value Research is not responsible for the use of this information. Before investing in a real account, it is necessary to have the appropriate training or delegate the task to a duly authorized professional.

Thanks for the writeup Pedro! Very nice analysis.

As a spinoff newbie following my questions:

#1) What happens to the ADRs if someone would not convert them?

#2) Do you believe this structure with the ADR is chosen by purpose, instead of a Spin-Off at the NYSE?

#3) Where is the Upside for Fries and Malone - is it really just the re-rating? Or is there sth similiar to the Liberty Media / Tele-Communications Spin-Out that Joel Greenblatt describes in his book "You can be a stock marker genius"?

4) I couldn't figure out yet where to find the Transitional Plan that defines the Equity Awards. Did you find it? I expect to get some clarity here regarding the dilution. Based on the prospect I don't get about how many shares they are talking as I don't know how to conbert their grant value to number of shares.

• True-Up Sunrise RSUs, with respect to 1,469,681 Sunrise Class A Common Shares;

• Sunrise SARs, with an aggregate intrinsic value of $2,381,050 at grant;

• New Sunrise RSUs, with an aggregate grant value of $9,731,282; and

• New Sunrise PSUs, with an aggregate grant value of $3,784,516.