Calandro's mistake in GEICO valuation

A mistake that points out the importance of Buffet's activist role in some of his best investments

In the famous (and recommendable) book “Applied Value Investing”, Joseph Calandro erred in the valuation of GEICO but anyway was a very good investment for Warren Buffet.

The activist role of Buffet was decisive in GEICO's success story. His knowledge of the sector, which allows him to be aware of the moats and the ability to influence the management team not to deviate from that growth strategy aligned with those moats, is essential. With the $70 per share paid for 50% ($55.75 market price), Buffet is discounting a potential that can only be unleashed with correct management of the company, in fact pre-Buffet the company abandons the path several times of growth where GEICO has greater moats.

I have been reviewing Calandro's valuation model summarized in the following table and I have doubts, isn't Calandro wrong in the calculation?

Calandro's adjusted NAV is 1.5 trillion, just 3% higher than the accounting NAV. The problem comes when you translate it to NAV per share:

Calandro (page 50) says that the NAV per share is $44.15 and citing note 14 of the endnotes:

“14. The amount of GEICO’s outstanding shares was approximately 67.9 million of which Buffett owned 50.4%, per Robert Bruner, Warren E. Buffett, 1995, Darden School of Business Case Services, #UVA-F-1160, 1998 (1996), p. eleven."

1.5 billion NAV / 67.9 million shares = $22 per share. Just half of what Calandro says.

Having corroborated the number of shares in the 1994 GEICO 10K, of which I put a screenshot, I ask myself:

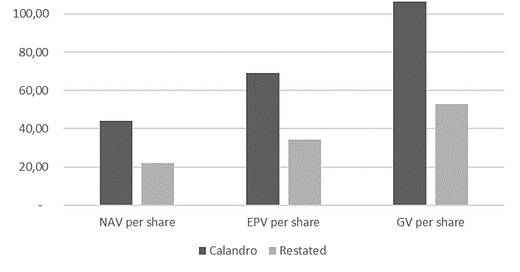

Wouldn't Calandro have divided the NAV by the number of Buffet's shares instead of the total? If so, the previous graph, after redoing the calculations, would be the following:

Barring error, there is no margin of safety to pay $70 even valuing the company's growth modeled by Calandro.

Although Calandro's calculations may have been very different from Buffet's own, did he buy GEICO out of sentimentality? (Graham's participation, linked since he was young...)

The truth is that the benefits estimated in Calandro's model fell short. It estimated 257 million and in 1998 it was already exceeding that amount. And by 2005 they exceeded 1.2 billion. Applying the 1.2 billion to the model, the EPV per share rises to $315 and the GV per share to $487.

Curiously, GEICO reports losses of 1,880 million in 2022 due to an increase in claims in all types of insurance, although in 2020 it reached a profit of 3,428 million. (2019: 1,506)