There are few industries closest to our lives and less known than the chemicals behind our food and other consumer goods like laundry detergents or the scent behind the fragrances that we use daily. On the background of the big Consumer Staples is hidden a Value Pond: the industry that design, and build the smell and taste that you easily recognized on your favorite products and the additives that allows to maintain the modern food industry chain.

The cost of these chemicals represents a small portion of the final product, around a 0.5%-2% in the case of flavors and scents and 4%-6% in the case of fragrances. Jointed to the regulatory licenses and patents, this industry erodes a big moat around the dependency of the biggest Consumer Staples, having behind their most iconic and recognizable products a formula owned, designed and manufactured by this industry.

Powerful moats based on switching cost and strengthened by licences, patents and other regulatory barriers.

With a market size of around 100 billion $, the industry could be fragmented in 3 key areas:

Nourish: This segment involves specialty chemicals that contribute to the development of flavors and fragrances associated with food and beverages. These chemicals could include compounds used to enhance or modify the taste and smell of various food products. Nourish may encompass a range of substances designed to improve the overall sensory experience of consuming food but also to guarantee stability and durability.

Scent & Fragrances: This segment focuses on chemicals used to create scents and fragrances for a variety of products, such as perfumes, colognes, cosmetics, household products, and more. Specialty chemicals in this category are likely formulated to provide specific olfactory experiences and may involve a combination of natural and synthetic compounds.

Biosciences: Biotechnological process based on probiotics, enzymes, microbial extracts.. to enhance product characteristics on food, laundry, animal nutrition & additional uses like dietary complements for consumer health sector.

The 5 biggest ducks in this pond, representing arround 50% of market share are:

International Flavors & Fragrances (IFF) - 12 billion $ sales

Kerry Group (KRZI) - 9,4 billion $ sales

DSM-Firmenich (DSFIR) - 9 billion $ sales

Givaudan (GIVN) - 7,7 billion $ sales

Symrise (SY1) - 5 billion $ sales

Novozymes (NZYM): 2,5 billion $ sales

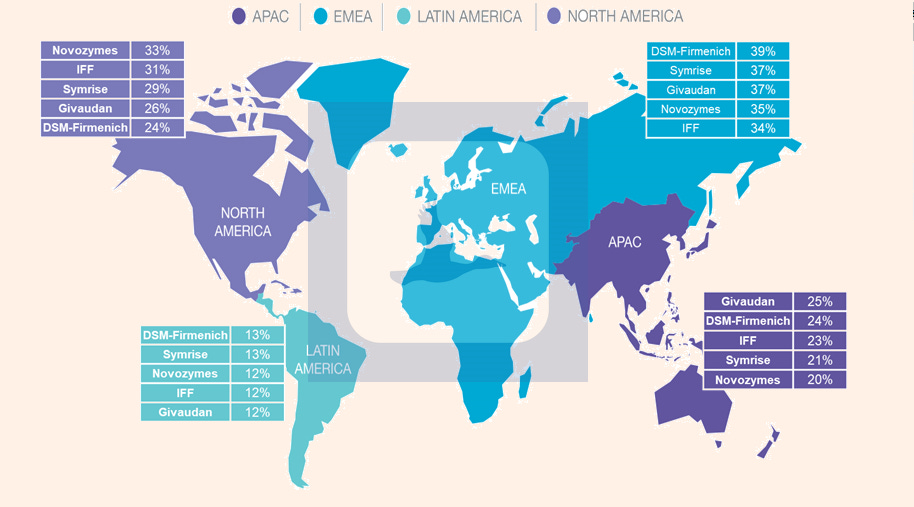

With a global presence distributed as follow:

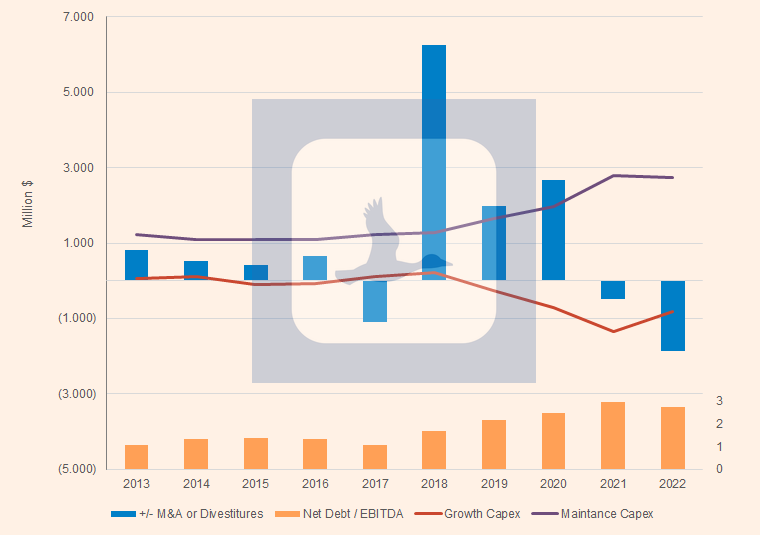

Capital cycle

10 years of intense concentration process with negative growth capex.

The global sector was involved in an intense M&A activity on the last 5 years, highlighting:

International Flavors & Fragrances (IFF): Merge with Dupont N&B segment producing a market leader with 12 billion $ sales

DSM-Firmenich (DSFIR): DSM fusion with Firmenich, creating a group closer to 9 billion $ sales.

Novozymes (NZYM): Novozymes fusion with Chr Hansen will create a niche leader on enzymes market with 3,5 billion $ sales.

Meanwhile, the growth capex remains negative for the last 10 years.

Concentration process and low capacity investment suggest a good moment on the Capital Cycle for the next years.

Business Returns

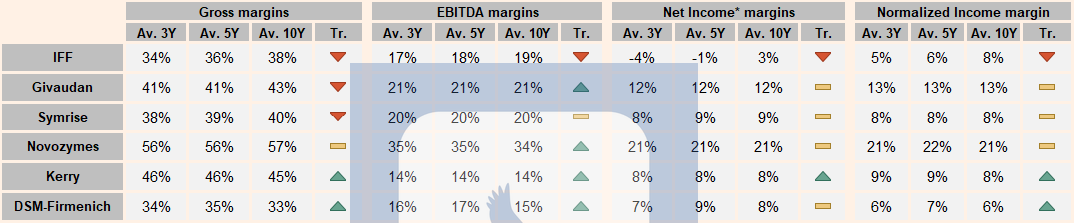

Margins stability with disparity between companies

Highlights:

International Flavors & Fragrances (IFF): Low margins with negative trend due to difficult integration of Frutarom (2018) and N&B (2020) that supposed 50% growth on sales and 100% respectively.

Givaudan (GIVN) : With presence in all the segments, Givaudan stands out in margins regarding the other bigger competitors.

Novozymes (NZYM): Excels in profitability with its focus on Bioscience segment.

Givaudan, as key player in the three segments, stands out by business profitability and Novozymes as niche leader on Bioscience.

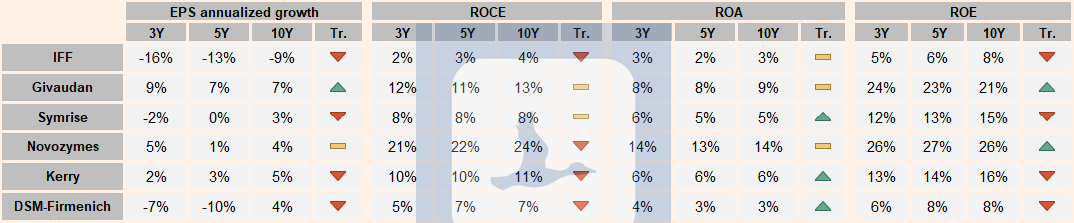

Capital returns

Dissimilar trend in EPS and return on capital

Highlights:

Givaudan (GIVN) & Novozymes (NZYM): Big consistency on the EPS growth in last 10Y and high returns of capital.

International Flavors & Fragrances (IFF): M&A had supposed the dilution of the shareholders with no returns on synergies. The capital management destroyed value for their pwners.

Recognizable good capital managers on the last 10 years in Givaudan and Novozymes. Expectations arround DSM-Firmenich and IFF future of returning value to shareholders.

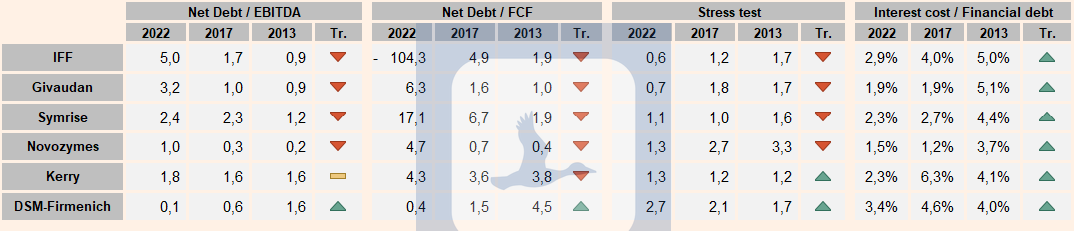

Debt & Solvency

Growing debt with moderate interest cost.

Highlights:

Growing debt in the industry due to the M&A process fed by low interest rates.

International Flavors & Fragrances (IFF): Depencency of divestitures & renegotiation of covenants.

Announced the sale of Cosmetics subsegment for 820 million $

Announced intention of more divestitures

Low interest rates stimulated M&A on the industry with big adquisitions and fusions that leads to high debt situations. Overall and at short term, the debt doesn’t entail stress on solvency.

Summary

Flavor & Fragrances is a key industry on global nourish & other consumer goods distribution with wide moats. The key players targeted in the report have enough size to offer global distribution for the bigger Consumer Staples both in commoditized ingredients and personalized high value components. The industry could be favoured by a concentration process and due to lack of capacity upgrades in last 10 years.

Within the sector, Givaudan and Novozymes stand out for their solvency situation, margins and capital management while IFF stands out for the destruction of value for shareholders.

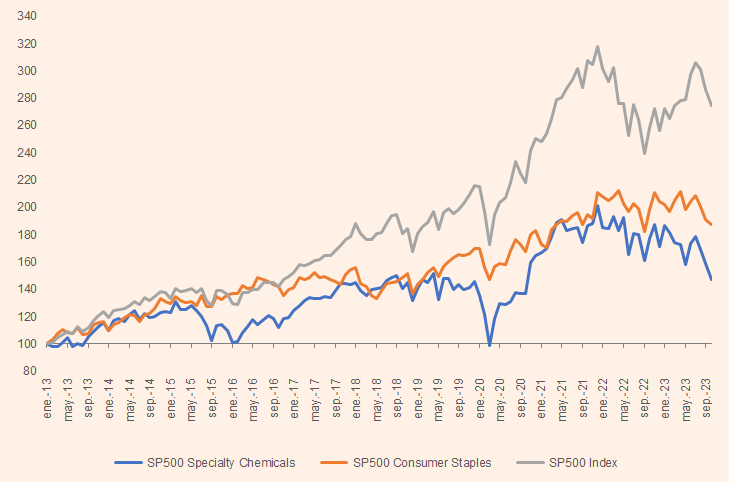

The stock returns of Specialty Chemicals had been underperforming both Consumer Staples and SP500 as shown on the following graph:

Do you want to extend Flavor & Fragances industry report?

Do you want additional information and valuation estimates of the companies mentioned here?

Reach us on duckpond@duckpondvr.com