Not all that glitter is growth

Why sometimes CAGR sales growing at 30% with 40-60% EBITDA margins and low multiples is not enough.

Ironwood Pharmaceuticals, Inc. ($IRWD)

Started in 1998, it focuses on drugs aimed at gastrointestinal problems. Its flagship drug, Linzess, is intended to treat irritable bowel syndrome, which is estimated to affect between 10-23% of the world's adults.

It is a small cap with sales close to $500 million per year and a market cap of $1.3 billion that has annualized sales growth of 30% in the last ten years with EBITDA margins of 40-60% in the last four. ROIC (Return of Invested Capital) is also excellent, consistently exceeding 30% over the past four years. At first glance, everything adds up.

A thorough analysis of a company that concludes with a valuation providing both the writer and the reader with a certain level of confidence in their investment is a path of hours of reading, hours of modeling in Excel, and hours of synthesis. Time is finite, and the most valuable asset, therefore, is to develop a critical sense and be clear about the red flags that you are not willing to overlook in a company, even if it initially appears to be of high quality.

In the case of Ironwood Pharmaceuticals, I have identified several red flags that have led me to discontinue the analysis.

The red flags

🔴Bad M&A: In the last quarters its sales have stabilized and the company has made the decision to acquire a Swiss biotech, VectaBio for 1 billion $ with a premium on its price of 80%, which has led Ironwood to had net cash in the closing from 2022 to a net debt of 640 million (Net Debt/Ebitda of 3 times).

VectivBio is a biopharmaceutical company focused on developing treatments for rare diseases. While their drugs may be promising, the truth is that it is a young company that has never turned a profit and is burning through cash at an exorbitant rate.

Unless one is a superstar in biotechnology with experience in pharma, along with a solid understanding of company valuation, this is an unavoidable red flag.

🔴Expensive and short term financing: Half of the financing, about 500 million $, has been provided by Wells Fargo in the form of a revolving credit facility, a fairly expensive type of short-term financing for which you will have to pay a variable interest built with:

Option 1: Secured Overnight Financing Rate (Today at 5.3%) + 1.75-3% depending on leverage rates.

Option 2: The largest of the following 3 types:

Federal Funds Rate + 0.5%

Prime lending rate which is currently at 8.5%

Federal Funds Rate +0.75% - 2% depending on leverage rates.

Additionally, a quarterly commitment fee of 0.30%-0.425% of the provisions will be paid.

Although it could be an interesting option if you can go deeper into the drug, the sector, the duration of the patents... the capital management of the management aimed at creating value does not convince us, and I think neither does the insiders. And here we have the third red flag:

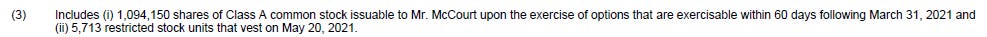

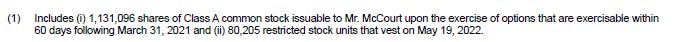

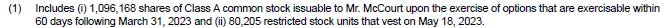

🔴Insider transactions: In the Proxy Statements of 2021-22-23, CEO Thomas MCCourt is recognized as a stockholder for 1.2 million, 1.4 million and 1.4 million shares respectively. That would be almost 2 times their annual compensation at market prices, which would indicate alignment with shareholders. The reality is very different: each year's Proxy Statement recognizes that the CEO has an option to acquire 1 million shares during that year that he never acquires:

The reality is that the CEO maintains only 289,600 shares, 30% of his annual salary and sells all the stock awards and stock options he executes for around $11-12. No other insider reports open market purchases, and most are stock options or stock awards that are sold during the following months.

The price fluctuates around the IPO price:

In summary, Ironwood Pharmaceuticals initially appears promising, with positive indicators like sales growth and ROIC. However, red flags emerge upon closer inspection. The acquisition of VectaBio has significantly increased debt, and VectaBio itself poses risks with its lack of profitability. The financing structure is reliant on potentially expensive short-term financing, and insider transactions, particularly by the CEO, raise concerns about alignment with shareholders.