Soon or later, the interest rates that supported the survival of risky debtors (families, businesses and states) will start to break things. Could be a decrease in consumption, could be caused by the more than desirable reduction on public spending on US… No one knows where, how and when but the era of easy money that had been sclerotizing parts of our economy since 2010 will knock us at any time. And if not, we would pay a high price: Inflation over 2% and slowing growth. Inefficiencies must be cleaned for the benefit of the saver.

As value researchers in this scenario, we should keep an eye on luxury brands and that’s how we reached Signet, a jewelry chain specialized in engagement rings that operates stores under several brands in USA, Canada and United Kingdom.

Let’s take a look to the next graph, with multiples P/E and EV/EBITDA for the Last Twelve Months and market expectations for the next two years.

In the luxury brands ecosystem, Signet Jewelry seems to be the most under valuated stock, but is this completely true? Let’s try to clarify.

Three bulletpoints

Signet owns recognizable brands as Kay, Jared, Diamond Direct or Blue Nile but the consumer & market perspective as accessible luxury don’t give them the protection halo of luxury brands in economy recession as the case of Capri, Christian Dior or Richemont could give to the investor.

The company valuation comes from negative long-term trend on engagement rings aggravated by the pandemic crysis in 2020. The exposure of Signet to this market is 50% sales against 20% of the competitors.

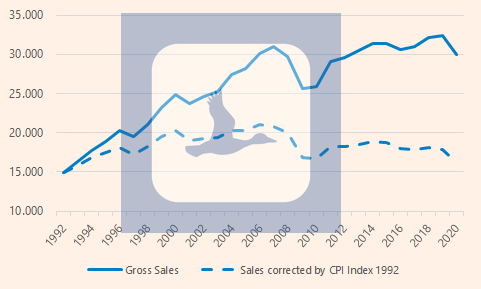

Jewelry sales in USA is a mature sector, with barely a 10% growth in 30 years (inflation adjusted).

With this standpoint seems difficult to justify the high luxury valuation but this doesn’t means that Signet is not an opportunity itself and there are some excellent factors to think it is:

Market position

Signet is a big duck in a pond full of small fishes: Leader on USA with the 10% of the market share. Against small local chains, Signet have the size to expand the business at the expense of its competitors in a declining market. The company target achieves 12% of the market share at mid-term.

Capital Allocation & Management

The capital management of the company is excellent since the beginning of the new CEO (Gina Drosos , Mid 2017), highlighting the following strategies:

Reducing unprofitable stores, mainly in 2nd tier shopping malls. 382 stores less in only 4 years without harming store segment sales.

Good M&A at reasonable multiples with strategic vision, mantaining Net Debt/EBITDA under 1.

Blue Nile: bought at Price Sales ratio of 0.6 for 390 million $ targetting the online diamond segment.

Diamonds Direct: at Price Sales ratio of 1 , reducing competition in bridal segment and improving customer experience for 500 million $.

Signet has a FCF EBITDA conversion close to 100% and is doing smart use of it, beyond the M&A:

Shares buyback program approved with 770 million $ limit (~20% float). In the last years other buybacks were executed at good prices:

Prioritizing debt repayment: 1.200 million $ of net repayments between 2017-2022

Executive members have skin in the game, in example:

CEO ~60 million $ in stocks.

CFO ~13 million $ in stocks.

President of KAY brand 7 million $ in stocks.

Engagement trend for the next years

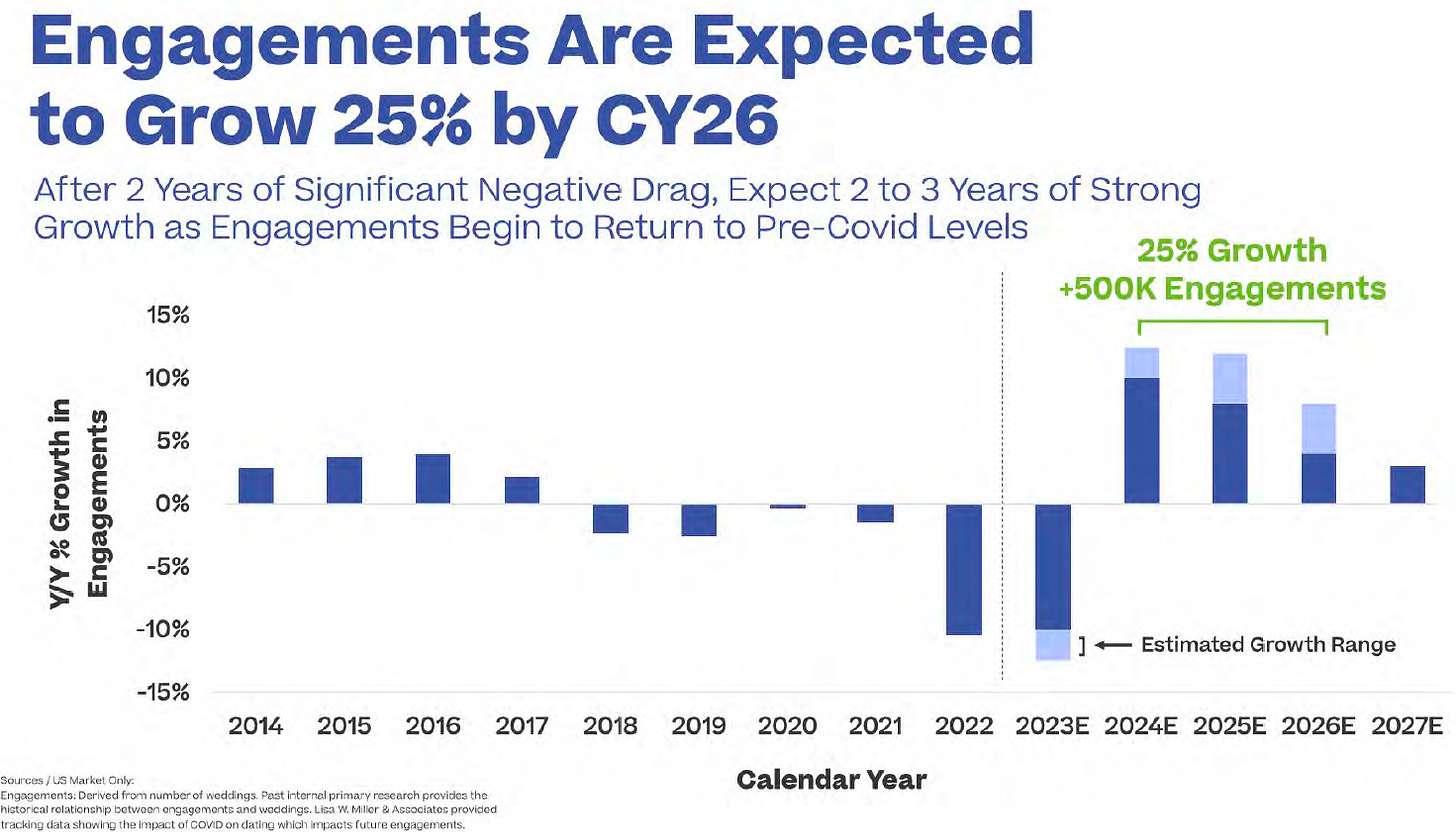

Covid years aggravated the declining in engagements as shown in the Google Search previous graph so the reversion to the trend is expected. Covid delayed both the milestones (dating, travels..) of the formed couples and the formation of new ones with the social interaction at minimum.

Regarding this point, Signet made a research study with 2.000 couples, detecting predictive behaviors that leads to engagement and after it is using AI and Big Data tools for tracking social media. Signet predicts a growth of 25% in engagements till 2026. With all due caution, we are not as optimistic as the management in our 3-year model giving a range between 10-15% to the recovery.

Guidance

Company mid-term guidance:

Revenue: 9 - 10 billion $ (~7 billion expected FY23)

Operating Margin: 11% - 12% (~9% expected FY23)

DuckPond VR mid-term perspectives:

Revenue: 8 billion $

Operating Margin: 10%

Valuation

Multiples over 2026 DuckPond VR perspectives:

P/E 10 with shares buyback full execution at 80 $ average: ~85-100% upside.

DCF Model over own scenario: ~70-90% upside.

Summary

The market does not trust the recovery that the sector expects in the Bridal segment, but Signet Jewelery is well positioned to absorb the majority of the growth that occurs. Its low debt and adequate capital management will allow it to face a more pessimistic scenario than the guidance presented and its leadership position within the sector opens the door to gaining market share even in a declining market. The company is taking steps to increase profitability, closing unprofitable stores while making acquisitions in key segments. At the current prices between 75-80$, this is a good buying opportunity.

Strengths

Excellent capital management

The big Duck on a fishes pond

Under jewelry sales, engagement rings are less cyclical (50% sales of Signet)

Insiders have skin in the game

Weaknesses

Signet’s top brands are not perceived as luxury.

Sales dependance of an aspirational middle class, unfavorable in the economic context.

Long-term decreasing trend on weddings.

Thanks for reading. If you consider this valuable please support us, suscribing, giving us a like and comment.

Do you want to extend Jewelry industry report?

Do you want additional information and valuation estimates of the companies mentioned here?

Reach us on duckpond@duckpondvr.com

DISCLAIMER: All the information provided in this document is purely informative and does not constitute a buying recommendation (according to Spanish Law Article 63 of Law 24/1988, of July 28, on the Stock Market Regulator, and Article 5.1 of Royal Decree 217/2008, of February 15). DuckPond Value Research is not responsible for the use of this information. Before investing in a real account, it is necessary to have the appropriate training or delegate the task to a duly authorized professional.

Thank you very much for giving visibility through this exhaustive analysis, a sector that was unknown to me and which from now on I will follow with great interest.

This is a really smart analysis.