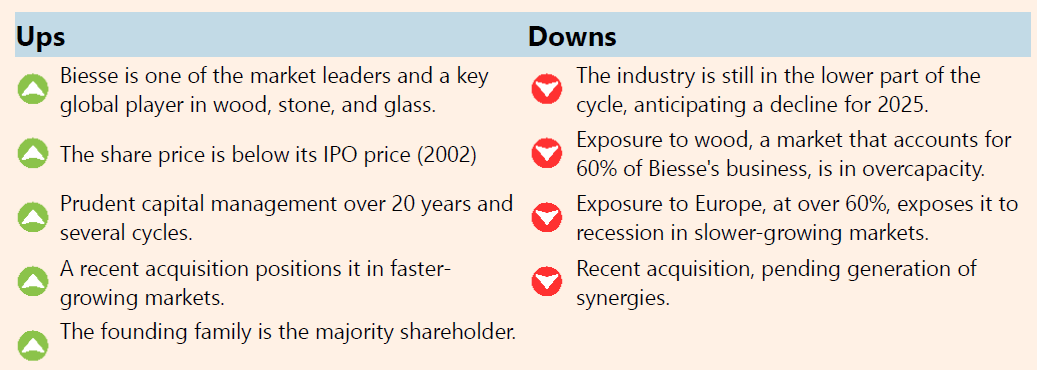

As Álvaro de Guzmán and Fernando Bernad, managers of AZValor, say, investment has to have a short path to "no" and a long path to "yes." And after a few months where there have been some "noes," today I bring you a "yes, but" in the form of a small-cap Italian company.

Don't be discouraged by the "but," Biesse SpA is a key player in a cyclical sector and a candidate to successfully overcome the bottom of the cycle, and for my part, it will be under covering.

I'm starting the thesis by introducing a new section called "5-minute drill" in honor of Peter Lynch. Lynch argues that, after a good analysis, the thesis should be explainable in a few minutes, in this case, lines. Let’s get to it!

5 minute drill

Biesse, an industrial machinery manufacturer for cutting and processing materials such as wood, glass, or stone, is behind the IKEA furniture chain that we have all assembled, the Carrara marble kitchen countertop, or the glass panels we can see in large buildings like the City of Arts and Sciences in Valencia or in the automotive sector. From small cutting centers to fully automated plants, Biesse has been providing specific solutions to its customers' problems for over 50 years.

Closely linked to construction, Biesse's industry is at a point in the capital cycle of capacity destruction, mainly in Europe, where Biesse has most of its commercial interests. With a history of prudent management, the company faces this situation with very low debt and a recent acquisition of a competitor that positions it for growth in the stone and glass cutting market. This market has higher growth than Biesse's core business, wood, where an adjustment process is still expected.

The valuation proposal is simple: It is currently trading at around 5 times an adjusted mid-cycle EBITDA (€57 million). With a multiple of 7 times, which would be conservative (average 9), it grants a potential of 63%. This scenario excludes potential growth that the company has in materials with better prospects.

Opinion: Despite the potential, I see a wait-and-see strategy due to the anticipated decline in sales in 2025 and uncertainties surrounding the integration of the recent acquisition and overcapacity in the wood industry, which indicate that the cycle's lowest point has not yet been reached. 2025 would mark three consecutive years of declining sales, something unprecedented for Biesse in the last 20 years.

The business

Founded in 1969 in Pesaro, Italy, Biesse has specialized in manufacturing machines for processing materials such as wood, glass, or stone for manufacturing industries. From small cutting centers to robotic machining centers (CNC) and complete logistics solutions, large clients such as IKEA, Saint-Gobain, or Herman Miller, as well as small businesses, rely on the quality of their products and after-sales service. The end industries for its products are consumer discretionary and, therefore, closely linked to the cycle. Mainly the following three:

Furniture manufacturing

Home Building

Automotive

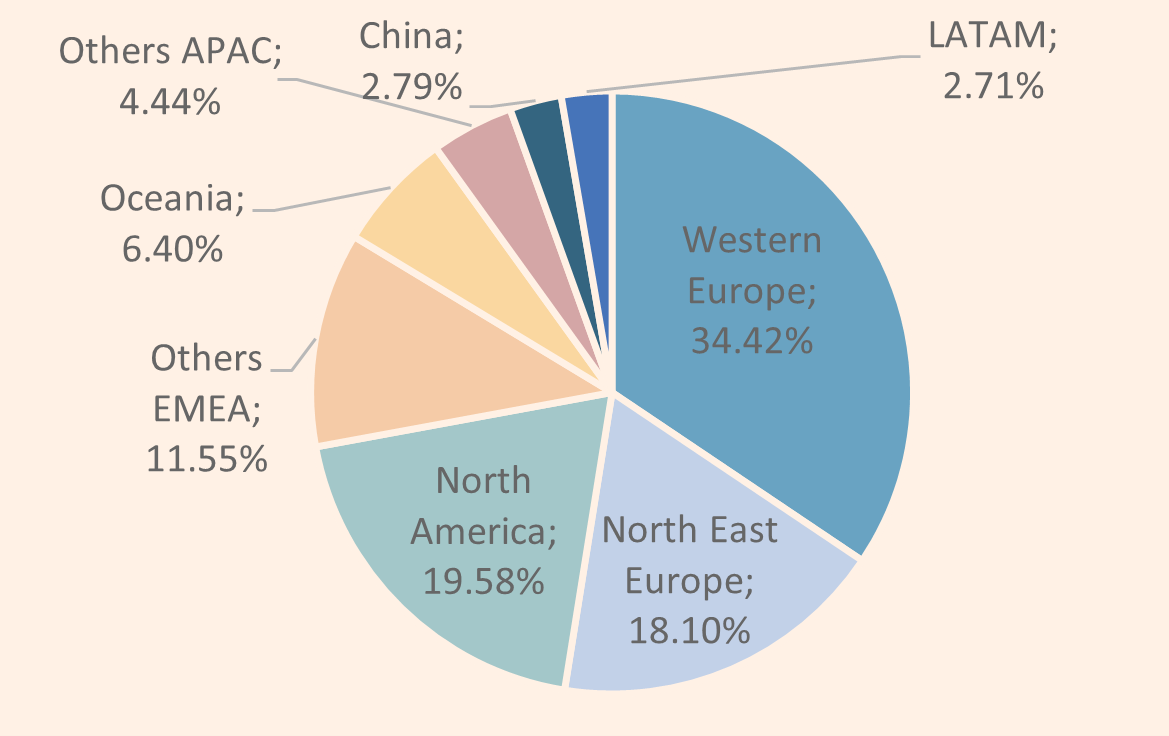

Although with an international presence, geographically it depends mainly on its customers in Europe. The distribution by region in 2024 (including GMM) is as follows:

Biesse segments its business into two divisions:

Machines and systems (90% of revenue): Under the Biesse brand, this encompasses the company's main activity: the production, installation, and maintenance of machinery for processing materials.

Mechatronics (10% of revenue): HSD Mechatronics and Diamut are the brands that produce mechanical and electrical components, used in Biesse products and in production lines of other industries.

Until 2020, the segmentation was done by materials, so we can estimate that around 70% of the turnover comes from machinery for wood. According to our estimates, this percentage could drop to 60% after the purchase of GMM in 2023, with 30% for glass and stone and 10% for the mechatronics division.

Approximately, Biesse's market share is 18% of the wood market and 14-15% for glass and stone (2018 data).

Biesse is a key player in the industry worldwide. It is mainly exposed to Europe and the furniture manufacturing sector.

The industry

Biesse is located in the "machine tools manufacturers" sector, which in 2022 reached a size of €80 billion. Within this category are companies with very different client industries, such as agricultural or construction machinery, or the processing of other mineral materials.

The relevant market for Biesse can be estimated at around 6 billion euros (7.5% of the total for tools manufacturers), segmented by materials: wood, stone, and glass, mainly, in which Biesse has significant relevance. According to 2018 data:

Wood: 14% market share (18% achievable market share): Biesse is one of the market leaders, behind the German company Homag. It is the largest market, with 3.7 billion euros.

Glass: 15% achievable market share: Biesse is the leader in an achievable market of €600 million. This market share has possibly been strengthened with the purchase of GMM in 2023.

Stone: 14% achievable market share: Biesse is the leader in stone, a market with a size of only €200 million, also strengthened by the purchase of GMM

Industry evolution

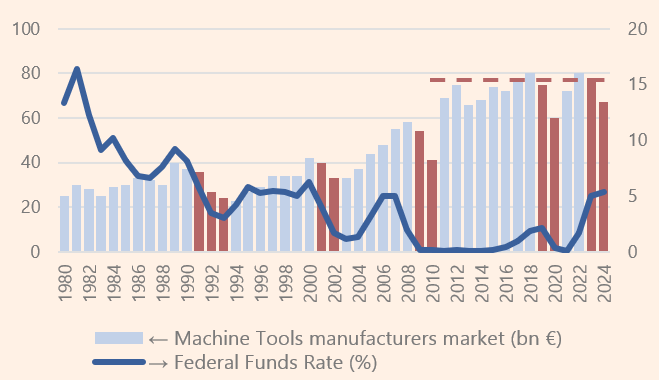

The influence of interest rates on a capital goods industry far from consumption, with a demand for final goods heavily influenced by them, is clearly seen in the following graph.

Periods of low interest rates drive growth, which is hampered by increases, leading to two-year recessions with declines in subsequent years. The machinery manufacturers sector had low growth rates (<1% per year) until 2002-2003, where a trend began until 2012 with annual growth rates of 7%.

Since 2012, the market has not grown significantly, while Biesse has grown in sales at annual rates of 7% until 2022. In 2019, the sector experienced a recession after a slight rise in interest rates. With estimated data for 2024 based on first-half data, the sector is experiencing its second consecutive year of decline.

Growth expectations for the market for machinery for the manufacture and transformation of materials are higher for other materials compared to wood (Wood & Housing).

According to Biesse, the sector could have marked its low point in 2024 and resume growth in 2025, and some of its customers also believe this, mainly relying on the recovery of construction with the lowering of interest rates.

With the purchase of GMM, Biesse has strengthened its positioning in Stone and Glass compared to its competitors. As we see in the following table, Biesse's product range covers all three materials, only matched by SCM Group.

Biesse in numbers

The main indicators of the income statement for the last six years show a sector that already in 2019 was showing symptoms of exhaustion, stretched by the pandemic and public spending. 2023 begins the recession, which is anticipated in an industry far removed from consumption such as this one.

Comparatively and with a long-term view, with its main competitor in wood, the evolution of Biesse does not show leadership in margins compared to Homag, the leader in sales, although it does show an improvement in efficiency after the 2008 crisis.

Both Homag and Biesse have had annualized sales growth of 9% since the lows of 2009. The evolution of margins has not recovered the exuberance of the years before the 2008 crisis, with EBIT margins above 10%, standing at 8-9% at the top of the last cycle.

For 2024, Biesse includes GMM in its consolidation scope, moderating the drop in sales but reducing the EBIT margin due to higher integrated costs.

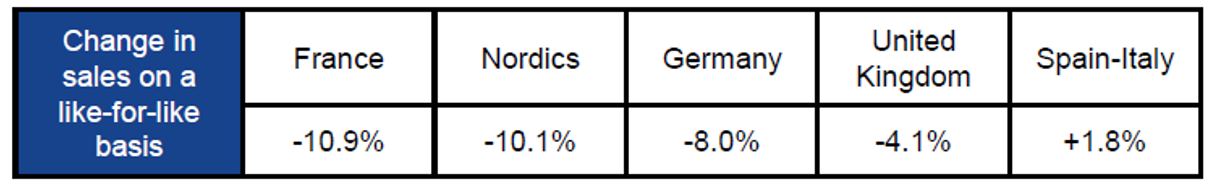

The first half of the year saw a 20% drop in like-for-like sales, -5.4% including GMM. Orders fell 13% compared to the same period in 2023, reflecting a still unpromising outlook for the company and the sector.

EBITDA decreased by 31% to 32 million euros due to the increase in costs from the integration of GMM, mainly in other operating costs and personnel.

The company expects integration synergies by the end of 2024, both from the integration of the product portfolio and from adjustments to the personnel structure, although it anticipates a 2-3% drop in sales in 2025, according to a meeting held with the CFO.

Competitors

The first half of the year is seeing sharp falls in the sector, with announcements of staff cuts and capacity reductions. Here is a review of some of the main ones:

Homag (Düerr AG Group): The Woodworking division of Dürr Group (Homag), acquired in 2014, reports a 14% drop in sales in H1 2024 with guidance of a 15% drop for FY. The market leader in wood projects a capacity reduction given the drop in orders due to "redundant capital investment by furniture and wood manufacturers for construction" after a recent staff reduction. The group is in a situation of controlled debt.

Scm Group: The main competitor in Italy for Biesse in all materials is resorting in 2024 to the Italian wage guarantee fund in four plants in Italy, affecting 1,800 employees (a figure close to 40% of the workforce).

Breton SPA: The specialist in stone cutting machinery is in a situation of high debt and liquidity problems. In H1 2024 it has experienced a 50% drop in sales and plans to reduce 200 employees, approximately 20% of the workforce, while around 50% are covered by wage guarantee funds.

In 2024, the sector could contract by around 15%. The competition is making capacity and workforce reductions due to past overinvestment in capital by furniture and wood manufacturers.

M&A

Biesse's history does not include major acquisitions. The most notable occurred at the end of 2023 when Biesse reached an agreement with GMM Machinery, an Italian machinery manufacturer dedicated to glass and stone, a market in which higher growth is expected, which reinforces its leadership in these materials.

Representing approximately 16% of Biesse's sales, it is the largest acquisition in its history, with an EV/EBITDA multiple of approximately 7 (a mid-cycle multiple):

2022 Sales: 124 million

2022 EBITDA: 12.5 million

Equity value + debt: 87 million

Management is confident of the synergies in customers and costs, derived from the process of unifying its portfolio, hoping to complete the merger by the end of 2024.

Capital Management

Capital management in a cyclical sector is of vital importance. Biesse has been characterized by prudent management, maintaining low debt ratios at mid-cycle times and even anticipating the end of cycles with net cash. This has allowed it to multiply net profit almost 5 times between 2013 and 2022 while fixed assets have only doubled.

Similarly, Biesse has optimized its working capital requirements, mainly by increasing the amount of advances required from its customers when formalizing orders. In 2013, they represented around 5% of sales, increasing the amount to 17% in 2021 and 2022. In 2023, with the decline in sales, it represented 14%.

This improvement in capital employed has allowed Biesse to achieve high returns on capital in a sector with low sales margins that has never managed to recover the pre-2008 exuberance.

Customers

Biesse's customer portfolio is very broad and atomized, with most customers concentrating on an average expenditure of 95,000 per year, with a certain impact from large customers.

The sales forecasts of these customers guide their investments, and therefore the expenditure that is made in Biesse's industry. As we are going to see, despite a 2024 with sharp falls in sales, Biesse's customers expect to make strong investments from 2025, coinciding with the recovery of new construction, both residential and commercial, driven by the expected interest rate cuts.

Saint Gobain (Home building): The French multinational is a client of Biesse for glass cutting machinery. After 2023 with a 6.5% drop in sales, the first half of 2024 reports a 6% drop in sales, with pressure on prices (-1%) but above all with a drop in volume (-4%), mainly impacted geographically by EMEA with 1% growth in America and Asia. (+4% NA -8% LATAM)

Saint Gobain is expanding mainly through acquisitions. In 2024 they have reduced Capex investment by 6% compared to H1 2023, although they continue to invest in growth in machinery and equipment. They do not provide guidance for 2024 nor expectations for 2025 but believe that in Europe the minimum has been reached in the new construction market.

"New construction markets remain difficult in Europe but are nearing a low point and we expect trading to continue to improve in the second half"

CEO Saint Gobain

Herman Miller (Home furnishing): Reporting an 11% drop in revenue at the end of the fiscal year in June, the American home and office furniture manufacturer expects a first quarter (calendar Q3) drop from last year, in line with the sector.

They are confident of recovery from 2025, under the protection of the recovery in new home construction and sales of second-hand homes.

Capital expenditure expectations for fiscal year 2025 are for an increase of around 20-30% compared to 2024, mainly for investments in the company's facilities (factories and stores) after three years of declining investment.

American Woodmark (Home furnishing): The manufacturer of furniture for kitchens and bathrooms closed its fiscal year in April 2024 with a 10% drop in sales and an additional 8% in the first fiscal quarter of 2025. Like Herman Miller, they expect demand growth with the recovery of new construction and renovations by 2025, and for this they project a strong investment in Capex until 2028, doubling the average levels of recent years.

Steelcase Inc (Home furnishing): Dedicated mainly to office furniture, Steelcase is committed to the recovery of office spaces, with growth in 2024 and 2025, albeit still below the 2019 highs.

The industry's largest customers are suffering low double-digit declines in 2024, anticipating a recovery in sales and investments in 2025, sheltered by interest rate cuts and the recovery in construction.

Ownership and Governance

The founding family (Selci) controls 51% of the company, with the second generation in charge. Roberto, son of the founder, has been the new chairman of the board since 2024, leaving the position of CEO to Massimo Potenza, Co-CEO since 2020. The founder, Giancarlo, appears to have left the board in 2024 without an official announcement. The rest of the free float has no relevant concentrations, with the following five being the main ones:

Except for the CEO, who has a small stake (2,000 shares), no other insider or board member has a position in the company.

The incentive plan does not include company shares in any case. Although this is common in listed SME companies due to its regulatory complexity and administrative costs, it is not a positive aspect that no insider has a relevant position in the company.

The incentive plan by objectives is as follows:

Short-term incentives (MBO) based on short-term objectives where EBIT weighs 40%, revenue 25%, the Net Invested Capital/Revenue ratio another 25%, and 10% decarbonization objectives.

Long-term incentives (LTM) based on EBITDA margin (50% weight), revenue (25%), and the ratio of invested capital to revenue (25%).

In 2023, incentives were slightly more than double the fixed remuneration for the CEO, with 1.5 million euros in incentives compared to 700 thousand euros in fixed remuneration.

Metrics such as EBITDA or revenue are not a prudent measure of value generation for the company, for two reasons:

A bonus on revenue can provide incentives to reduce margins or increase commission expense.

The company channels personnel and resource expenses to intangible assets (brands, patents...) at the discretion of the CEO, so the circumstance of inflated EBITDA with capitalized expenses to the asset may occur.

Despite the inadequacy of the system and the lack of shareholders among insiders, the Selci family does not receive a large remuneration from the company, and therefore is incentivized to obtain returns from the company in the same way as the rest of the shareholders: through the revaluation of shares and dividends. As of the date of the report, share buybacks do not seem to be an option. Spending on remuneration for directors and board members has been kept under control in the last 10 years, below 0.6% of sales.

Insiders not related to the founder have no stake in the company. The metrics chosen fot the incentives do not align executive members in value creation.

Valuation

The valuation has been carried out through the calculation of a normalized income statement until the year 2027, where the relevant factors of the integration of GMM and its costs have been taken into account, as well as a first half of 2024 with a very strong drop in sales.

The company offered its own vision through a 2024-2026 plan dated at the beginning of 2024 with the following targets for 2026:

Revenue: €830-880 million

EBITDA: €75-90 million with a 9%-10% margin.

The plan outlined the recovery already for 2025, but in the meeting held with the CFO, he lowered expectations, proposing a drop of between 2-3% in sales.

Due to all the aspects discussed in the report, mainly those related to overcapacity in the wood sector (60% of sales) and its European bias (60%), as well as the challenges of integrating GMM, a conservative normalization has been carried out with respect to the company's prospects. The main items on the income statement are as follows:

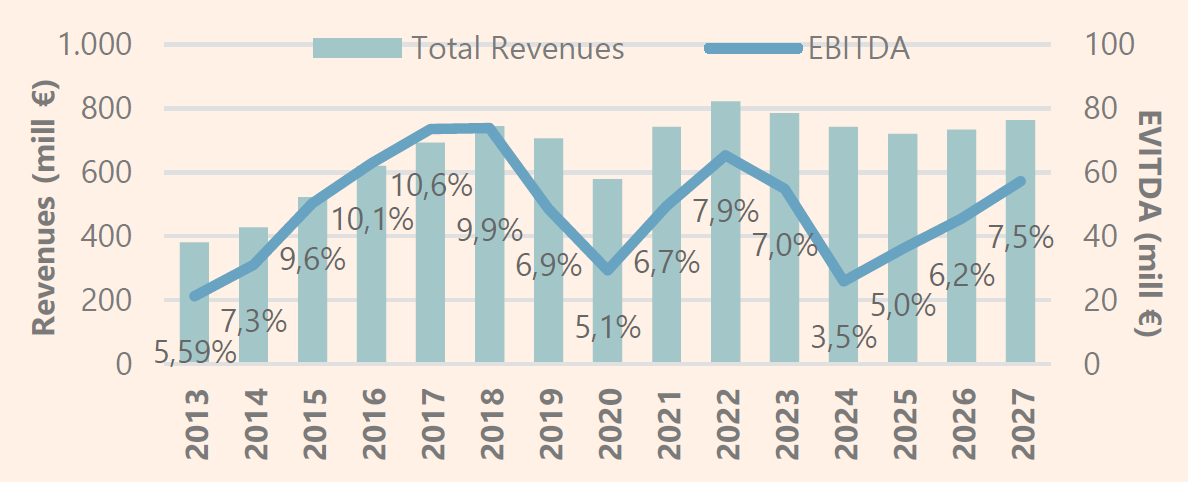

The forecast in sales, Adjusted EBITDA, and Adjusted EBITDA margin from 2013 to 2027 would be as follows:

Given the volatility of profits and cash flows, an EV/EBITDA multiple valuation has been selected as the best possible option, adopting a conservative view.

Adjusted EBITDA: Biesse capitalizes R&D expenses as the creation of intangible assets, excluding amortization expenses from the EBITDA margin. As a matter of prudence, the EBITDA in the valuation has been adjusted, taking into account the amortization of those intangible assets as R&D expenses, and therefore included in EBITDA. Although the most appropriate adjustment would be the cash outflow in the year for investment, it has been considered a good proxy, with long-term convergence, and it allows not to alter the profit reported by the company.

The effect on reported and adjusted EBITDA margins is approximately 2% for the 2013-2023 period.

Working Capital Requirements: Biesse has improved its working capital management by increasing the amount of advances requested from customers for projects as well as reducing payment days, while maintaining stability in its inventory management and payment to suppliers. In the years of falling sales, capital requirements increase slightly compared to the years in which they recover and increase.

Based on this case study and through the study of the elasticities of the variables to the increase in sales, the following evolution has been reached, used in the cash flow projection.

Taxes: A 29.4% rate has been used as the normalized rate in the valuation, through the study of the breakdown of taxes from 2018 to 2023. To the effective rate of 25.4%, which includes a baseline of 24% in Italy plus other adjustments, is added IRAP, a tax similar to the Economic Activities Tax. The breakdown that leads to the normalized rate is as follows:

DISCLAIMER: All the information provided in this document is purely informative and does not constitute a buying recommendation (according to Spanish Law Article 63 of Law 24/1988, of July 28, on the Stock Market Regulator, and Article 5.1 of Royal Decree 217/2008, of February 15). DuckPond Value Research is not responsible for the use of this information. Before investing in a real account, it is necessary to have the appropriate training or delegate the task to a duly authorized professional.

Reach us on duckpond@duckpondvr.com