Dräger is more than just a brand. Since the early 20th century, this surname has been closely associated with technological advancements in medical devices such as intensive care ventilators and breathing systems for firefighters or mine rescuers. The "Drägermen", as the mine rescue teams were called in the early and mid-20th century, symbolize the brand's reliability and innovation.

Heritage alone isn't sufficient to sustain a business, and Dräger is struggling in a highly competitive market, particularly in the healthcare sector. After years of excessive demand for ventilators and masks during the pandemic the company now faces weak sales growth and shrinking margins.

On one hand, Dräger faces disadvantages compared to large conglomerates like Philips (NYSE: PHG) or GE Healthcare (NASDAQ:GEHC). On the other, Chinese competitors like Mindray have commoditized much of the low-value-added portfolio, while strong innovation of competitors such as Getinge (OTC:GNGBF) is challenging the high-end range. These factors have pressured margins and, consequently, the stock price.

The company is currently trading at €50–55 per preferred share with an appreciation of nearly 15% in recent weeks. Assuming an EV/EBIT ratio of 8x for the Safety division in 2024, which appears conservative given its 5% annualized sales growth, the Medical division would effectively be worthless. Could the Medical segment really have a terminal value of zero?

Judging by the negative margins projected for the division in 2024, which range from -1.4% to -2.2% after adjusting for non-recurring items, this assumption may hold true. Key drivers of these weak results are the 24% decline in sales in Asia during the first nine months of the year, driven by anti-corruption campaigns in China and the normalization of capital healthcare spending in EMEA post-pandemic, which remains Dräger’s primary sales region.

Despite these temporary challenges, Dräger remains a trusted brand among professionals. Its Evita and Babylog product lines set the standard for reliability and innovation in hospitals, while workplace safety products like X-am and Polytron offer high precision and long-term reliability in critical environments. Switching costs in the hospital segment, due to staff training, and in industrial gas detection devices, due to fear of change, create a narrow defensive moat.

Moreover, since 2023, the company has been focused on its “Profitability First” program, aiming to improve business profitability through price increases, cost management and the divestiture of unprofitable businesses. The goal is to increase the EBIT margin by 1 percentage point per year, starting from 4% in 2024, with a target of 10%, aligning it more closely with its competitors.

Even if the company falls short of this target, by 2027, with 3% annual top-line growth (below industry expectations) and partial sucess of the profitability plan, which aims for a 6% EBIT margin, the company would trade at an EV/EBIT multiple of 5x. This would represent a 60% upside potential based on an 8x multiple. Its competitors are currently trading at an average multiple of 17x, which is justified by their higher margins and different portfolios.

Let’s dive deeper into the company, which operates in two highly distinct and complex markets, but first, if you're not subscribed, make sure to do so to stay informed about upcoming published theses.

Business understanding

Dräger is a century-old company founded in 1889 in Lübeck, Germany. Listed since 1979 in German stock market, operates in two very distinct sectors: a medical segment, representing 57% of its revenue, and a safety segment for employees and facilities, accounting for 43%. As we will explore later, these vastly different markets are linked to the company’s history and share relevant technological and process synergies.

The medical division manufactures, installs, and maintains anesthesia machines, ventilators and pulmonary monitoring systems, incubators, and other healthcare-related products.

The safety division produces devices such as portable and fixed gas detectors, breathing equipment for firefighters, gas and fire detectors for chemical plants, drug testing devices, and breathalyzers.

Beyond hospitals, which are heavily reliant on public funding in Europe, the safety segment provides prevention and emergency solutions across a wide range of industries, including oil and gas, mining, and chemicals.

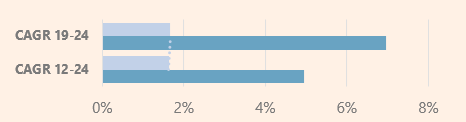

Dräger has mantained long-term annual growth rates above 4%, outperforming its key geographical regions, though still lagging behind global growth rates.

Increasing competition within the medical division has led to lower sales growth rates, reducing the healthcare segment’s overall contribution to total revenue.

Although the pandemic disrupted dynamics within the medical segment, between 2022 and 2024, growth returned to long-term rates, with an increase below 2%, compared to over 5% growth in the Safety branch.

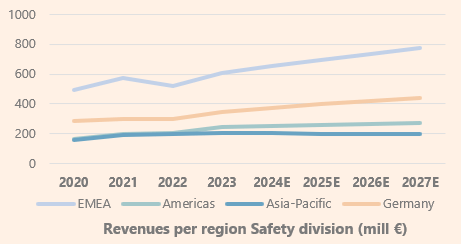

Dräger’s main market is Germany, and Europe remains the primary geographical region for both segments, with a greater dependence on it for the Safety division. However, the Americas’ share of revenue has increased by 3% in recent years, with annualized growth of 10% between 2020 and 2024.

Revenue distribution aligns with the company’s organizational structure. While most manufacturing takes place in Europe, this market requires an extensive commercial network of sales representatives, trade shows, etc. which compels Dräger to maintain sales structures in all of its markets.

Let’s take a brief look into the company’s history to understand the connection between the two segments it operates in.

The origins

Johann Heinrich Dräger (1847–1917), a watchmaker, designed a beer bottling system in 1889 that improved existing machines by incorporating a carbon dioxide reduction valve. He decided to manufacture and market it himself. This valve later proved to have medical applications in anesthesia during surgeries, reducing fatalities caused by imprecise gas dosages in mixtures.

In 1906, Heinrich became involved in a mining accident in France, which later inspired him to develop an improved breathing apparatus. This device gained widespread use in the U.S. and Europe, to the point where rescue teams became known as “Drägermen.” Their popularity even earned them a cameo in a Superman comic.

Through his involvement in mining, Heinrich also developed the Pulmotor, the world’s first mass-produced emergency ventilator and the precursor to modern oxygen delivery systems.

As we can see, Dräger’s presence in two such distinct sectors is no coincidence; it stems from technical innovations that enabled Johann to address challenges in both fields.

The Dräger name endures to this day. Stefan Dräger, the founder’s great-great-grandson, serves as Chairman of the Board, and the family still owns approximately 72% of the company through a holding structure and individual stakes.

Dräger’s legacy on two distinct sectors makes it a unique company, difficult to compare to others, requiring distinct analyses of the dynamics and competition in each field.

Medical Segment

As part of the vast global Medical Devices market, Dräger is dedicated to the development, production, and commercialization primarily in three areas: anesthesia machines, mechanical ventilation, and thermoregulation (incubators). The company also provides monitoring solutions and consumable medical supplies, such as replacements and accessories for devices.

At first glance, the three main markets benefit from advantages driven by macro trends: global economic development has led to increased life expectancy, improved quality of life, and a shift in lifestyle patterns. These trends have the following direct second-order effects for Dräger:

The rise in the number of surgeries, both vital and corrective to improve quality of life, drives demand for operating rooms and, consequently, anesthesia machines and ventilation systems. According to an EY report, the number of annual surgeries is expected to double by 2034.

The increase in premature births driven by delayed motherhood and the need to safeguard the mother's health increases demand for incubators. In developed countries, premature births account for 10%.

These two trends persist and are intensifying as economic development transforms various regions, such as China since 2000. According to The Lancet, the surgery rate per 100,000 inhabitants is 11,000 for high-income countries and around 500 for low-income countries.

These trends are reflected in medium-to-long-term market studies, which estimate the annualized growth for the three areas between 5% and 9% through 2030. Within these markets, Dräger is a European leader with a strong global presence in all three markets.

These devices are crucial in healthcare, providing vital support to critically ill patients, and are therefore subject to strict regulatory controls. While this creates a significant barrier to entry, along with the initial development costs, the global market is highly competitive.

Although not entirely homogeneous, the following are the main companies and their divisions that compete with Dräger in ventilation, anesthesia, and neonatal care.

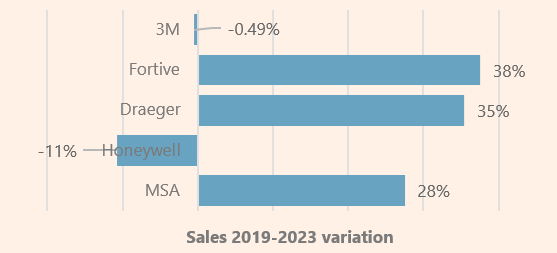

From a comparative perspective, isolating the effect of Covid, we see that the sector has grown at an average annualized rate of 2% since 2019. This is relatively low compared to the nominal GDP growth of the United States and Europe, the main markets for these companies (4% and 6%, respectively).

Margins, which vary significantly due to differences in geographical presence and product portfolio, have improved since 2019 but remain particularly low in Dräger’s case.

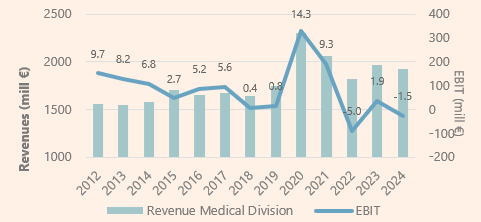

This situation is not a short-term issue caused by Covid-related disruptions or rising raw material prices. Wjole these factors could contribute, Dräger has faced profitability problems in this segment over a longer time frame, dating back to 2017:

While no single factor can be isolated, several sector-specific causes make Dräger’s profitability challenging. Despite 2% annual sales growth since 2012, EBIT margins have not exceeded 2% (excluding the pandemic) and even turned negative in 2024:

Chinese competition has improved its products, turning part of its portfolio into a commodity, thus gaining ground in European markets.

“New competitors, particularly from Asia, are also a factor; the quality of their products has increased significantly over the past few years, meaning that they are now competing with Dräger in the lower and middle performance and price segment.” Annual Accounts 2016

Dräger’s dependence on Europe, where many clients are public health services, has led to group purchasing initiatives that have strengthened their bargaining power, further pressuring margins.

One of the key factors, both present and future for medical devices, is interconnectivity and integrated systems for medical management. In this area, Dräger also faces a disadvantage compared to companies like GE Healthcare or Siemens, due to these giants’ broader product portfolios, which enable them to standardize software and integrate a wider range of products in their offerings.

“Large, diversified conglomerates among other primary competitors have strong market positions in certain segments and regions due to the wide range of products and services they offer.” Annual Accounts 2016

In recent years, in addition to the long-term problems, two more factors can be added:

The decline in demand in China has led to a 24% drop in sales in the first nine months of 2024 in the Asia-Pacific region. Asset underutilization has further worsened margins. This region accounts for 20% of the division’s total.

Healthcare spending as a percentage of GDP in EMEA has decreased since the pandemic, returning to the previous trend, according to OECD data in its report “Health at a Glance.”

Specifically, the report highlights that healthcare Capex in real terms has remained almost stagnant since 2020 in Europe, while it has been growing in the USA. It is particularly noteworthy that Dräger’s industry directly benefited from over-purchasing during the pandemic years, making it highly likely that, with the normalization of investment, this industry will be more affected than the average capex spending.

Both dynamics are reflected in Dräger’s sales breakdown by region, where we can observe the impact in APAC in 2024 and the effect in EMEA since 2020.

As we can see, Dräger is facing competitive pressures on multiple fronts, despite its brand image built on a long history of reliability and innovation.The company does not report differentiated segments within its division, so so visibility into the performance of different products is limited. However, it is clear that there is a heavy reliance on ventilation, a sector that is currently facing the most intense margin challenges. As we will see later, management is focused on a goal they have termed “Profitability First,” aiming to increase EBIT by 1 percentage point per year until 2030.

Competitors are also facing challenges. Let’s now discuss the difficulties facing Medtronic and Philips.

Exit of Medtronic and Philips Issues

A 2024 academic study on the impact of Medtronic’s exit evaluated 133 intensive care units across 15 countries: Argentina, Brazil, Chile, China, Colombia, Ecuador, Spain, Honduras, Italy, Morocco, Mexico, Peru, Poland, Portugal, and Uruguay. In these markets, MedTronic and its model Puritan Bennet range accounted for 42% of the market share, followed by Getinge with 20%, and Dräger with 18%. Despite the limited scope of the study, the exit of a major competitor will likely benefit Dräger in the medium term.

“Medtronic also announced a withdrawal from the ventilator market altogether. And we are very well positioned to benefit from that. And running campaigns to target these installed bases and customers that have traditional relations and our open orders with these players that withdraw -- and we do have all the necessary approvals, in the meantime, for our devices that are relevant for this.” Dräger H1 2024 transcript

One of the study’s main concerns highlights a competitive advantage of these devices, the know-how, emphasizing the significant challenges in transitioning to other suppliers, such as training staff and uncertainties regarding after-sales service for the new equipment.

Meanwhile, Philips’ Respitronics suffered a massive recall in 2021 for one of its product lines and has faced lawsuits worth $1.1 billion in the USA.Throughout 2024, Philips continues the process of rectifying product defects and seeking re-approval for distribution.

In summary: Dräger operates in a medical sector with strong long-term growth trends but is highly competitive, where it does not have significant lasting advantages and currently faces weaknesses relative to its competitors due to its European bias. This is reflected in the margins, which we will examine later. Its brand image and product quality are its main strengths in a market showing signs of consolidation.

Let's now turn our focus to a completely different market with the safety division.

Safety Segment

The Safety division is responsible for developing, manufacturing, and marketing products primarily targeted at the following three markets:

Breathing systems for firefighters and rescue teams (SCBA devices)

Gas detection systems, both fixed and mobile

Personal protective equipment and respiratory protection (PPE & RPE)

Additionally, it also manufactures devices such as breathalyzers and drug testing equipment for companies and law enforcement.

Unlike the medical segment, this division is diversified across various sectors. One key sector is public spending, such as fire services, while private sectors, primarily in raw materials and chemicals, also play a significant role.

Dräger is a leader in Europe and prominent player worldwide in the three main products, with an undeniable brand reputation:

RK EU/WorldSegmentProduct1/2Breathing SystemsBreathing systems for firefighters and other emergency services1/1Gas DetectionFixed or mobile systems for industries1/2Personal Protective EquipmentPPE for rescues, hazardous work conditions, and protection during work

Pesonal Protective Equipment (PPE) or Respiratory Protective Equipment (RPE) devices and drug tests are sold through specialized distributors and even on platforms like Amazon, where Dräger’s products enjoy a very good reputation.

The competition in these markets is highly varied, with large companies operating competitive subdivisions in some areas. However, MSA stands out as the most directly comparable competitor. In comparison to these more similar divisions, Dräger is smaller in this market.

The pandemic had a lesser impact on this sector, primarily affecting PPE and RPE products. Long-term growth rates have remained stable post-Covid, with Dräger performing well in sales.

Although somewhat less favorable, Dräger’s margins in the Safety segment are also lower compared to its competitors, though they have improved sustainably since 2019.

The evolution of the division over the past twelve years shows sustained sales growth, with margin pressures starting in 2016, which were recovered through price increases and cost control, as well as expansion into higher-margin markets.

With notable growth across all markets, notable expansion has been observed in the Americas (primarily USA), where its products compete in quality with MSA and Honeywell in a higher-demand market.

The division’s medium-term outlook is very positive:

In breathing devices for firefighters (SCBA), growth is expected between 4% and 6%.

In the gas detection market, where Dräger is a global leader, annualized growth of 8-10% is expected until 2030, primarily due to the expansion of the oil, gas, and mining industries. Growth is focused on the Middle East, China, and India. Dräger has growth potential in the USA due to its high-quality standards and compliance with OSHA and ATEX regulations.

The PPE and RPE market is expected to grow between 4% and 5% due to the increasing importance of workplace safety and strong regulations regarding the expiration of equipment and the need for constant renewal.

Despite having lower margins than competitors, the Safety division is positioned as a leader in reliability and innovation in some industries, where it generates a certain level of switching cost. In markets where Dräger is a leader, high growth is expected over the next 5 years.

So far, we have a century-old company, a leader in very specific niches in Europe or, in some cases, globally, facing margin challenges mainly due to competitive pressures. Let's dive into the cost structure analysis to assess the recovery potential.

Cost Structure Analysis

The cost structure up to EBIT, excluding resutls from investments in associates, is as follows, with significant weight on material costs and sales expenses. Dräger has commercial teams operating across all geographies. The commercial activity in the sector is intensive, and intermediation involves commission expenses.

The previously analyzed factors, particularly in the Medical segment, have led to reduced margins. Despite sales growth, especially since 2015-2016, gross margins have declined by 3 to 4 percentage points.

The improvement in the operating expense structure relative to sales has not prevented a decline in operating margins by 2 to 3 percentage points.

Dräger has managed to relatively reduce its operating expense structure, with the most significant savings coming from sales expenses. Currently, around 21-22% of revenue is allocated mainly to intensive commercial activities in both segments.

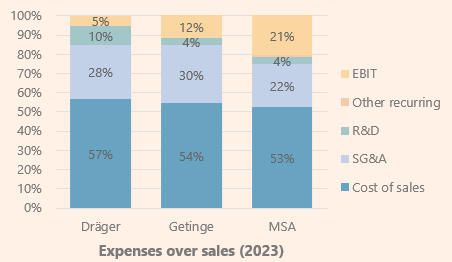

As analyzed by divisions, Dräger’s low margins are heavily impacted by sector trends in healthcare but are particularly low compared to its competitors. This difference has been consistently observed historically when compared to two of its most directly comparable companies: Getinge (GNGBF) in the Medical division and MSA (MSA) in Safety.

These margin differences mainly stem from geographic market disparities. Dräger has the largest exposure to EMEA, a region where most of the healthcare market is public or semi-public and highly fragmented. Getinge, also European, is better positioned in the Americas.

Dräger’s overexposure to the European market, with Germany accounting for 21% of sales, is a clear disadvantage due to several factors:

A market similar in size to the U.S. but with greater local regulatory and linguistic barriers.

Public or reimbursement-based healthcare systems that weaken the supplier's negotiating power. Germany, in particular, has one of the world's strictest systems, with public tariffs and controlled prices. A 2018 study found that medical devices in the U.S., could cost 2 to 6 times more than in the EU, especially in Germany.

"In addition to linguistic fragmentation that raises costs for labelling and marketing materials (often calling for specialist medical translators), there are also regional legislative differences within each country. For example, Germany has very restrictive regulations about medical device pricing. Regional, provincial, and other institutions may also influence pricing decisions depending on where the medical device is to be sold."

Starting from weaker gross margins, Dräger also shows a higher proportion of functional expenses, mainly unbalanced by R&D and selling, where there is room to improve efficiency.

The three companies allocate their personnel expenses by functional area, but both Dräger and Getinge report costs separately. In 2023, Getinge’s cost per employee was $104,000 (37% of sales) compared to Dräger's $91,000 (39.5%). Despite the higher cost, Getinge achieves greater productivity per employee.

The management is implementing a medium-term plan called "Profitability First", shifting focus from sales growth to improving profitability. Key initiatives include:

Price increases.

Cost discipline.

Divestment of unprofitable business units.

The goal is to increase EBIT by 1 percentage point per year starting in 2024, aiming for 10% margins by 2030.

Highlights of the "Profitability First" program as of Q3 2024 include:

Price increases in 2024, primarily in the Safety division.

A 3% reduction in functional costs in 2023.

Divestment of non-profitable or non-strategic units, such as the fossil fuel gas analysis business and fire alarm systems in the Netherlands.

Sale of assets: land in the U.S. and a building in Spain.

Although the target may not be fully achieved solely through cost structure improvements, the recovery of demand in China and the normalization of healthcare spending in EMEA will help improve profitability in the coming years.

Despite headwinds, there are reasons to believe management can increase the EBIT margin through three paths:

The recovery in EMEA and APAC, along with growth in the Americas, will enhance operational leverage and gross margins.

Faster sales growth in the Safety division will gradually increase the weighting of its higher EBIT.

There is room to reduce functional expenses, particularly in R&D and selling.

Other considerations

Before evaluating the management, let's briefly review other aspects of the financial statements and the profitability of the business:

Debt: Management takes a prudent approach running the company, consistently maintaining a debt level below 1x Net Debt/EBITDA. In the interim consolidated statements for Q3 2024, the company reported €475 million in financial debt, with 70% classified as non-current, and a cash position of €179 million. This results in a net financial debt of €295 million, or 0.9x the 2024 EBITDA, with a very comfortable debt maturity schedule.

Returns on capital are low, with a normalized trend ranging between 5% and 10% since 2015, excluding the unusual pandemic years.

The company does not report customer concentration above 10%. Dräger's markets are highly fragmented and spread across various geographies.

The management

The most relevant members of the executive team are the CEO and the CFO. The Dräger family holds 72% of the common shares, and therefore has skin in the game and control of the company.

Stefan Dräger: Serving as the Chairman of the Board of Directors since 2005. A descendant of the founder, before assuming the role, he worked in various areas of the company, including production management and international expansion, consolidating his experience within the family business.

Gert-Hartwig Lescow: He is the Vice Chairman of the Board and is responsible for finance and IT. He joined Dräger in 2008, bringing extensive experience in the financial sector after working in multinational companies in the technology and healthcare industries. He does not report market purchases but holds a position close to 500,000 euros related to an employee bonus program that granted additional shares.

The division heads have little to no shareholder representation, although since 2023, there is an annual component of the variable compensation that will be paid in virtual shares with a five-year retention period.The benefit of meeting the current thesis, combined with the accumulated bonus they will earn in the coming years, could provide enough incentive:

It is noteworthy that in a company with a high sales expense (sales teams, trade fairs, commissions...), the Head of HR also holds the position of Head of Sales. This could hinder the reduction and efficiency of staff in this area, as they are also responsible for keeping the sales team happy and increasing sales.The commitment to the long term by the founding family contrasts with the low skin in the game of the division heads and the CFO, even though they have been in their roles for some time. This is not an indication of alignment with shareholders, although the new bonus system may help. The role of Head of Sales & HR also does not seem optimal. It could create a conflict of interest between cost-saving measures and sales growth. It will be especially interesting to monitor the purchases of the CFO and division heads in the coming years.

Valuation

In terms of topline, a projected scenario has been outlined through 2027 by region/division based on the following annualized growth rates (CAGR) until 2027:

For the Medical division, a conservative approach has been adopted based on the recovery of its traditional markets, continued growth in the Americas, and a slow recovery in Asia-Pacific.

For the Safety division, a conservative view has also been taken, assuming persistent challenges in the Asia-Pacific region without projecting a recovery, while maintaining high growth rates in its traditional markets.

Management is confident about the recovery of the APAC segment; however, since they do not expect it to materialize by 2025, caution has been exercised in the forecast, delaying the recovery. A faster-than-expected recovery in these markets could present a positive surprise for the investment thesis.

The rest of the income statement has also been approached conservatively, staying below the company’s target EBIT% as outlined in its program, given that no decisive cost savings have yet been observed. Most of the margin improvement projected in the scenario stems from topline growth, with very modest improvements in functional expenses.

Positive surprises in this aspect could arise from a relative reduction in R&D expenses without needing to cut the nominal budget or from better and more significant adjustments in sales expenses.

Valuation Based on EV/EBIT

Using the projected normalized EBIT, a valuation has been carried out via the EV/EBIT multiple, where the Enterprise Value has been adjusted as following:

The model shows a revaluation for the preferred stock of 60%, which is an insufficient margin of safety to confidently face the potential risks of the company.

The valuation based on a multiple of 8 times is below its competitors but aligns with the special circumstances of weakness outlined in the thesis.

Why preffered over ordinary?

Dräger's capital is divided into two types of shares:

Preferred shares waive the voting rights in exchange for the following advantages:

Priority to receive a dividend of €0.13 per share.

An additional €0.06 per share, once the ordinary shares have received the €0.13.

Unpaid dividends accumulate and have priority over ordinary shares.

If the accumulated dividends from the previous year are not paid in the current year, they grant voting rights until they are settled.

Priority over 25% of the income from a possible liquidation.

72% of the voting shares are controlled by the Dräger family, which leads to two effects:

The value of the voting right is lower due to the controlling majority.

The liquidity of the ordinary shares is lower.

Currently, the preferred shares trade with a premium of around 15% over the ordinary shares. This differential is historically on average to the usual 18%. The largest differential typically occurs in bull markets, where the preferred shares can even exceed a 30% premium. This is due to the lower free float of the ordinary shares (held by the Dräger family), which prevents large capital investors from taking positions.

Given these circumstances, and for a minority position in the capital, the recommendation would be to make the investment via preferred shares.

Risk assesment

Finally, we present a summary of the risks ordered by the impact they could cause. All of them have been discussed previously.

High risks

Competition in the healthcare sector: Dräger faces strong competition, particularly in the healthcare sector. This risk could erode sales in key markets, making it difficult to recover margins.

Profit margins: Dräger operates with very low profit margins in both divisions. The success of the plan depends on a predictable topline evolution, which may not materialize, keeping the medical division in negative margins and therefore draining EBIT from the group.

Medium Risks

Dependence on public spending in Europe: A large portion of Dräger's sales depends on public budgets. The high debt levels of some economies, their economic development, and the health of the eurozone could hinder the recovery of its primary market.

Decline in demand in China: Caused by anticorruption policies, demand is expected to recover, but there are no guarantees that it will lead to a recovery for Dräger.

Innovation in the ventilation market: Specifically in the assisted ventilation market, Getinge's product quality is surpassing Dräger's according to various studies. Losing high-end sales, with the low-end range already weakened, could result in failing to meet margin improvement objectives.

Low Risks:

Risks related to the cost structure: Dräger has high material costs and sales expenses, especially due to its extensive commercial network. Additionally, R&D spending is higher than its competitors'. Despite achieving notable reductions in the past, the management might struggle to reduce the structure of a company with such a long history.

Disadvantages in interconnectivity: Dräger is at a disadvantage compared to companies like GE Healthcare or Siemens in terms of interconnectivity and integrated systems for medical management. The effort in software development could hinder the recovery of margins in the division.

Management alignment: The long-term commitment of the founding family contrasts with the low "skin in the game" of division directors and the CFO. The positions of Head of Sales and Human Resources may also create conflicting interests.

DISCLAIMER: All the information provided in this document is purely informative and does not constitute a buying recommendation (according to Spanish Law Article 63 of Law 24/1988, of July 28, on the Stock Market Regulator, and Article 5.1 of Royal Decree 217/2008, of February 15). DuckPond Value Research is not responsible for the use of this information. Before investing in a real account, it is necessary to have the appropriate training or delegate the task to a duly authorized professional.

Net debt in 2024e excl. leases will be around zero, or possibly even a slight net cash position. Cash on hand was € 180m in Q3. Q4 FCF should be c. € 100m.