Since we published the Capri arbitration thesis on January 11, 2024, the stock has dropped around 30%, primarily due to poor quarters for Capri and the luxury sector in general, as well as market doubts regarding the acceptance of the merger agreement by the US Federal Trade Commision. On April 23, the fateful news was confirmed: the FTC blocked the merger agreement, and the stock plummeted back to levels prior to the merger announcement. Meanwhile, European, Chinese, and Japanese regulators have given the green light during these months.

To understand why the FTC would block a merger deal between luxury accessory brands that has been approved by regulators around the world, one must look at politics.

Since the beginning of the Biden administration and with the July 2021 Executive Order, Biden is shifting the role that the FTC has maintained for 40 years, moving it away from mere consumer protection towards addressing industrial concentration and corporate dominance as a social problem.

Under the leadership of Lisa Khan, the main measures are aimed at making mergers more expensive and difficult, and establishing stricter Merger Guidelines. This framework of uncertainty has slowed down the pace of mergers but has not prevented those proposed from being completed, with three highly publicized losses in court:

Microsoft's acquisition of Activision Blizzard

Meta's acquisition of Within

Illumina's acquisition of Grail

As explained by Fred Ashton, Director of Competition Policy at the American Action Forum, the Biden administration is using uncertainty in the business community and the prolongation and complexity of procedures as a mechanism to slow down merger processes, as legally many of these cases end up being lost in court.

Arbitrage and special situations are not without risk, and the story could end here, with a thesis that loses 30% of its value in four months. However, neither we nor Tapestry are giving up. The company has filed a lawsuit against the FTC ruling, led by Latham & Watkins and specialist lawyer Mandy Reeves. In the words of Tapestry CEO Joanne C. Crevoiserat:

“We have full confidence in the merits and pro-competitive nature of this transaction. It will bring significant benefits to the combined company’s customers, employees, partners, and shareholders in the U.S. and around the world. We have strong legal arguments in defense of this transaction and look forward to presenting them in court and working expeditiously to close the transaction in calendar year 2024”

In this corporate world, often more governed by bureaucrats and erroneous beliefs about antitrust, one never knows, but we have reasons to believe that the arbitrage thesis, which initially offered a 14% potential, can now offer up to 50%.

The FTC's rejection to the agreement is based on two pillars:

Aspects that harm consumers

Aspects that harm employees

We are not experts in antitrust regulation, but the demand filed by Tapestry adequately covers both claims. Let's delve deeper into them.

Consumers impact

A handbag, in its functional definition, is nothing more than a tool for carrying a series of essential items in daily life. It is difficult to justify consumer protection when those who buy designer bags do not face any real harm in utility. In this regard, the litigation claims:

“The FTC’s worldview cannot explain why consumers spend hundreds or more to buy a frog-shaped crossbody bag, a bright pink puffed satchel, or a top-handle bag that looks like a pizza box (all handbags that Kate Spade offers) …a handbag purchase is far more emotional, multifaceted, and discretionary than the FTC’s theory can tolerate. For some, handbags are an extension of their self-expression. For others, they are purely functional, holding little or no sentimental value.”

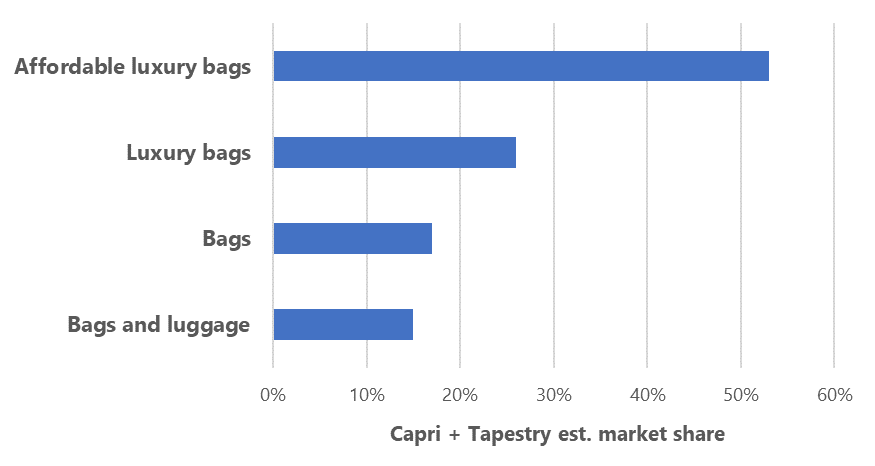

To address this nonsense, the FTC segments the market by purchasing power, using the brand slogan “accessible luxury” as a weapon against Tapestry itself. By segmenting Tapestry and Capri as accessible luxury and identifying their position in that market, they believe that their merger would harm consumers through price increases. With this definition, the combined market share of Tapestry and Coach exceeds the key 30% threshold, which is critical for the possibility of a block by the FTC, as could be seen in the next graph.

It may seem trivial, but the FTC's ability to define a relevant market is crucial for its blockage, as according to the Clayton Act, "[the] determination of the relevant market is a necessary predicate to a finding of a violation." In other words, if the FTC includes the merging parties in the handbag market, it's impossible to argue harm to the consumer. The challenge in the trial will be to demonstrate that Capri and Tapestry can represent a significant percentage of a market they have no basis to define.

As we can see in the following image, the lawsuit provides about a hundred different options as a sample of a market with over 150 brands that Tapestry and Capri claim to compete with. In fact, the merging parties allege that some of their products compete in the luxury segment, while others compete in more distant segments.

In this attempt to artificially create a market defined as “accessible luxury”, the FTC suggests that handbags made of synthetic materials are inferior to those in which Tapestry and Capri operate, overlooking the fact that brands defined as 'true luxury' such as Chanel, Hermès, or Louis Vuitton use synthetic materials like nylon in some of their creations.

The European Commission, in its approval, points out that the relevance of Michael Kors, Capri's main asset, is declining and that “even relatively small competitors can constrain prices of larger companies”. The combined trends of declining Michael Kors’ sales and the increasing sales and shares of competing products further demonstrate that the merged entity will not have power to harm consumers.

Employees impact

Another of the arguments that the FTC uses against the operation focuses on the impact that the merger may have on the U.S. labor market. The agency says it could have negative effects on the wages, benefits and working conditions of people working or seeking employment within the sector.

The average hourly wage for a retail sales staff in the U.S. is $15 as of April 24, 2024, but the range typically falls between $14 and $18. Hourly rate can vary widely depending on many important factors, including education, certifications, additional skills or the number of years you have spent in the profession.

This data is what the defense uses to argue that Tapestry and Capri employees could easily change companies within the sector if they wished and that the merger should not affect the average price paid per hour in the sector. Precisely for this reason, both companies increased the salaries of their employees in the U.S. to a base of $15 per hour in 2021.

At the end of 2023, Capri had approximately 15,500 total employees. Approximately 11,500 of the employees were engaged in retail selling and administrative positions. While Tapestry had 18,500 employees around the world as of July 1, 2023. Of these employees, approximately 14,700 employees worked in retail locations.

With the number of brands that make up the retail sector and that compete within the U.S., it is difficult to think that Tapestry could have a dominant position once the merger is completed. Without going any further, Ralph Lauren alone has 10,400 employees in the U.S.

Legal Defense

Tapestry and Capri will be represented by the law firm Latham & Watkins LLP. Specifically, the lawyer who will be in charge of the case is Amanda P. Reeves. She is recognized as one of the top antitrust lawyers in the world.

Amanda P. Reeves is a sought-after global leader in the antitrust bar, who clients turn to for sophisticated advice and representation in their toughest matters. Her work cuts across all industries, including high-tech, entertainment, sports, media, communications, life sciences, healthcare, semiconductors, agriculture, automotive, retail, and consumer products.

Recently, over 6 months, she successfully tried two antitrust merger litigations against the DOJ (U.S. Sugar/Imperial Sugar and Booz-Allen/Everwatch), in addition to obtaining unconditional clearance for MGM’s US$7 billion sale to Amazon and Affera’s US$1 billion sale to Medtronic following FTC Second Requests, among others.

The choice of a lawyer with so much experience in litigation cases against regulatory agencies demonstrates the strong determination that Tapestry has to complete the acquisition in calendar 2024.

DISCLAIMER: All the information provided in this document is purely informative and does not constitute a buying recommendation (according to Spanish Law Article 63 of Law 24/1988, of July 28, on the Stock Market Regulator, and Article 5.1 of Royal Decree 217/2008, of February 15). DuckPond Value Research & Investment Notes are not responsible for the use of this information. Before investing in a real account, it is necessary to have the appropriate training or delegate the task to a duly authorized professional.